From Houston (BN): Chevron’s BIG FOOT (32/2) tlp development is enduring another delay.

After sailing out of Kiewit’s Ingleside TX yard into the Gulf of Mexico on 14 March, the big tlp was expected to be on site in Walker Ridge 29 within two weeks. Instead, persistent loop currents in the GoM have forced Chevron to ‘park’ Big Foot about 96km north to await better ocean conditions.

First oil was expected by the end of the year before the latest delay. The $5bn project has been a bit star-crossed. Originally slated for first oil in late 2014, topside construction issues pushed facility completion to the right. With the tlp virtually complete last fall, loop currents and other weather issues delayed sail-out for months. Now this.

Simple math shows the cost of delay. If Big Foot had come onstream as planned, Chevron would have had at least six months of production at $90-110/bbl. Instead, assuming current pricing patterns hold (a big assumption), revenues will be about half that much.

The dry-tree extended tlp has the capacity to handle up to 75,000b/d and 0.7mcm/d. Chevron operates (60%) for Statoil (27.5%) and Marubeni (12.5%).

From the North Sea (NT): Talisman’s hopes of removing the topsides of the ill-fated YME (31/22) jackup platform this summer are under threat.

Reports are emerging that the commissioning of Pioneering Spirit, Allseas’ newbuild single-lift vessel which is lined up for the job, is taking much longer than expected and the vessel may only become available in late September.

Talisman says it understands that Allseas is evaluating the commissioning schedule and that it has no new information on when the removal operation will take place. So far it has only talked vaguely of ‘sometime this summer’.

A request to Allseas for clarification was unanswered at press time. At some point, however, if Pioneering Spirit fails to show as winter conditions begin to set in, Talisman is likely to have to postpone the operation until next year.

Meanwhile the Yme drilling derrick, which was not installed on the platform, has been sold to Norway Energy & Drilling Centre, located near Stavanger, where it will become part of a test rig available for industry use.

From Houston (BN): LLOG announced initial production from its DELTA HOUSE (31/19) fps in Mississippi Canyon 254 in 1,372m.

LLOG plans to have eight wells onstream by year-end. The fps is designed for peak capacity of 100,000b/d and 6.8mcm/d.

LLOG executives said this year will be transformative for the company, with five exploration wells and continued development around Delta House and Who Dat (30/1). Its first fps started up in 2011.

Backed by Blackstone Energy Partners, LLOG operates (50%) for Ridgewood and Red Willow (23.75% each) and Houston Energy (2.5%).

From Rotterdam (MT): SBM Offshore’s latest pair of GENERATION 3 pre-salt fpso’s being converted at China’s Guangzhou Shipyard are due to set sail later this year for its Brasa Shipyard in Brazil for further modules integration and completion, before heading off to work for Petrobras.

The two sister ships, Cidade de Marica and Cidade de Saquarema, will be completed at Brasa before going on location in late 2015 and mid-2016, respectively. Both are part of a conversion project worth approximately $3.5bn, the largest such project handled by SBM. Both will have a service life and charter of 20 years each.

The combined weight of the topsides for these two converted double-hull fpsos comes to 46,000t. Each conversion has involved the building of an entire new deck for each unit.

From Australia (RW): The MANORA (31/23) development drilling programme, offshore Thailand, has been curtailed with operator Mubadala Petroleum and partner Tap Oil Ltd deciding to postpone two production wells and one injection well indefinitely. The decision follows a review of the seven wells put into production so far.

The field has already reached peak production of 15,000b/d with flows hitting 16,000b/d on some days. The full field development had initially been set at up to 10 producing wells and five injectors, but this will now be reviewed.

Four of the existing wells (MNA-01, 02, 03 and 05) have shown the expected high productivity and are producing free of water and sand. The other three are injecting water to support production from the Central fault Block. MNA-07, a potential producer in the East fault Block tested at 1,332b/d with 64% water cut, while MNA-08 also on the east fault is producing at 2,377b/d with 14% water cut. MNA-11 in the Central Fault Block intersected 98m of oil pay which is the thickest so far in the reservoir. This has confirmed there are thicker sands in the central block.

Mubadala operates (60%) for Tap (30%) and Northern Gulf Petroleum (10%). The latter is in default of the $27mn payment demand for the programme and had until 20 April to pay or lose access to revenue from production. By 20 May without payment, the company will lose its title to the block.

From the North Sea (NT): A $56mn contract for the conversion of the fso for Statoil’s GINA KROG (32/2) development has been placed by Teekay with the Sembawang shipyard in Singapore.

The unit will be converted from Teekay’s Randgrid shuttle tanker, which is expected to arrive at the yard in June. In addition to hull reinforcements, the scope includes refurbishment of the submersible turret loading (STL) compartment and the installation of an azimuth thruster. Delivery is due in May next year.

Technip, working in partnership with China Offshore Oil Engineering Corp, has picked up the FEED work on a pair of tension leg platforms for CNOOC’s LIUHUA complex in the South China Sea. The twin fields, 11-1 and 16-2, lie in waters of roughly 400m.

The FEED activity, to be executed out of Technip’s Houston office, will cover the tlp hull, topside including drilling rigs, process system and the mooring and riser system and is due to be completed by the end of the year.

The former field was first developed by Amoco in the early 1990's using a semi production unit and an fpso. It is seen as likely that an fpso will be included here as well. An earlier concept had one tlp located 7km from the fpso, which both handled production and provided power, while the other floater was 35km away and drew its power from the first tlp.

GMC has completed design work on a self-installing buoyant tower destined for the PRINOS field, offshore Greece. GMC’s brief was to propose remedial work on existing facilities on the field as well as a new unit to extend its life. This concept could be linked to the current Prinos Delta processing platform. One of the key design issues was to come up with a concept that could be built locally as well as being installed without the use of heavylift vessels, which the combined drilling and production unit met.

The class certification for the fpso Armada Perdana working on CAMAC’s OYO field, offshore Nigeria, is expected to be issued before the end of the month...Full production of 28,000boe/d has resumed at the HUNTINGTON (32/2) field in the UK, including 3,000boe/d of gas into the CATS pipeline system. Production at Voyageur Spirit had been limited due to problems with the pipeline network and it will be shut down again in the summer for maintenance at the receiving terminal...First oil has been reported at Lundin’s BERTRAM field, offshore Malaysia, through a wellhead platform and an fpso moored in 75m off the east coast of the mainland.

The aged production ship PETROJARL 1 (32/1) has gone into drydock at Damen Shipyard in Rotterdam for a year-long programme of upgrade and renewal work. The work is being done in partnership with Frames and Nevesbu.

The Japanese 4M consortium - Modec, Mitsui, Mitsui OSK Lines and Marubeni - will provide and finance the fpso Cidade de Campos dos Goytacazes MV29 for Petrobras’s TARTARUGA VERDE & MESTICA fields. Modec will supply the production ship while the others will provide finance, which they have done before on four other projects.

The spread-moored unit, which will operate under a 20 year charter, will be moored in 765m and is due for delivery in late 2017. It will have the standard Petrobras processing capacity of 150,000b/d and 5mcm/d and storage of 1.6mmbbls.

Worley Parsons has secured an engineering and project services agreement with Ophir Energy that covers the development of its FORTUNA field as a floating LNG project in Block R, offshore Equatorial Guinea. A 20-well subsea production system will feed the 3mt/a FLNG unit. The field is in waters of 1,400-1,900m.

Bumi Armada is to supply an fsu to ELECTROGAS MALTA as part of an LNG terminal development ... Technip has picked up a SURF-IRM contract with Dana Petroleum for work on its TRITON fpso which handles production from six fields in the Central North Sea. The work includes installation of two new risers and one new umbilical and a range of remedial and maintenance work ... Nautronix has said that Subsea 7 has completed installation of a 16-station NASNet acoustic positioning array on Statoil’s AASTA HANSTEEN (32/2) field in Norway in advance of the main subsea installation programme...Kongsberg Maritime and Braemar ACM have joined Enegi Oil in its MARGINAL FIELD INITIATIVE providing remote control and monitoring equipment and financing and other commercial services, respectively.

Recommended Reading

Hirs: LNG Plan is a Global Fail

2024-03-13 - Only by expanding U.S. LNG output can we provide the certainty that customers require to build new gas power plants, says Ed Hirs.

Exclusive: Dan Romito Urges Methane Mitigation Game Plan

2024-04-08 - Dan Romito, the consulting partner at Pickering Energy Partners, says evading mitigation responsibility is "naive" as methane detection technology and regulation are focusing on oil and gas companies, in this Hart Energy Exclusive interview.

From Satellites to Regulators, Everyone is Snooping on Oil, Gas

2024-04-10 - From methane taxes to an environmental group’s satellite trained on oil and gas emissions, producers face intense scrutiny, even if the watchers aren’t necessarily interested in solving the problem.

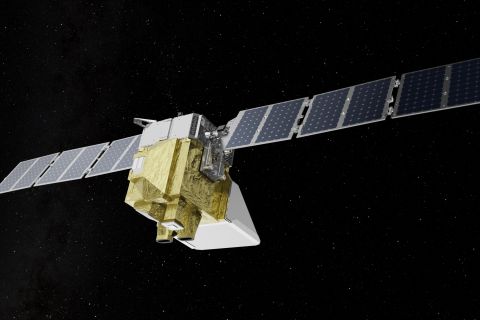

Markman: Is MethaneSAT Watching You? Yes.

2024-04-05 - EDF’s MethaneSAT is the first satellite devoted exclusively to methane and it is targeting the oil and gas space.

BOEM Adjusts Monetary Penalties for Oil, Gas Companies

2024-01-25 - BOEM’s adjustment is based on a 2015 act that requires annual inflation adjustments.