The following information is provided by Macquarie Capital Markets Canada Ltd. All inquiries on the following listings should be directed to Macquarie. Hart Energy is not a brokerage firm and does not endorse or facilitate any transactions.

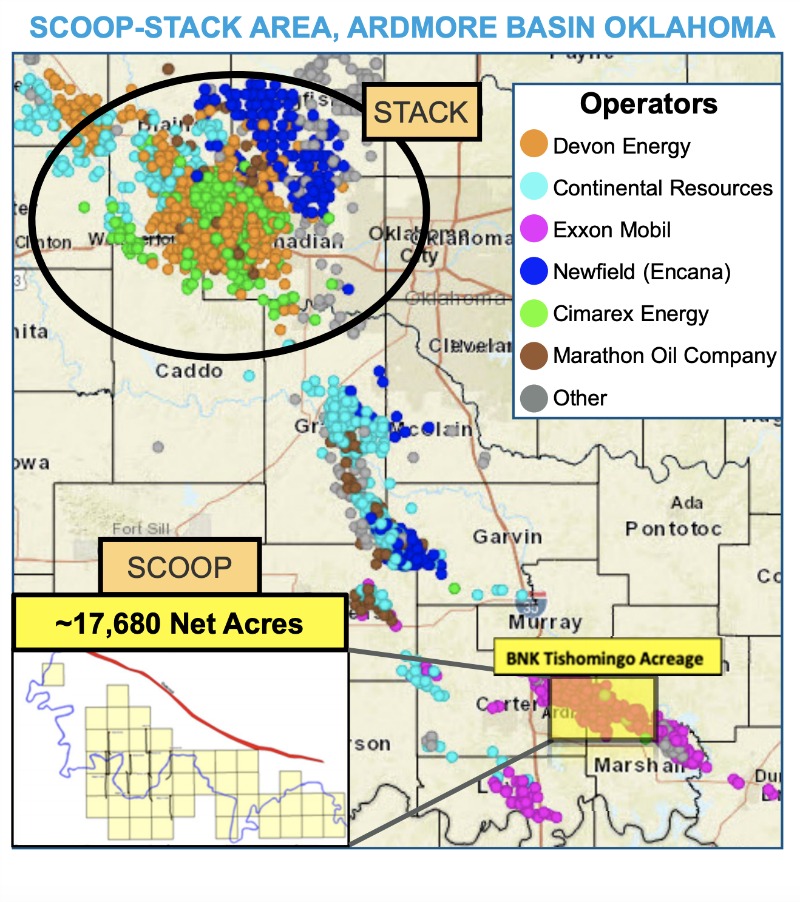

BNK Petroleum Inc. retained Macquarie Capital Markets Canada Ltd. for the sale of its Tishomingo Project in the southern Scoop play in Oklahoma.

Highlights:

- 17,680 net acres, with over 95% HBP

- 2018 production of 1,662 barrels of oil equivalent per day (boe/d) from the Mississippian Caney Shale and Sycamore Limestone formations, with roughly 90% light oil and liquids

- 17 wells producing with an additional 167 booked locations as follows:

- 50 Proved Undeveloped Locations

- 65 Probable Locations

- 52 Possible Locations

- Significant amount of unbooked/undeveloped land to the Eastern portion of the Tishomingo project

- Three untested zones that BNK currently holds the rights to provides for material upside potential

BNK Petroleum engaged the advisory and capital markets division of Macquarie Capital Markets Canada Ltd. as financial adviser to assist in seeking outcomes that will maximize value for BNK and its stakeholders. These outcomes may include an asset sale, corporate merger, corporate sale, recapitalization or reorganization.

For information visit macquarie.com or contact Ryan Tosi, Macquarie analyst, at Ryan.Tosi@macquarie.com or 403-539-8509.

Recommended Reading

Exxon Mobil Guyana Awards Two Contracts for its Whiptail Project

2024-04-16 - Exxon Mobil Guyana awarded Strohm and TechnipFMC with contracts for its Whiptail Project located offshore in Guyana’s Stabroek Block.

Deepwater Roundup 2024: Offshore Europe, Middle East

2024-04-16 - Part three of Hart Energy’s 2024 Deepwater Roundup takes a look at Europe and the Middle East. Aphrodite, Cyprus’ first offshore project looks to come online in 2027 and Phase 2 of TPAO-operated Sakarya Field looks to come onstream the following year.

E&P Highlights: April 15, 2024

2024-04-15 - Here’s a roundup of the latest E&P headlines, including an ultra-deepwater discovery and new contract awards.

Trio Petroleum to Increase Monterey County Oil Production

2024-04-15 - Trio Petroleum’s HH-1 well in McCool Ranch and the HV-3A well in the Presidents Field collectively produce about 75 bbl/d.

Trillion Energy Begins SASB Revitalization Project

2024-04-15 - Trillion Energy reported 49 m of new gas pay will be perforated in four wells.