The following information is provided by Houlihan Lokey Capital Inc. All inquiries on the following listings should be directed to Houlihan Lokey. Hart Energy is not a brokerage firm and does not endorse or facilitate any transactions.

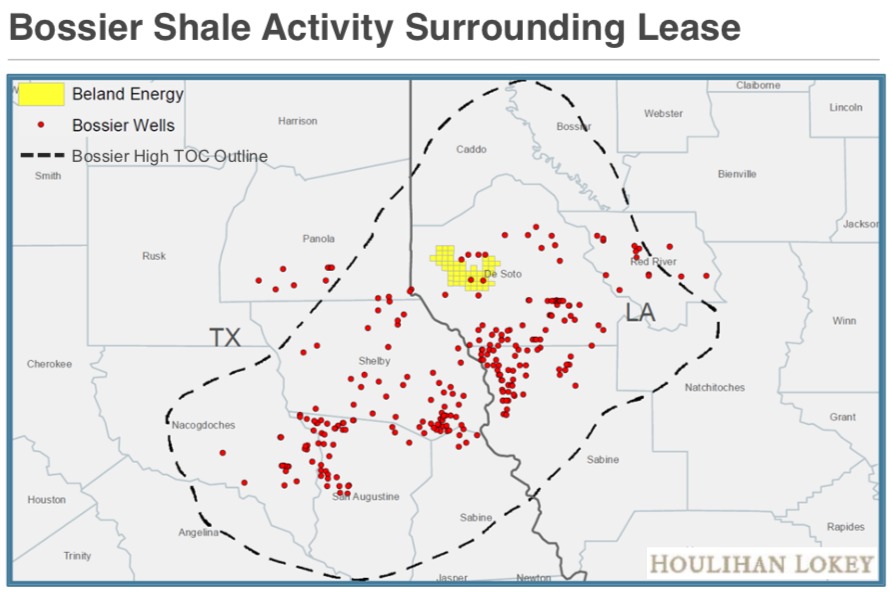

Beland Energy LLC is offering for sale its Bossier Shale interests in De Soto Parish, La. Beland has retained Houlihan Lokey Capital Inc. as its exclusive financial adviser to assist with this transaction.

Asset Highlights:

- Contiguous leasehold covering 37,086 gross (23,690 net) acres

- About 97.5% HBP

- About 97.4% operated

- Operated ownership of 80% WI / 63% NRI

- Attractive realized pricing given existing infrastructure on leasehold and desirable location relative to Henry Hub and LNG export projects

- Transaction includes Bossier Shale rights only

- Exceptional reservoir properties and well performance

- Consistent Bossier Shale target interval across Beland’s position

- Porosity quality and overall thickness are comparable to or better than that of the Haynesville

- Net pay thickness ranges from 275 ft to 325 ft

- Latest generation Bossier Shale completions are outperforming latest generation Haynesville wells on a percentage generational uplift basis

- Substantial and scalable resource base and asset value

- Individual wells forecasted to achieve greater than 45% IRRs at strip

- Net resource of about 1.4 trillion cubic feet; PV-10 value of about $460 million at strip

- 175 future drilling locations assuming six wells per section; includes 132 locations with greater than or equal to 7,500-ft laterals

- Current development plan forecasts peak net production of about 610 million cubic feet per day by 2022

Bids are due Oct. 29. For information visit www.hl.com or contact Kirk Tholen, managing director and head of E&P A&D for Houlihan Lokey, at KTholen@HL.com or 832-319-5110.

Recommended Reading

NGL Growth Leads Enterprise Product Partners to Strong Fourth Quarter

2024-02-02 - Enterprise Product Partners executives are still waiting to receive final federal approval to go ahead with the company’s Sea Port Terminal Project.

Sunoco’s $7B Acquisition of NuStar Evades Further FTC Scrutiny

2024-04-09 - The waiting period under the Hart-Scott-Rodino Antitrust Improvements Act for Sunoco’s pending acquisition of NuStar Energy has expired, bringing the deal one step closer to completion.

After Megamerger, Canadian Pacific Kansas City Rail Ends 2023 on High

2024-02-02 - After the historic merger of two railways in April, revenues reached CA$3.8B for fourth-quarter 2023.

Moda Midstream II Receives Financial Commitment for Next Round of Development

2024-03-20 - Kingwood, Texas-based Moda Midstream II announced on March 20 that it received an equity commitment from EnCap Flatrock Midstream.

Enbridge Advances Expansion of Permian’s Gray Oak Pipeline

2024-02-13 - In its fourth-quarter earnings call, Enbridge also said the Mainline pipeline system tolling agreement is awaiting regulatory approval from a Canadian regulatory agency.