The following information is provided by EnergyNet. All inquiries on the following listings should be directed to EnergyNet. Hart Energy is not a brokerage firm and does not endorse or facilitate any transactions.

Bonanza Mineral Partners LLC retained EnergyNet for the sale of Haynesville Shale assets in northern Louisiana through an auction closing Aug. 15.

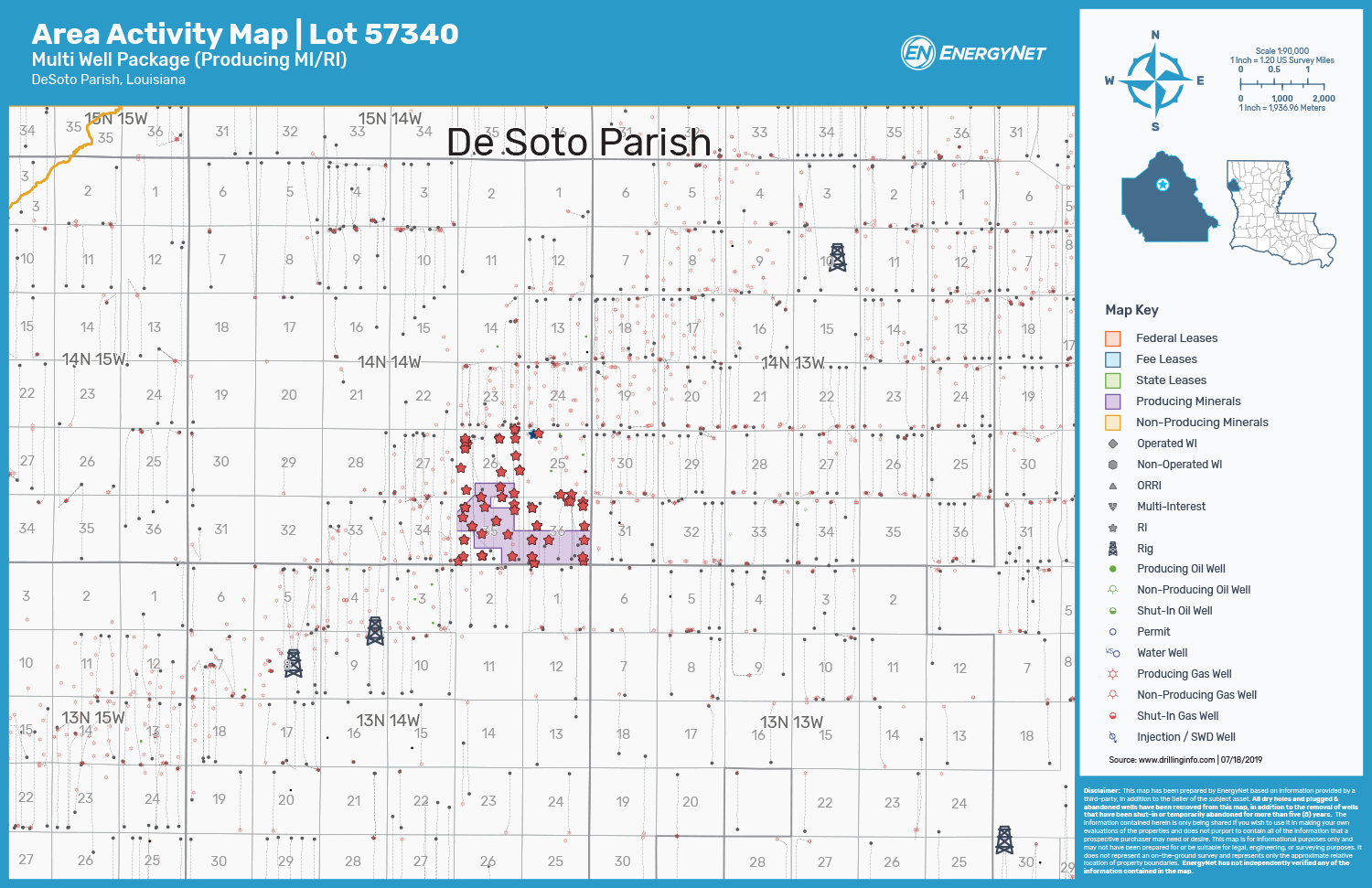

The offering comprises producing mineral and royalty interests in over 50 wells located in DeSoto Parish, La. The package also includes Cotton Valley potential, according to EnergyNet.

Highlights:

- 308.00 Net Royalty Acres:

- 3.75% to 0.388806% Royalty Interest in 52 Wells

- 43 Producing Wells | One Non-Producing Well | Eight Shut-In Wells

- Six-Month Average 8/8ths Production: 70.409 million cubic feet per day of Gas and 31 barrels per day of Oil

- Six-Month Average Net Income: $103,893 per Month

- Operators: Covey Park Energy LLC and Indigo II Louisiana Operating LLC (Editor's note: Covey Park was acquired by Comstock Resources Inc. in a transaction that closed July 16.)

Bids are due by 2 p.m. CDT Aug. 15. For complete due diligence information energynet.com or email Michael Baker, vice president of business development, at Michael.Baker@energynet.com, or Denna Arias, director of transaction management, at Denna.Arias@energynet.com.

Recommended Reading

TotalEnergies Starts Production at Akpo West Offshore Nigeria

2024-02-07 - Subsea tieback expected to add 14,000 bbl/d of condensate by mid-year, and up to 4 MMcm/d of gas by 2028.

E&P Highlights: Feb. 5, 2024

2024-02-05 - Here’s a roundup of the latest E&P headlines, including an update on Enauta’s Atlanta Phase 1 project.

CNOOC’s Suizhong 36-1/Luda 5-2 Starts Production Offshore China

2024-02-05 - CNOOC plans 118 development wells in the shallow water project in the Bohai Sea — the largest secondary development and adjustment project offshore China.

US Drillers Cut Oil, Gas Rigs for First Time in Three Weeks

2024-02-02 - Baker Hughes said U.S. oil rigs held steady at 499 this week, while gas rigs fell by two to 117.

Equinor Receives Significant Discovery License from C-NLOPB

2024-02-02 - C-NLOPB estimates recoverable reserves from Equinor’s Cambriol discovery at 340 MMbbl.