The following information is provided by TenOaks Energy Advisors LLC. All inquiries on the following listings should be directed to TenOaks. Hart Energy is not a brokerage firm and does not endorse or facilitate any transactions.

Blackbeard Resources LLC has retained TenOaks Energy Advisors as its exclusive adviser in connection with the sale of its Delaware Basin portfolio.

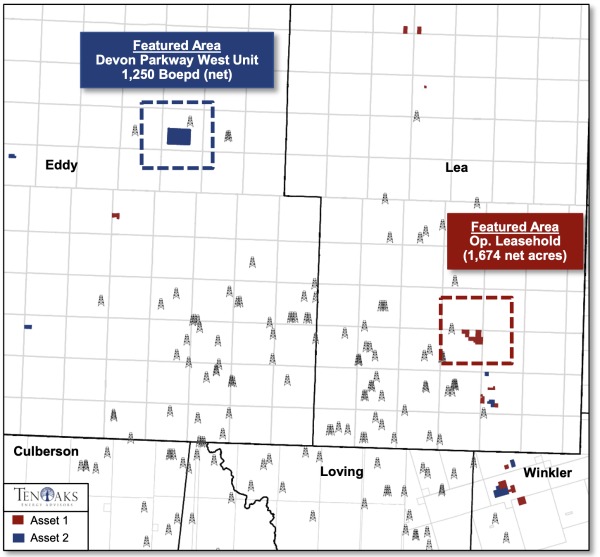

The properties have been divided into two asset types.

Asset 1

- Leasehold with Majority Operational Control

- Exposure to more than 4,000 ft of oil-rich column along the Eastern Delaware trend with multiple Wolfcamp and Bone Spring targets

- 2,790 net acres across Lea and Eddy counties, N.M., and Winkler County, Texas

- Lea County position includes 2,228 net acres (75% operational control)

- 25% HBP | 77.0% - 87.5% lease Net Revenue Interests in key operated tracts

- More than 460 upside locations quantified across multiple delineated benches

Asset 2

- Producing Nonoperated Leasehold

- Non-operated positions under Devon, Ameredev, Mewbourne, and Felix

- Features about 9.5% working interest in Devon’s 3,840-acre Parkway West (Bone Spring) Unit in Eddy County

- Net production: 1,250 barrels of oil equivalent per day from 97 wells | primarily horizontal development

- 19 completions since January 2018

- Proved Developed Producing (PDP) PV-10 value: $37.2 million

- 2019 PDP cash flow: about $1.0 million per month

- 13 active permits / 189 future drilling locations quantified

Bids are due March 20. For information visit tenoaksenergyadvisors.com or contact B.J. Brandenberger, TenOaks partner, at 214-420-2323 or BJ.Brandenberger@tenoaksadvisors.com.

Recommended Reading

Greenbacker Names New CFO, Adds Heads of Infrastructure, Capital Markets

2024-02-02 - Christopher Smith will serve as Greenbacker’s new CFO, and the power and renewable energy asset manager also added positions to head its infrastructure and capital markets efforts.

TC Energy Appoints Sean O’Donnell as Executive VP, CFO

2024-04-03 - Prior to joining TC Energy, O’Donnell worked with Quantum Capital Group for 13 years as an operating partner and served on the firm’s investment committee.

Jerry Jones Invests Another $100MM in Comstock Resources

2024-03-20 - Dallas Cowboys owner and Comstock Resources majority shareholder Jerry Jones is investing another $100 million in the company.

BP Restructures, Reduces Executive Team to 10

2024-04-18 - BP said the organizational changes will reduce duplication and reporting line complexity.

Air Products Sees $15B Hydrogen, Energy Transition Project Backlog

2024-02-07 - Pennsylvania-headquartered Air Products has eight hydrogen projects underway and is targeting an IRR of more than 10%.