(Source: EQM Midstream Partners LP)

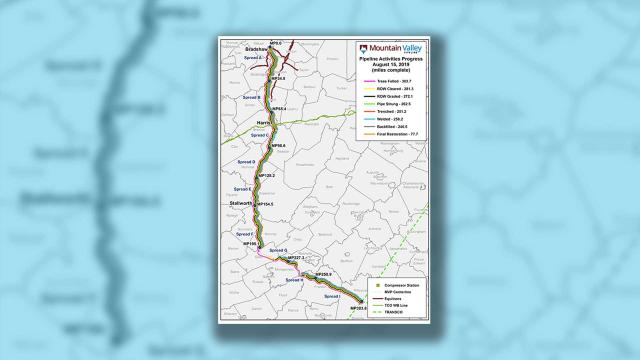

EQM Midstream Partners LP delayed the expected completion of its Mountain Valley natural gas pipeline from West Virginia to Virginia to early 2021 and said it could boost the $5.4 billion project’s cost by 5% to around $5.7 billion.

Industry analysts, however, said Mountain Valley and other U.S. pipelines will likely be delayed even further by a Montana court’s decision that the U.S. Army Corps of Engineers did not comply with the Endangered Species Act.

EQM, which changed the projected in-service date in a statement issued late June 11, had previously said it expected Mountain Valley to enter service in late 2020.

“We are confident in the ultimate completion of this important infrastructure project,” EQM COO Diana Charletta said, noting it was about 92% complete.

When EQM started construction in February 2018, it estimated Mountain Valley would cost about $3.5 billion and be completed by the end of 2018.

But successful legal challenges to federal permits resulted in lengthy delays and higher costs for Mountain Valley and other gas pipes, like Dominion Energy Inc.’s $8 billion Atlantic Coast line from West Virginia to North Carolina.

Analysts at Height Capital Markets in Washington said on June 12 that EQM’s new in-service date and potential cost increase are optimistic given legal issues with the Army Corps’ Nationwide Permit 12 program, which Mountain Valley intends to use to cross the remaining 10 miles of water bodies along its route.

In April, a Montana judge ruled the Army Corps violated federal law by issuing Nationwide Permits to cross water bodies without adequately consulting other agencies on risks to endangered species and habitat.

“Besides the (Nationwide Permit) issue, Mountain Valley faces litigation risk on several upcoming permitting decisions,” Height Capital Markets said, noting the project will likely enter service in second-quarter 2021.

Recommended Reading

Yellen Expects Further Sanctions on Iran, Oil Exports Possible Target

2024-04-16 - U.S. Treasury Secretary Janet Yellen intends to hit Iran with new sanctions in coming days due to its unprecedented attack on Israel.

Renewed US Sanctions to Complicate Venezuelan Oil Sales, Not Stop Them

2024-04-19 - Venezuela’s oil exports to world markets will not stop, despite reimposed sanctions by Washington, and will likely continue to flow with the help of Iran—as well as China and Russia.

US Decision on Venezuelan License to Dictate Production Flow

2024-04-05 - The outlook for Venezuela’s oil industry appears uncertain, Rystad Energy said April 4 in a research report, as a license issued by the U.S. Office of Assets Control (OFAC) is set to expire on April 18.

US Orders Most Companies to Wind Down Operations in Venezuela by May

2024-04-17 - The U.S. Office of Foreign Assets Control issued a new license related to Venezuela that gives companies until the end of May to wind down operations following a lack of progress on national elections.