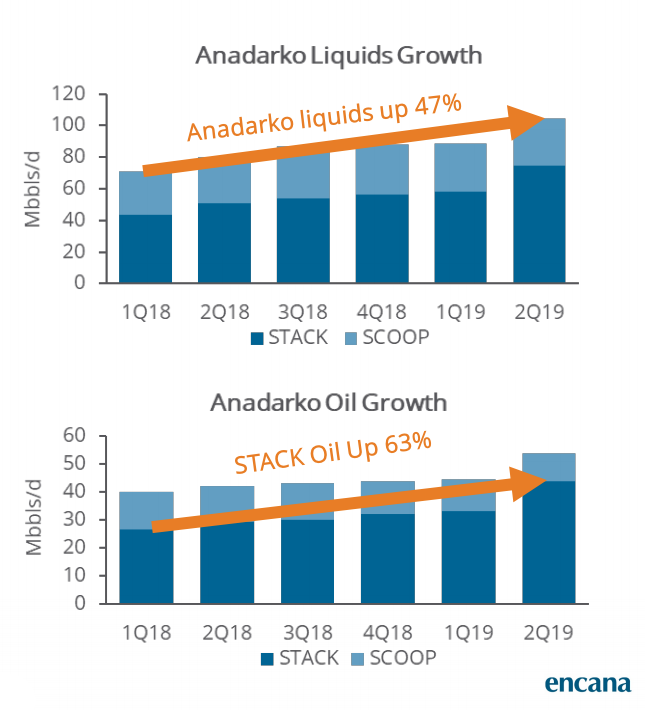

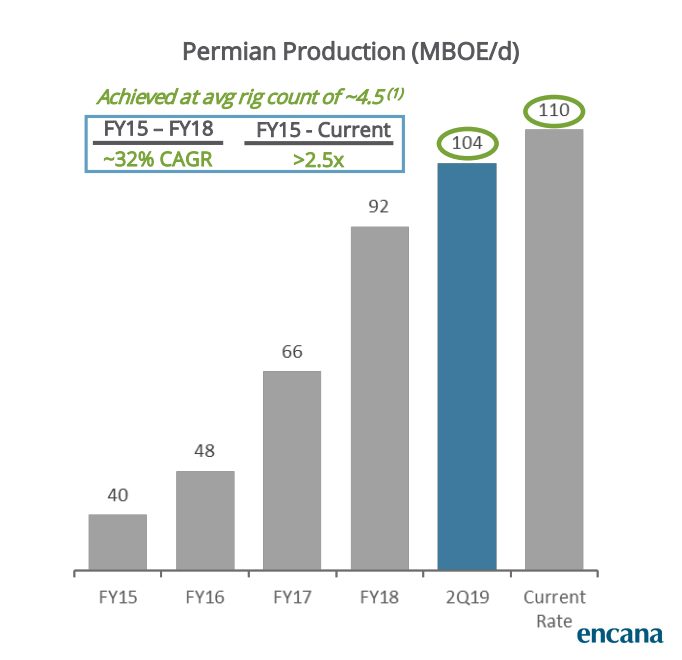

Encana Corp. edged past estimates for quarterly profit on July 31, helped by increased shale oil production in the Anadarko and Permian basins.

Total pro forma production rose 11% to 591,800 barrels of oil per day (boe/d) in the quarter.

Encana inked a deal in June to exit its offshore operations in China and sold its Arkoma Basin natural gas assets earlier in July to focus on its core regions—Anadarko and Permian basins in the U.S. and Montney in Canada.

The Permian and Anadarko basins have been at the heart of the U.S. shale revolution, prompting several companies to invest in assets in the blocks.

Encana's profit was also boosted by a 3.7% rise in realized prices for oil.

The Calgary, Alberta-based oil and gas producer's net income was $336 million in the second quarter ended June 30, compared with a loss of $151 million a year earlier, during which it booked a non-cash charge.

RELATED:

Encana Halts Oklahoma Well Completion Following Quake

On an adjusted basis, the company earned 21 cents per share, or $290 million in the quarter, beating the average analyst estimate of 20 cents, according to IBES data from Refinitiv.

Recommended Reading

Humble Midstream II, Quantum Capital Form Partnership for Infrastructure Projects

2024-01-30 - Humble Midstream II Partners and Quantum Capital Group’s partnership will promote a focus on energy transition infrastructure.

Greenbacker Names New CFO, Adds Heads of Infrastructure, Capital Markets

2024-02-02 - Christopher Smith will serve as Greenbacker’s new CFO, and the power and renewable energy asset manager also added positions to head its infrastructure and capital markets efforts.

SunPower Begins Search for New CEO

2024-02-27 - Former CEO Peter Faricy departed SunPower Corp. on Feb. 26, according to the company.

Green Swan Seeks US Financing for Global Decarbonization Projects

2024-02-21 - Green Swan, an investment platform seeking to provide capital to countries signed on to the Paris Agreement, is courting U.S. investors to fund decarbonization projects in countries including Iran and Venezuela, its executives told Hart Energy.

M4E Lithium Closes Funding for Brazilian Lithium Exploration

2024-03-15 - M4E’s financing package includes an equity investment, a royalty purchase and an option for a strategic offtake agreement.