The following information is provided by TenOaks Energy Advisors LLC. All inquiries on the following listings should be directed to TenOaks. Hart Energy is not a brokerage firm and does not endorse or facilitate any transactions.

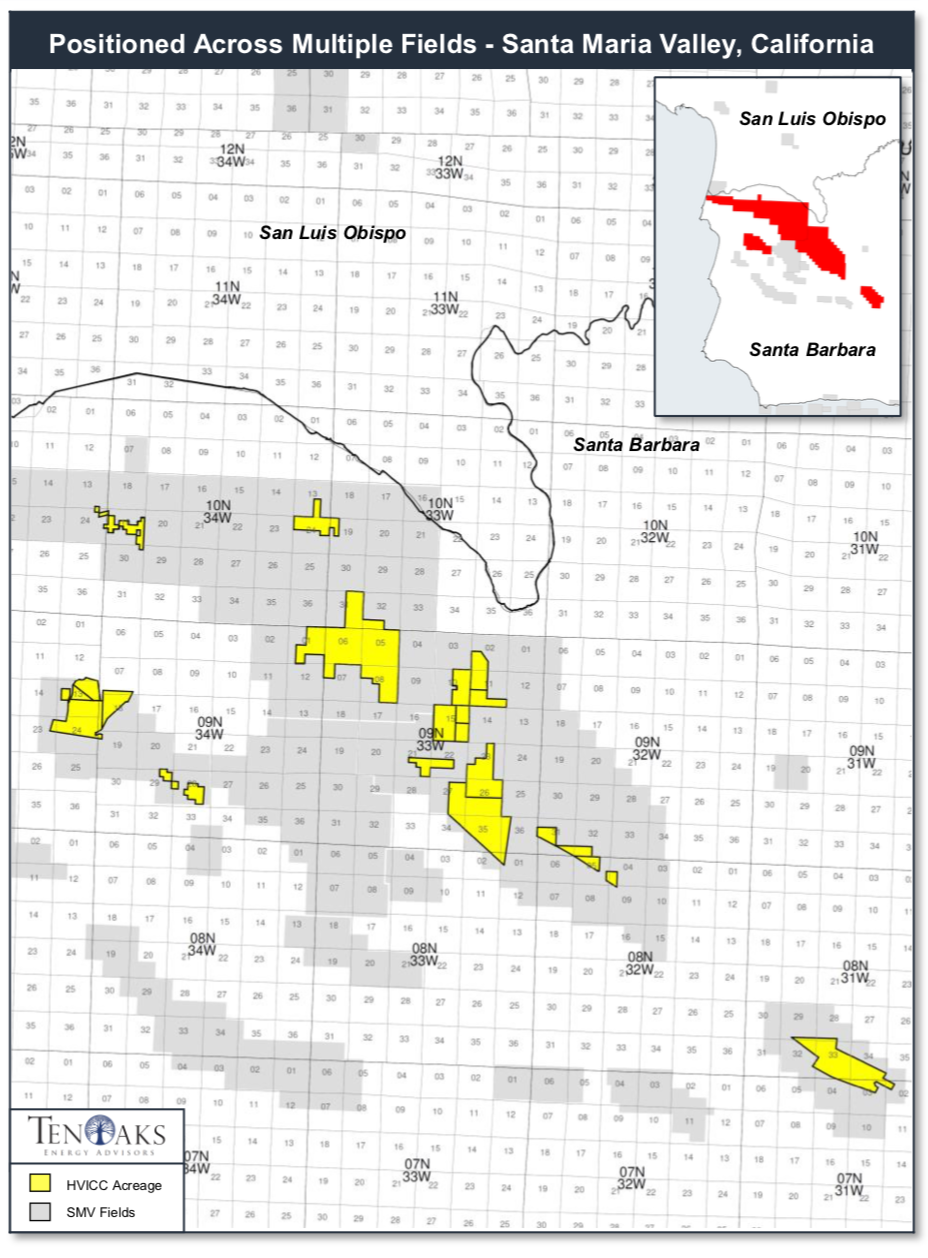

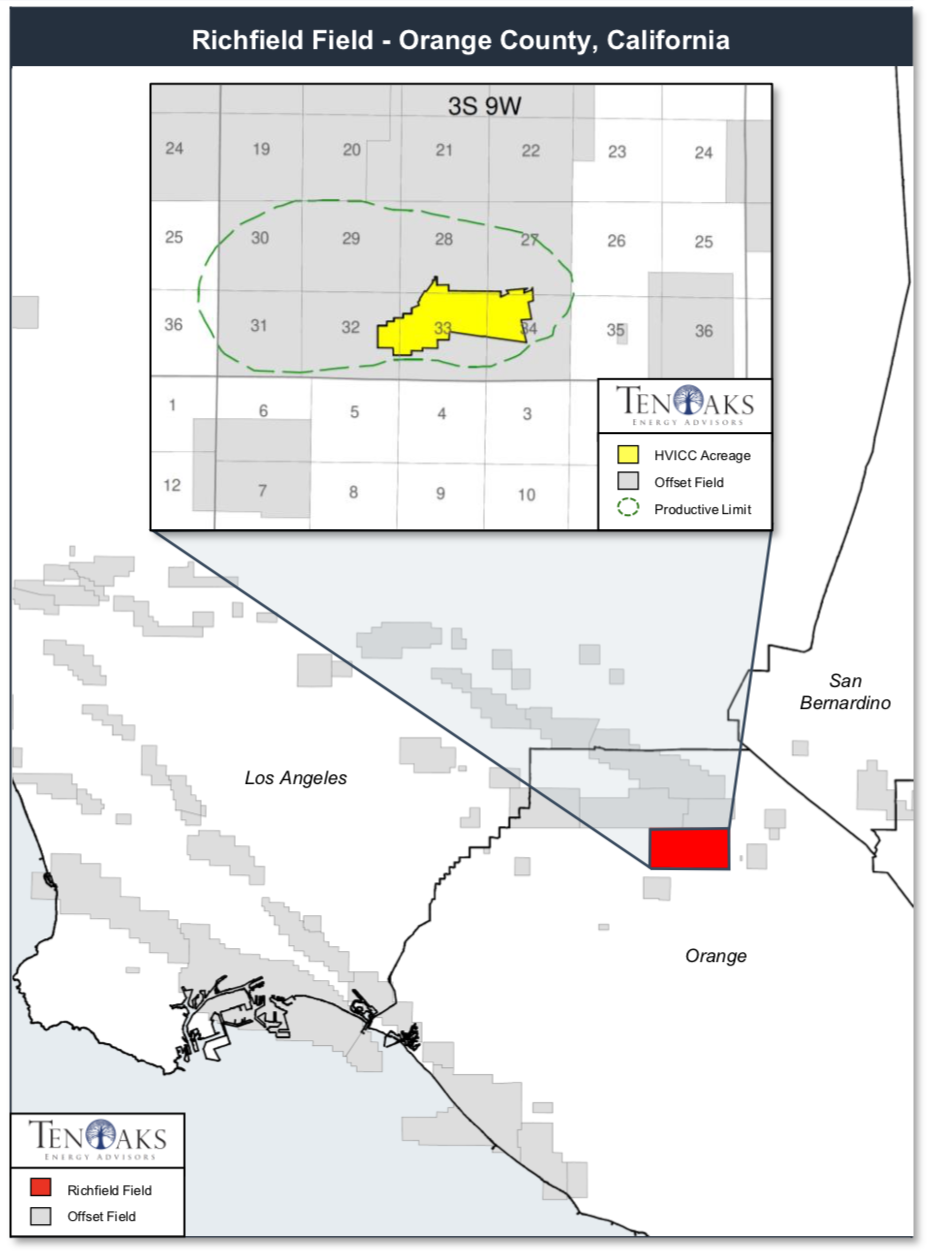

HVI Cat Canyon Inc. (HVICC) is offering for sale certain conventional oil properties in California located in the Santa Maria Valley (SMV) of Santa Barbara County and the Richfield Field (REDU) of Orange County.

TenOaks Energy Advisors has been retained by HVICC in connection with the potential sale of the properties. The sale will be conducted pursuant to section 363 of the Bankruptcy Code following a voluntary Chapter 11 filing made by HVICC on July 25, 2019.

Highlights:

SMV Overview

- Projected April 2020 production of 425 gross (390 net) bbl/d of oil

- HVICC currently has a workover rig running on the properties and has brought several wells back to production beginning December 2019

- More than 160 RTP / behind pipe candidates identified that can be strategically brought back online to increase near term production and cash flow

- Infrastructure / equipment upgrades continue to be a focal point for HVICC

REDU Overview

- Projected April 2020 production of 122 gross (95 net) bbl/d of oil

- HVICC has actively brought wells back online beginning December 2019 effectively increasing production to 122 gross bbl/d of oil up from initial bankruptcy production of 11 gross bbl/d of oil

- 31 wells have been identified as potential RTP candidates that can be strategically brought back online to increase near term production and cash flow

Bids are due by noon CT May 7. The transaction is expected to have an April 1 effective date.

For information visit tenoaksenergyadvisors.com or contact Lindsay Sherrer at TenOaks Energy Advisors at 214-420-2324 or Lindsay.Sherrer@tenoaksadvisors.com.

Recommended Reading

US Drillers Add Oil, Gas Rigs for First Time in Five Weeks

2024-04-19 - The oil and gas rig count, an early indicator of future output, rose by two to 619 in the week to April 19.

Strike Energy Updates 3D Seismic Acquisition in Perth Basin

2024-04-19 - Strike Energy completed its 3D seismic acquisition of Ocean Hill on schedule and under budget, the company said.

Santos’ Pikka Phase 1 in Alaska to Deliver First Oil by 2026

2024-04-18 - Australia's Santos expects first oil to flow from the 80,000 bbl/d Pikka Phase 1 project in Alaska by 2026, diversifying Santos' portfolio and reducing geographic concentration risk.

Iraq to Seek Bids for Oil, Gas Contracts April 27

2024-04-18 - Iraq will auction 30 new oil and gas projects in two licensing rounds distributed across the country.

Vår Energi Hits Oil with Ringhorne North

2024-04-17 - Vår Energi’s North Sea discovery de-risks drilling prospects in the area and could be tied back to Balder area infrastructure.