Houston-based Magnum Hunter Resources Corp. (Amex: MHR) plans to acquire Appalachian Basin-focused NGAS Resources Inc., Lexington, Ky., (Nasdaq: NGAS) for approximately $98 million in common stock and assumed liabilities.

NGAS has core assets of more than 360,000 acres (68% undeveloped), primarily in the southern Appalachian Basin, with interests in approximately 1,400 wells, an extensive inventory of some 2,400 low-risk horizontal drilling locations and exposure to the Huron shale and emerging Weir oil play. The company also operates the gas-gathering facilities for its core Appalachian properties, providing deliverability directly from the wellhead to the interstate pipeline.

As well, NGAS has proved reserves of 78.4 billion cubic feet equivalent as of year-end 2009 (74% gas and 65% PDP), long-lived reserves with an R/P ratio of 23.4 years and daily production of approximately 9.2 million cubic feet equivalent as of Sep. 30.

Upside includes the ability to achieve an estimated $7 million to $8 million of synergies and cost reductions through restructured gas transportation agreement, consolidation of G&A with Triad Hunter, elimination of public company expenses and possible spin-off of NGAS' broker-dealer business to a third-party management group; highly accretive to reserves, production and cash flow per share; and the ability to hold significant lease acreage without substantial drilling expenditures through acreage that is held-by-production and utilization of future partnership funds.

The acquired liabilities consist of a senior credit facility, with approximately $35.2 million outstanding; approximately $14.7 million in remaining NGAS 6% convertible notes to be paid off at closing; other long-term debt of about $6.3 million to be assumed; and cash and positive working capital of approximately $11.6 million as of Sept. 30.

Magnum Hunter will acquire NGAS for $0.55 per share with a fixed exchange ratio of 0.0846 based on an agreed Magnum Hunter stock price of $6.50 per share. The buyer will also issue approximately 6.6 million shares, representing approximately 8% of its fully diluted shares outstanding.

Approximately 4.2 million Magnum Hunter common shares, or $27.3 million, will be issued to NGAS shareholders, and 2.4 Magnum Hunter common shares, or $15.9 million, will be issued to certain holders of NGAS’ 6% convertible notes, which are expected to convert to NGAS common shares by the closing date. Additionally, a $10-million payment will be made to a third-party to restructure an out-of-market, gas-gathering and transportation agreement through issuance of Magnum Hunter common shares at closing.

The transaction is also conditioned on the restructuring of NGAS’ transportation agreements with Seminole Energy Services LLC, including the payment of $10 million in cash or Magnum Hunter restricted stock, the cancellation of approximately $7 million in remaining note installments from Seminole's purchase of the NGAS Appalachian gathering system in August 2009 and the right to acquire a 50% interest in Magnum Hunter's Marcellus gas processing plant.

The assumed liabilities will be refinanced under a new senior credit facility with an initial borrowing base of $120 million, to be provided by BMO Capital Markets Corp., which is financial advisor to Magnum Hunter.

Magnum Hunter chief executive Gary C. Evans says, "We have been studying the possibility of a business combination with NGAS for most of 2010. This transaction enables our combined enterprise to own high-quality, long-lived proved developed producing assets with significant development upside covering approximately 300,000 acres. We believe the combination provides tremendous value for both companies' shareholders. At closing, all financial measures are accretive to our shareholder base.”

Evans adds that Magnum Hunter's upside exposure in one of its three existing core areas, the Appalachian Basin, will be substantially increased with the addition of NGAS to its portfolio.

“The company's acquisition of NGAS essentially creates a long-dated call option in natural gas while we continue to develop some of our other high return resource plays,” he says.

NGAS president and CEO William S. Daugherty says, " Magnum Hunter's substantial financial resources, coupled with its existing Appalachian operations, will enable the combined operations to accelerate growth for all of its shareholder constituencies."

The deal is expected to close by March 31, 2011.

Capital One Southcoast Inc. provided a fairness opinion to Magnum Hunter's board. Fulbright & Jaworski LLP is legal advisor to Magnum Hunter. KeyBanc Capital Markets Inc. is advisor to NGAS; Skadden, Arps, Slate, Meagher & Flom LLP is the company’s legal advisor.

NGAS Resources is a British Columbia corporation, and the deal will be implemented as an arrangement under British Columbia law.

Recommended Reading

Exclusive: ‘Reality Has Hit,’ NatGas Not Just a Bridge Fuel, Landrieu Says

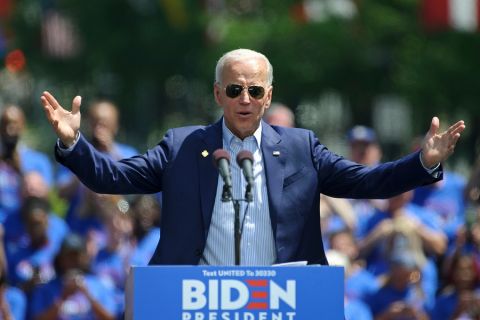

2024-04-11 - The Biden administration's LNG pause is "disappointing" and natural gas is a "solution to energy woes," co-chairs for Natural Allies for a Clean Energy Future Senator Mary Landrieu and Congressman Kendrick Meek told Hart Energy's Jordan Blum at CERAWeek by S&P Global.

Belcher: Our Leaders Should Embrace, Not Vilify, Certified Natural Gas

2024-03-18 - Recognition gained through gas certification verified by third-party auditors has led natural gas producers and midstream companies to voluntarily comply and often exceed compliance with regulatory requirements, including the EPA methane rule.

Hirs: LNG Plan is a Global Fail

2024-03-13 - Only by expanding U.S. LNG output can we provide the certainty that customers require to build new gas power plants, says Ed Hirs.

Pitts: Producers Ponder Ramifications of Biden’s LNG Strategy

2024-03-13 - While existing offtake agreements have been spared by the Biden administration's LNG permitting pause, the ramifications fall on supplying the Asian market post-2030, many analysts argue.

The Problem with the Pause: US LNG Trade Gets Political

2024-02-13 - Industry leaders worry that the DOE’s suspension of approvals for LNG projects will persuade global customers to seek other suppliers, wreaking havoc on energy security.