The following information is provided by EnergyNet. All inquiries on the following listings should be directed to EnergyNet. Hart Energy is not a brokerage firm and does not endorse or facilitate any transactions.

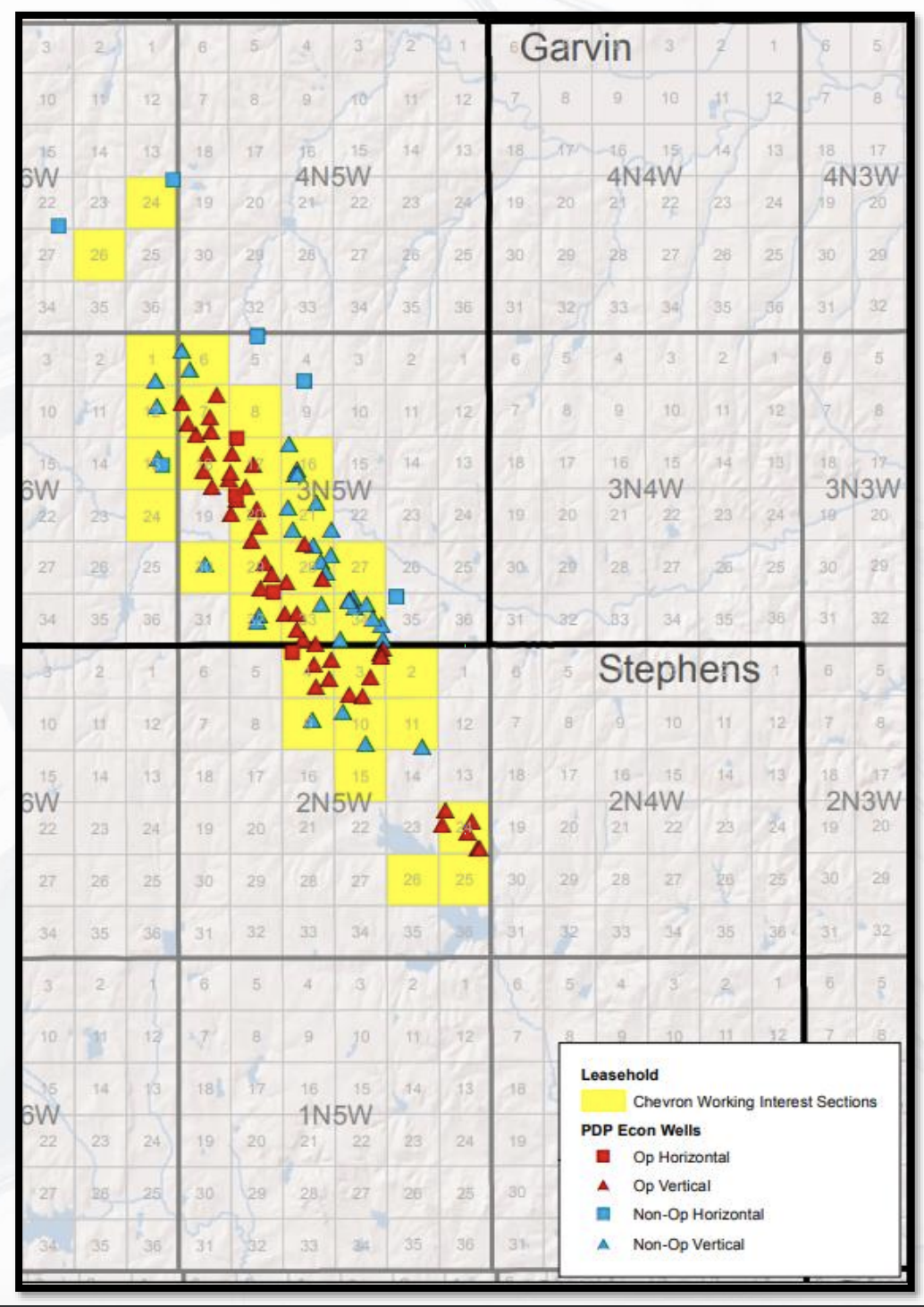

Affiliates of Chevron Corp. retained EnergyNet Indigo for the sale of its assets in the Carter Knox Field in Oklahoma's Grady and Stephens counties. The offering includes operations, nonoperated working interest and royalty interest.

Highlights:

- Operations in Carter Knox Field:

- Average Working Interest 49.1871% / Average Net Revenue Interest 41.9806%

- 52 Producing Wells | Six Shut-In Wells | Two Temporarily Abandoned Wells

- Producing from the Hunton, Sycamore, Viola, Bromide, Goddard, Morrow and Woodford Formations

- Nonoperated Working Interest in Carter Knox Field:

- Average Working Interest 11.1478% / Average Net Revenue Interest 9.2601% (Before Payout)

- 52 Producing Wells | Nine Shut-In Wells | One Temporarily Abandoned Well

- Three Non-Consent (After Payout Only) Wells

- Select Operators include Mack Energy Co., Gulfport Midcon LLC and Marathon Oil Co.

- Royalty Interest in Carter Knox Field:

- Average Royalty Interest 2.0652%

- 68 Producing Wells | 23 Shut-In Wells

- Select Operators include Mack Energy Co. and Marathon Oil Co.

- Six-Month Average 8/8ths Production: 69.213 MMcf/d of Gas and 2,600 bbl/d of Oil

- 12-Month Average Net Income: $233,117/Month

- Operator Bond Required

Bids are due Aug. 28. A data room is available.

The Chevron Carter Knox package is listed on EnergyNet’s new platform, EnergyNet Indigo, which is tailor-made for higher valued assets. The platform features asset deals valued from $20 million to more than $250 million, according to the A&D advisory firm.

For complete due diligence information visit indigo.energynet.com or email Cody Felton, vice president of business development, at Cody.Felton@energynet.com, or Denna Arias, vice president of corporate development, at Denna.Arias@energynet.com.

Recommended Reading

CERAWeek: Trinidad Energy Minister on LNG Restructuring, Venezuelan Gas Supply

2024-03-28 - Stuart Young, Trinidad and Tobago’s Minister of Energy, discussed with Hart Energy at CERAWeek by S&P Global, the restructuring of Atlantic LNG, the geopolitical noise around inking deals with U.S.-sanctioned Venezuela and plans to source gas from Venezuela and Suriname.

US Gulf Coast Heavy Crude Oil Prices Firm as Supplies Tighten

2024-04-10 - Pushing up heavy crude prices are falling oil exports from Mexico, the potential for resumption of sanctions on Venezuelan crude, the imminent startup of a Canadian pipeline and continued output cuts by OPEC+.

Paisie: Economics Edge Out Geopolitics

2024-02-01 - Weakening economic outlooks overpower geopolitical risks in oil pricing.

Exxon’s Payara Hits 220,000 bbl/d Ceiling in Just Three Months

2024-02-05 - ExxonMobil Corp.’s third development offshore Guyana in the Stabroek Block — the Payara project— reached its nameplate production capacity of 220,000 bbl/d in January 2024, less than three months after commencing production and ahead of schedule.

ARC Resources Adds Ex-Chevron Gas Chief to Board, Tallies Divestments

2024-02-11 - Montney Shale producer ARC Resources aims to sign up to 25% of its 1.38 Bcf/d of gas output to long-term LNG contracts for higher-priced sales overseas.