The following information is provided by EnergyNet. All inquiries on the following listings should be directed to EnergyNet. Hart Energy is not a brokerage firm and does not endorse or facilitate any transactions.

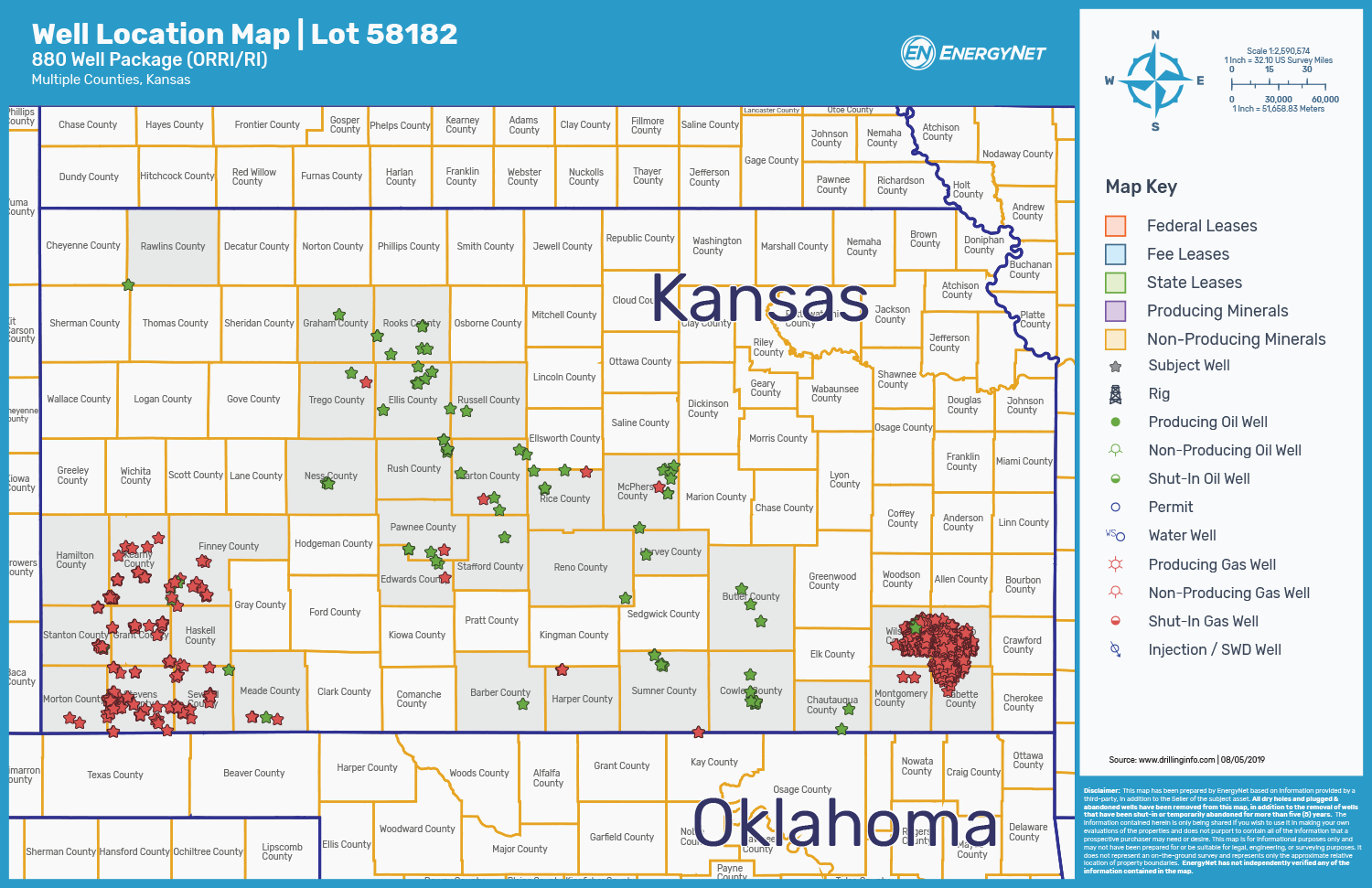

Cascade Acquisition Partners LP retained EnergyNet for the sale of an 880-well package with assets located throughout Kansas through an auction closing Aug. 27.

The offering comprises both overriding royalty interest (ORRI) and royalty interest in various counties in Kansas. Operators include Linn Energy Inc., Merit Energy Co., River Rock Operating LLC and Scout Energy Management LLC.

Highlights:

- 20.3125% to 0.013497% ORRI in 713 Wells:

- 658 Producing Wells | 55 Non-Producing Wells

- 10.9375% to 0.004395% Royalty Interest in 167 Wells:

- Six Wells Include Additional ORRI

- 145 Producing Wells | 22 Non-Producing Wells

- Six-Month Average 8/8ths Production: 787 barrels per day of Oil and 12.784 million cubic feet per day of Gas

- 10-Month Average Net Cash Flow: $13,252 per Month

Bids are due by 3:20 p.m. CDT Aug. 27. For complete due diligence information energynet.com or email Michael Baker, vice president of business development, at Michael.Baker@energynet.com, or Denna Arias, director of transaction management, at Denna.Arias@energynet.com.

Recommended Reading

TPG Adds Lebovitz as Head of Infrastructure for Climate Investing Platform

2024-02-07 - TPG Rise Climate was launched in 2021 to make investments across asset classes in climate solutions globally.

Air Products Sees $15B Hydrogen, Energy Transition Project Backlog

2024-02-07 - Pennsylvania-headquartered Air Products has eight hydrogen projects underway and is targeting an IRR of more than 10%.

NGL Growth Leads Enterprise Product Partners to Strong Fourth Quarter

2024-02-02 - Enterprise Product Partners executives are still waiting to receive final federal approval to go ahead with the company’s Sea Port Terminal Project.

Sherrill to Lead HEP’s Low Carbon Solutions Division

2024-02-06 - Richard Sherill will serve as president of Howard Energy Partners’ low carbon solutions division, while also serving on Talos Energy’s board.

Magnolia Appoints David Khani to Board

2024-02-08 - David Khani’s appointment to Magnolia Oil & Gas’ board as an independent director brings the board’s size to eight members.