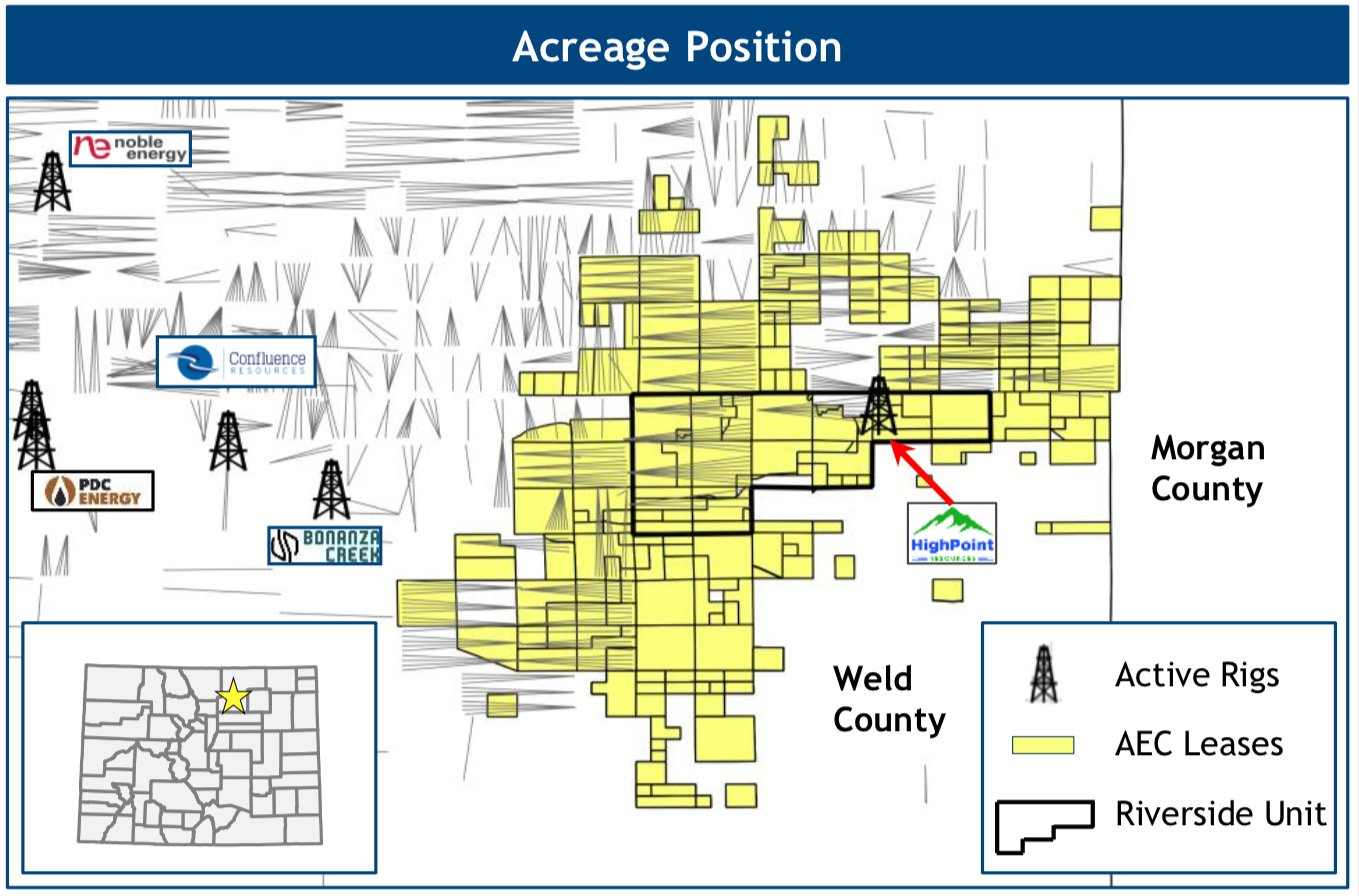

Anschutz Exploration Corp. retained SunTrust Robinson Humphrey Inc. as its exclusive financial adviser for the sale of a Denver-Julesburg (D-J) Basin Royalty and Non-Op package through an offering with bids due in late September. The offering is comprised of Royalty Interests and associated Non-Operated oil and gas producing properties located in Weld County, Colo.

Highlights:

- HighPoint Resources and Bonanza Creek Energy are active operators on the acreage

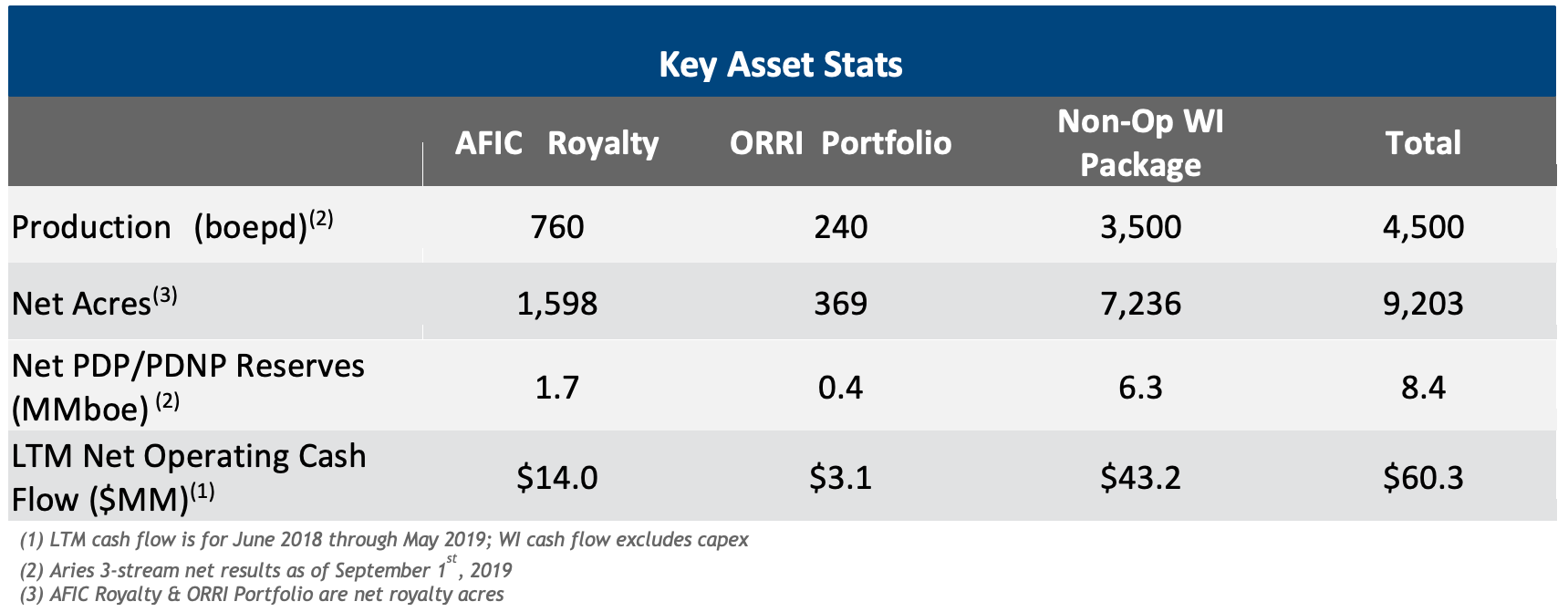

- 4,500 Net barrels of oil equivalent/day as of September 1, 2019

- 211 gross non-operated producing wells, Over 90% of acreage is HBP

- 26 wells in drilling and completion operations stages

- 250-plus additional future development locations across position

- Last 12-month Operating Cash Flow $60.3 MM (June 2018 – May 2019, excluding capex)

- Rural setting in pro-industry Weld County minimizes regulatory risk

Summary of Packages Offered:

- Royalty Interest Packages:

- Anschutz Family Investment Co. (AFIC) royalty package

- AFIC – 1,598 net acres

- AFIC royalty interest ranges from less than 1% up to 14.5% per 1,280 acre drill spacing unit (DSU), where ownership is present

- 2018 net cash flow of $13.8 million

- Last 12-month net cash flow of $14.0 million (June 2018 through May 2019)

- Anschutz “ORRI Portfolio”

- Overriding Royalty Interest (ORRI) Portfolio - 360 net acres

- ORRI Portfolio interest ranges from less than 1% to 3.7% per 1,280 DSU, where ownership is present

- 2018 net cash flow of $2.5 million

- Last 12-month net cash flow of $3.1 million (June 2018 through May 2019)

- Anschutz Family Investment Co. (AFIC) royalty package

- Non-Op Working Interest Package:

- 39,481 Gross (7,236 net acres) in Weld County

- Current net production: 3,500 boe/d, 65% oil

- January 2020 forecasted net production: 3,700 boe/d (Aries 3-stream net results as of Jan. 1, 2020)

- Over 200% production increase from January 2018

- Last 12-month net cash flow of $43.2 million (June 2018 through May 2019, excluding capex)

- 39,481 Gross (7,236 net acres) in Weld County

The transaction is structured as a sale of assets with an effective date of Sept. 1.

This information is provided by SunTrust Robinson Humphrey Inc. Contact Samantha Holroyd, Managing Director, at 713-426-9001 or Samantha.Holroyd@suntrust.com.

Hart Energy is not a brokerage firm and does not endorse or facilitate any transactions.

Recommended Reading

Hess Midstream Increases Class A Distribution

2024-04-24 - Hess Midstream has increased its quarterly distribution per Class A share by approximately 45% since the first quarter of 2021.

Hess Corp. Boosts Bakken Output, Drilling Ahead of Chevron Merger

2024-01-31 - Hess Corp. increased its drilling activity and output from the Bakken play of North Dakota during the fourth quarter, the E&P reported in its latest earnings.

Sunoco’s $7B Acquisition of NuStar Evades Further FTC Scrutiny

2024-04-09 - The waiting period under the Hart-Scott-Rodino Antitrust Improvements Act for Sunoco’s pending acquisition of NuStar Energy has expired, bringing the deal one step closer to completion.

CEO: Coterra ‘Deeply Curious’ on M&A Amid E&P Consolidation Wave

2024-02-26 - Coterra Energy has yet to get in on the large-scale M&A wave sweeping across the Lower 48—but CEO Tom Jorden said Coterra is keeping an eye on acquisition opportunities.

CorEnergy Infrastructure to Reorganize in Pre-packaged Bankruptcy

2024-02-26 - CorEnergy, coming off a January sale of its MoGas and Omega pipeline and gathering systems, filed for bankruptcy protect after reaching an agreement with most of its debtors.