The following information is provided by EnergyNet. All inquiries on the following listings should be directed to EnergyNet. Hart Energy is not a brokerage firm and does not endorse or facilitate any transactions.

Chevron USA Inc. retained EnergyNet for the sale of an operated position in the Midland Basin through a sealed-bid offering closing Nov. 19. (Editor's note: Bid due date has been updated.)

The offer includes mature producing Permian assets with future development upside in the Jo-Mill and Spraberry fields located in Borden and Dawson counties, Texas. The company, an affiliate of Chevron Corp., retained EnergyNet to serve as its exclusive transaction and technical advisor for the sale.

Highlights:

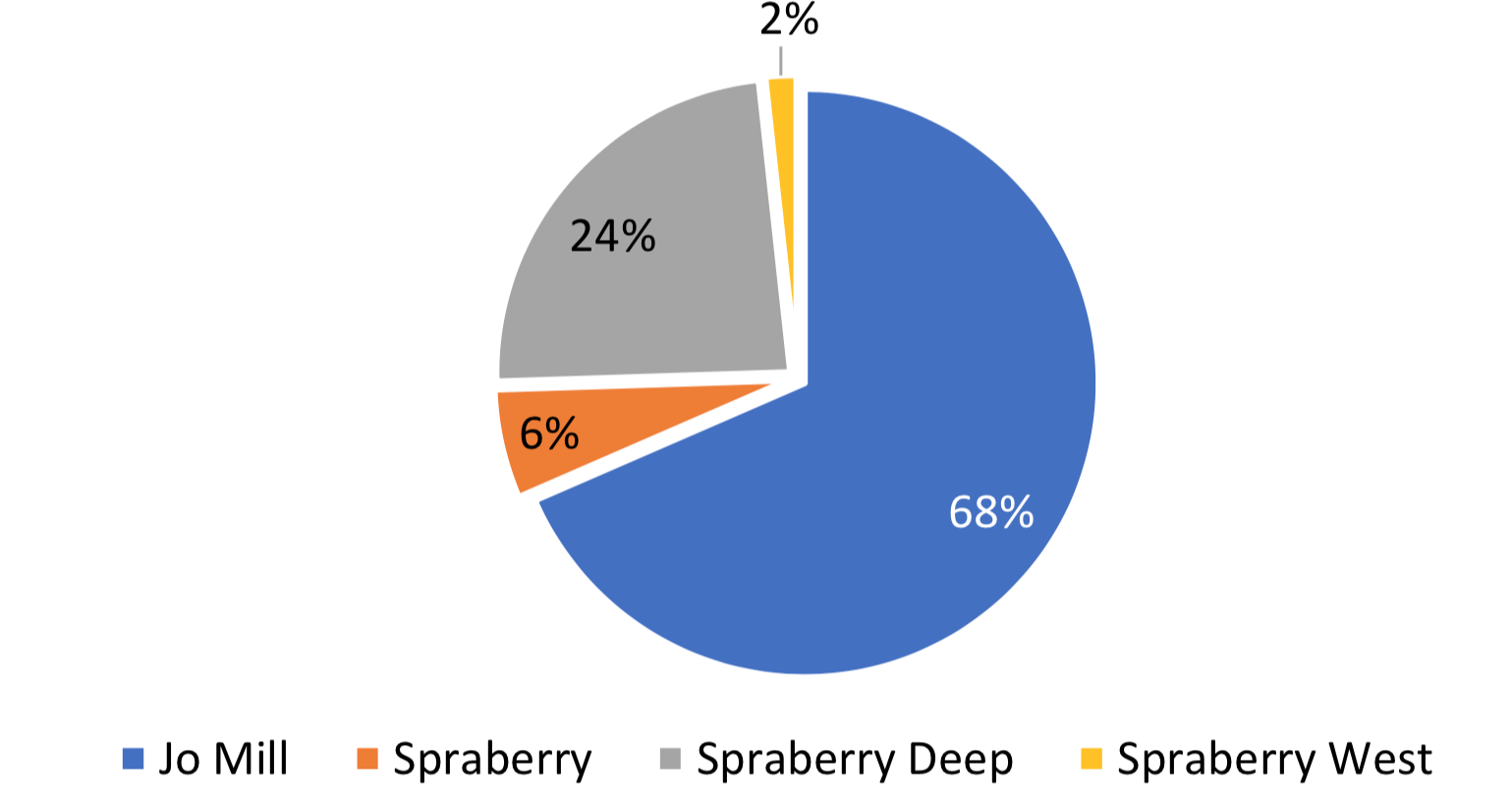

- Operations in Jo-Mill, Spraberry, Spraberry Deep and Spraberry West Fields

- 236 Producing wells; Average Working Interest 65.66% / Weighted Average Net Revenue Interest 58.11%

- Producing from Jo-Mill, San Andres and Spraberry Formations

- 27,975.73 Gross (21,038.29 Net) HBP Leasehold Acres

- Six-Month Average 8/8ths Production: 2,618 barrels per day of Oil And 1.016 million cubic feet per day of Gas

- 12-Month Average Net Income: $1,578,125 per Month

Upside Potential:

- Mature Producing PDP (Proved Developed Producing) Cash Flowing Asset with Future Development Upside

- Horizontal Infill Spraberry Potential

- Vintage Vertical Well Improvement through Horizontal Fracking

- Infill Development on 20-Acre Spacing

- Production Enhancement through Two Sided Injection Support

- Optimize Injection Support through Conversion and Pattern Realignment

- Re-enter and Establish Production in Inactive Wells due to New Fracking Technology Applications

Bids are due by 4 p.m. CDT Nov. 19. The transaction is expected to have a Dec. 1 effective date.

For complete due diligence information visit energynet.com or email Cody Felton, vice president of business development, at Cody.Felton@energynet.com, or Denna Arias, director of transaction management, at Denna.Arias@energynet.com.

Recommended Reading

ChampionX to Acquire RMSpumptools, Expanding International Reach

2024-03-25 - ChampionX said it expects the deal to extend its reach in international markets including the Middle East, Latin America and other global offshore developments.

Parker Wellbore, TDE Partner to ‘Revolutionize’ Well Drilling

2024-03-13 - Parker Wellbore and TDE are offering what they call the industry’s first downhole high power, high bandwidth data highway.

DXP Enterprises Buys Water Service Company Kappe Associates

2024-02-06 - DXP Enterprise’s purchase of Kappe, a water and wastewater company, adds scale to DXP’s national water management profile.

DNO Acquires Arran Field Stake, Continuing North Sea Expansion

2024-02-06 - DNO will pay $70 million for Arran Field interests held by ONE-Dyas, and up to $5 million in contingency payments if certain operational targets are met.

Select Water Solutions Bolts On Haynesville, Rockies Assets for $90MM

2024-01-31 - Select Water Solutions Inc. added disposal and recycling capacity in the Haynesville Shale and the Rockies across three acquisitions in January.