The following information is provided by RedOaks Energy Advisors LLC. All inquiries on the following listings should be directed to RedOaks. Hart Energy is not a brokerage firm and does not endorse or facilitate any transactions.

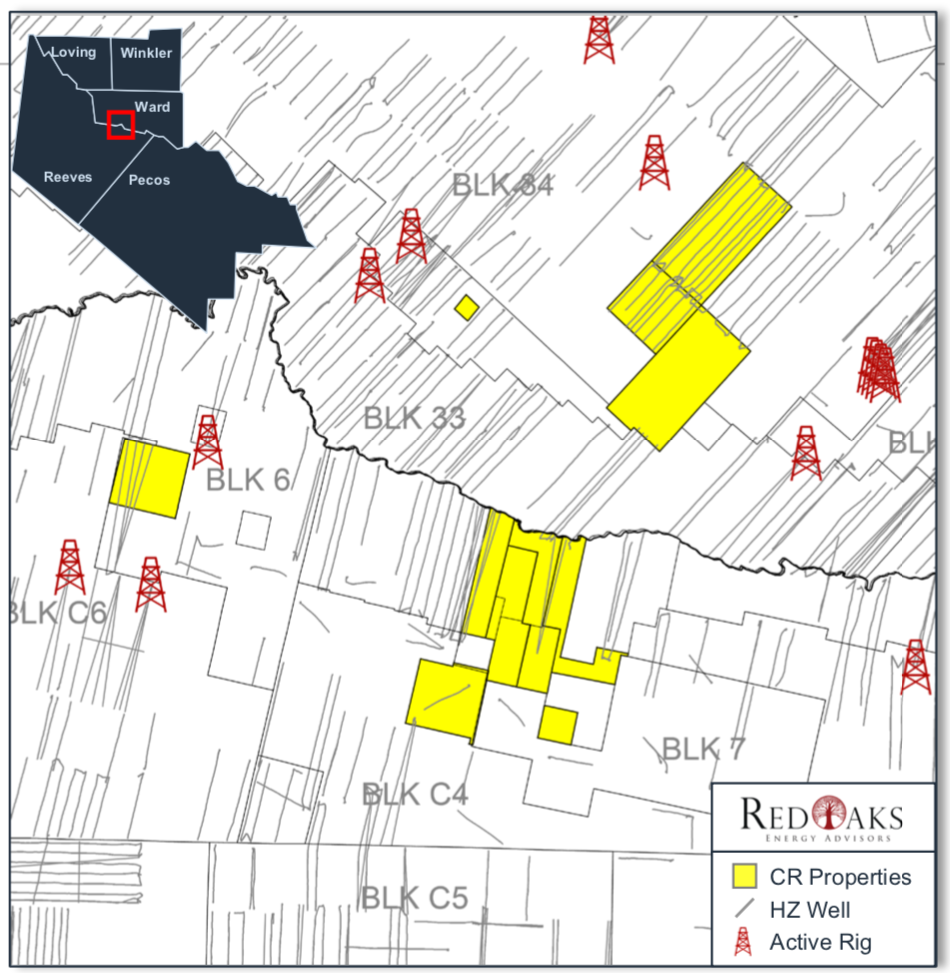

Colgate Energy LLC retained RedOaks Energy Advisors LLC for the sale of certain overriding royalty interests (ORRIs) in the Delaware Basin in an offering closing Sept. 26.

Highlights:

- 643 Net Royalty Acres along the Pecos River

- 478 Net Royalty Acres: Reeves County

- 165 Net Royalty Acres: Ward County

- 18 horizontal producers

- Near-term upside: six drilled buy uncompleted wells

- 267 quantified upside drilling locations

- Operators: Diamondback Energy Inc., Occidental Petroleum Corp. and Callon Petroleum Co.

Bids are due by noon CST Sept. 26. For information visit redoaksenergyadvisors.com or contact David Carter, managing director of RedOaks, at David.Carter@redoaksadvisors.com or 214-420-2334.

Recommended Reading

BWX Technologies Awarded $45B Contract to Manage Radioactive Cleanup

2024-03-05 - The U.S. Department of Energy’s Office of Environmental Management awarded nuclear technologies company BWX Technologies Inc. a contract worth up to $45 billion for environmental management at the Hanford Site.

Laredo Oil Settles Lawsuit with A&S Minerals, Erehwon

2024-03-12 - Laredo Oil said a confidential settlement agreement resolves a title dispute with Erehwon Oil & Gas LLC and A&S Minerals Development Co. LLC regarding mineral rights in Valley County, Montana.

DOE Considers Technip, LanzaTech For $200MM ‘Breakthrough’ Technology Award

2024-03-25 - The U.S. Department of Energy funding will be used to develop technology that turns CO2 into sustainable ethylene.

US Decision on Venezuelan License to Dictate Production Flow

2024-04-05 - The outlook for Venezuela’s oil industry appears uncertain, Rystad Energy said April 4 in a research report, as a license issued by the U.S. Office of Assets Control (OFAC) is set to expire on April 18.

New BOEM Regulations Raise Industry Decommissioning Obligations by $6.9B

2024-04-15 - Under new regulations, the Bureau of Ocean Energy Management estimates the oil and gas industry will be required to provide an additional $6.9 billion in new financial assurances to cover industry decommissioning costs.