Laredo Petroleum Inc. received a delisting warning from the New York Stock Exchange (NYSE) due to a low stock price, the Tulsa, Okla.-based oil and gas producer disclosed in a March 27 press release.

The notice comes at a time when much of the industry is still reeling from a crash in oil prices with both Brent and WTI crude benchmarks down nearly two thirds this year driven by a coronavirus-related slump in economic activity and an oil price war between Saudi Arabia and Russia.

According to a Reuters report on March 27, physical crude oil traders said they expect prices in the Permian Basin, where Laredo operations are focused, to slide by as much as another $10 a barrel by May, when tanks in the region as well as across the country are seen hitting maximum capacity. That would leave the price of a barrel of oil pumped from the Permian in the single digits, the Reuters report said.

Laredo began this year with its common stock trading around $2.76 per share but has since seen its stock price nosedive by roughly 87%. The average closing price of Laredo’s common stock over the prior 30-consecutive trading day period was below $1 per share, which is the minimum average share price for continued listing on the NYSE.

In the release, Laredo said the company is considering all available options to regain compliance with the NYSE’s continued listing standards, which may include a reverse stock split.

Laredo’s activities are centered on the east side of the Permian Basin, primarily Glasscock and Reagan counties, Texas. The company has more than 140,000 gross acres, the majority of which is contiguous and also 85% HBP, according to the Laredo website.

Recommended Reading

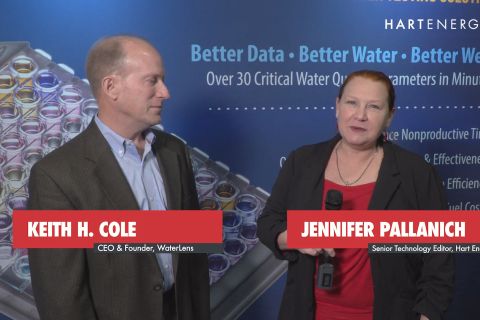

Exclusive: Calling on Automation to Help with Handling Produced Water

2024-03-10 - Water testing and real-time data can help automate decisions to handle produced water.

Exclusive: Chevron New Energies' Bayou Bend Strengthens CCUS Growth

2024-02-21 - In this Hart Energy LIVE Exclusive interview, Chris Powers, Chevron New Energies' vice president of CCUS, gives an overview of the company's CCS/CCUS activity and talks about the potential and challenges of it onshore-offshore Bayou Bend project.

Exclusive: As AI Evolves, Energy Evolving With It

2024-02-22 - In this Hart Energy LIVE Exclusive interview, Hart Energy's Jordan Blum asks 4cast's COO Andrew Muñoz about how AI is changing the energy industry—especially in the oilfield.

Exclusive: Liberty CEO Says World Needs to Get 'Energy Sober'

2024-04-02 - More money for the energy transition isn’t meaningfully moving how energy is being produced and fossile fuels will continue to dominate, Liberty Energy Chairman and CEO Christ Wright said.

Chesapeake, Awaiting FTC's OK, Plots Southwestern Integration

2024-04-01 - While the Federal Trade Commission reviews Chesapeake Energy's $7.4 billion deal for Southwestern Energy, the two companies are already aligning organizational design, work practices and processes and data infrastructure while waiting for federal approvals, COO Josh Viets told Hart Energy.