The following information is provided by Houlihan Lokey Capital Inc. All inquiries on the following listings should be directed to Houlihan Lokey. Hart Energy is not a brokerage firm and does not endorse or facilitate any transactions.

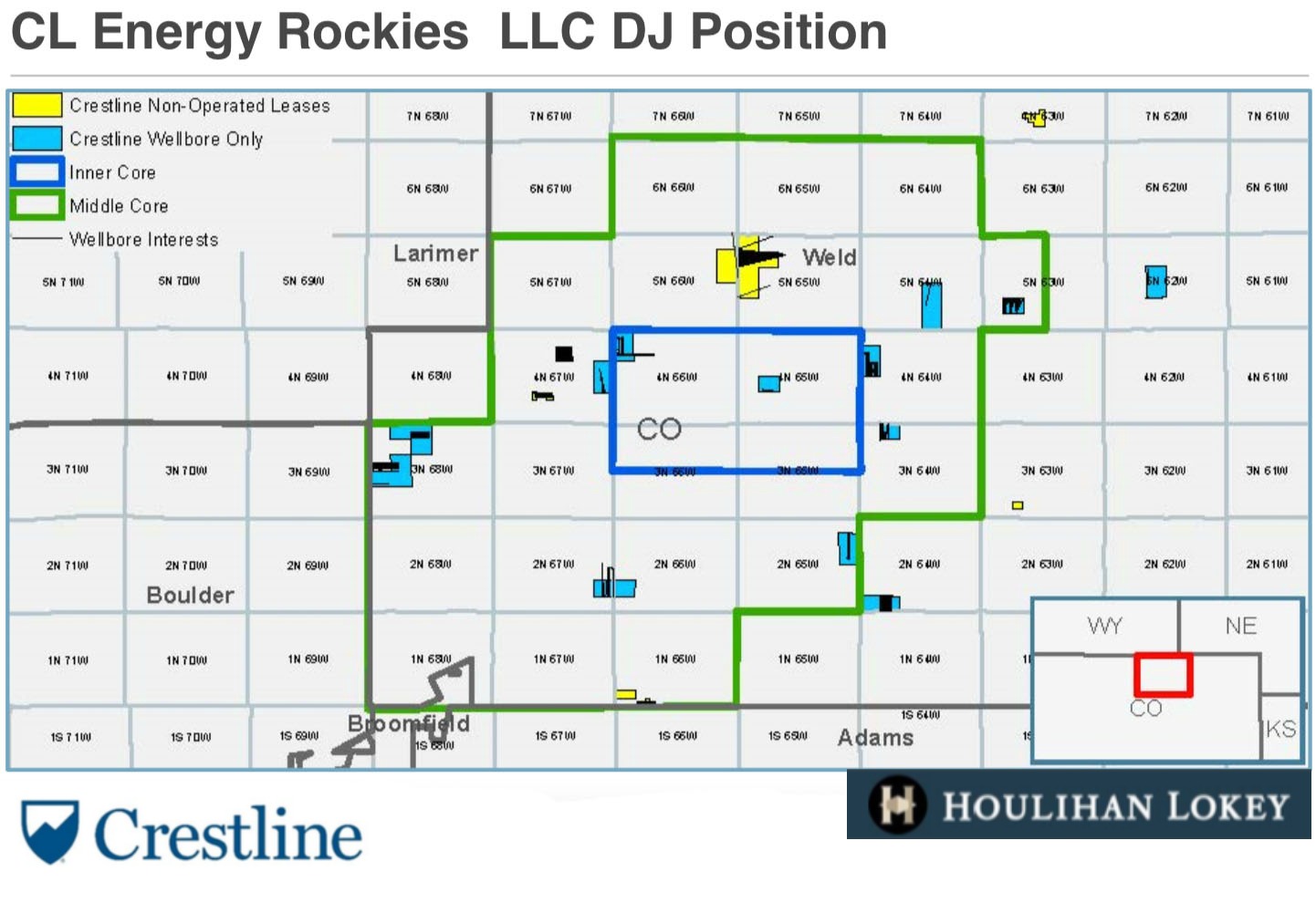

CL Energy Rockies LLC is offering for sale liquids-weighted properties with substantial inventory located in the Denver-Julesburg (D-J) Basin.

CL Energy, managed by investment firm Crestline Investors Inc., has retained Houlihan Lokey Capital Inc. as its exclusive financial adviser to assist with this transaction.

Highlights:

- Attractive Nonoperated Position

- Current net production rate as of July 2018: 1,723 boe/d (343 bbl/d of oil, 5.176 MMcf/d of gas, 518 bbl/d of NGL)

- About 260 net acres in D-J Basin with 137 existing horizontal wells

- 130 producing with an average Working Interest of 18.9%

- Seven non-producing with an average Working Interest of 43.3%

- Under premier operators including PDC Energy Inc., Encana Corp., Extraction Oil & Gas Inc.

- Incremental upside via documented history of authority for expenditure (AFE) assignments

- Predictable Production with Infill Upside

- Individual wells achieve greater than 60% internal rate of returns

- Net proved reserves of about 6.4 million boe; PV-10 value of about $62.3 million

- 60 gross proved undeveloped (PUD) locations

Bids are due Nov. 16. For information visit hl.com or contact Kirk Tholen, managing director and head of E&P A&D for Houlihan Lokey, at KTholen@HL.com or 832-319-5110.

Recommended Reading

CERAWeek: Tecpetrol CEO Touts Argentina Conventional, Unconventional Potential

2024-03-28 - Tecpetrol CEO Ricardo Markous touted Argentina’s conventional and unconventional potential saying the country’s oil production would nearly double by 2030 while LNG exports would likely evolve over three phases.

Woodside Brings in the Know-how

2024-04-01 - Woodside Energy Group CEO Meg O’Neill is relying on technical sophistication to guide the Australian giant as it takes on three challenging projects in the U.S. Gulf of Mexico.

Baker Hughes Detects LNG Slowdown Solutions, Global Opportunities

2024-01-26 - Baker Hughes’ fourth quarter earnings call confronts Biden’s halt on LNG permitting with “solve itself” attitude.

ConocoPhillips CEO Ryan Lance Calls LNG Pause ‘Shortsighted’

2024-02-14 - ConocoPhillips chairman and CEO Ryan Lance called U.S. President Joe Biden’s recent decision to pause new applications for the export of American LNG “shortsighted in the short-term.”

Antero Poised to Benefit from Second Wave of LNG

2024-02-20 - Despite the U.S. Department of Energy’s recent pause on LNG export permits, Antero foresees LNG market growth for the rest of the decade—and plans to deliver.