The following information is provided by Detring Energy Advisors LLC. All inquiries on the following listings should be directed to Detring. Hart Energy is not a brokerage firm and does not endorse or facilitate any transactions.

Rio Oil and Gas (Permian) II LLC retained Detring Energy Advisors for the sale of a core Delaware Basin nonop opportunity in Ward County, Texas.

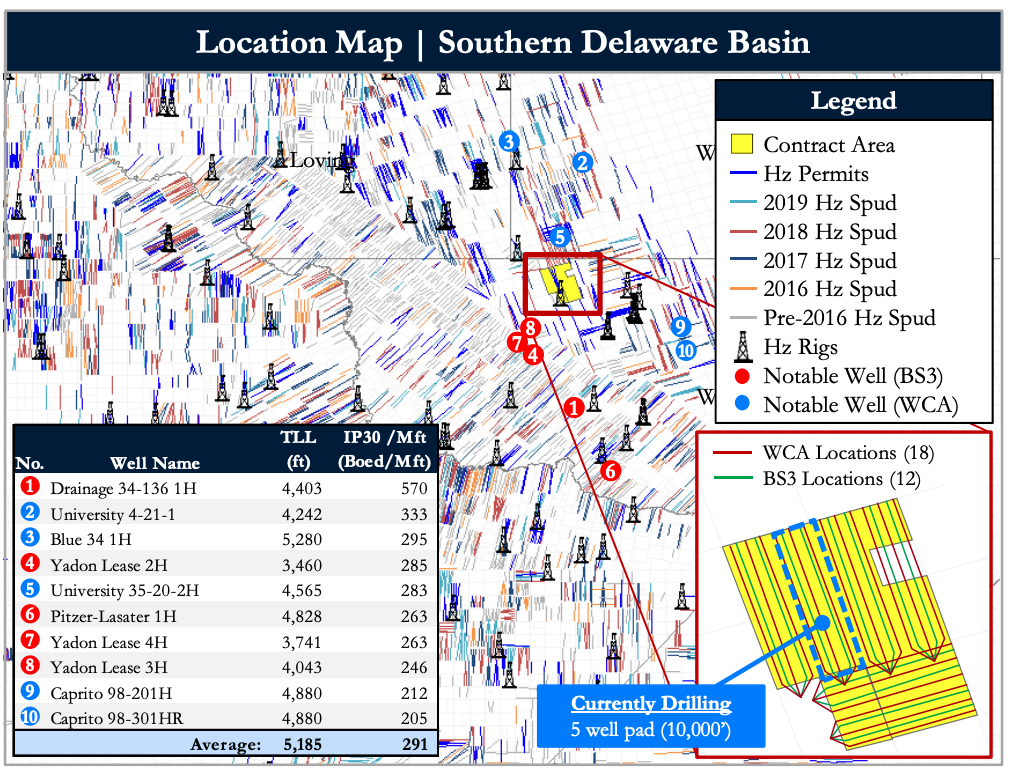

The offer comprises of nonoperated working interest and related assets in the Block 18/War Wink Field of Ward County within the Permian Basin. According to Detring, the company's exclusive adviser for the transaction, the assets offer an attractive opportunity to acquire an 8.33% working interest with a relatively low royalty burden (1/6th) ahead of a significant horizontal well program operated by Chevron USA Inc.

Drilling operations have commenced on the initial five well pad with Chevron indicating it plans to spud a second five well pad immediately following the drilling of the initial pad. A total of 10 wells are expected to be completed and online prior to Dec. 31, 2020, Detring said.

Highlights:

- 8.33% in a roughly 3,364 contiguous gross acre contract area in the core of current Ward County horizontal development

- 6.94% Net Revenue Interest (1/6th effective royalty burden)

- Large, contiguous footprint allows for extended-reach laterals

- Operated by Chevron Corp., a premier Delaware Basin operator

- Acreage is 100% HBP by long-life, low-decline vertical production (about 30 barrels per day of oil net, roughly 7% next 12-month decline)

- Anticipated Large Scale Horizontal Development Program

- University Lands development contemplates about 30 extended-lateral wells (six pads) to be drilled on the assets by the end of 2023 (about four years)

- The first five-well pad has already spud, with a second five-well pad expected to spud immediately thereafter (10 wells expected turn-in-line by end-of-year 2020)

- There are no legacy (parent) horizontal wells on the acreage; the development program will have the benefit of optimum reservoir management from its inception

- Simultaneous, Multi-Bench Development Imminent

- Prolific stacked-pay in the deep, overpressured core of the most active basin in the U.S.

- Robust type curves generate IRR’s of 70%-plus (WCA / BS3) in current pricing environment

- Future development potential in multiple Wolfcamp and Bone Spring horizons (four to six wells per mile)

Process Summary:

- Evaluation materials available via the Virtual Data Room on Oct. 21

- Proposals due on Nov. 20

Detring said the seller anticipates executing a purchase and sales agreement by mid-December, with closing occurring in January.

For information visit detring.com or contact Melinda Faust at mel@detring.com or 713-595-1004.

Recommended Reading

CNOOC’s Suizhong 36-1/Luda 5-2 Starts Production Offshore China

2024-02-05 - CNOOC plans 118 development wells in the shallow water project in the Bohai Sea — the largest secondary development and adjustment project offshore China.

CNOOC Makes 100 MMton Oilfield Discovery in Bohai Sea

2024-03-18 - CNOOC said the Qinhuangdao 27-3 oilfield has been tested to produce approximately 742 bbl/d of oil from a single well.

CNOOC Finds Light Crude at Kaiping South Field

2024-03-07 - The deepwater Kaiping South Field in the South China Sea holds at least 100 MMtons of oil equivalent.

TotalEnergies Starts Production at Akpo West Offshore Nigeria

2024-02-07 - Subsea tieback expected to add 14,000 bbl/d of condensate by mid-year, and up to 4 MMcm/d of gas by 2028.

Shell Brings Deepwater Rydberg Subsea Tieback Onstream

2024-02-23 - The two-well Gulf of Mexico development will send 16,000 boe/d at peak rates to the Appomattox production semisubmersible.