Canadian Natural Resources Ltd., Canada's largest independent petroleum producer, on March 2 reported a quarterly profit that blew past analysts' expectations, driven by higher realized prices from North America and low costs.

The company said strong production and record low operating costs was driving its cash flow, which is targeted to exceed capex by about CA$230 million (US$172 million) per month. The company raised its quarterly dividend by 10%

In a later conference call, company executives predicted possible "opportunistic acquisitions," but did not name them, saying it will buy only ones that "fit" and "add value."

The company may also sell some assets that produce about 1,000 barrels of oil equivalent per day (Mboe/d) and are not "material components" of the company, executives said.

Canadian Natural, which operates in Western Canada, the North Sea and offshore West Africa, said fund flow from operations rose to CA$1.68 billion in the fourth quarter from CA$1.38 billion a year earlier.

The company did not express concern about a potential border tax that the U.S. administration has talked about, which could affect the energy sector as nearly all of Canada's crude production is exported south.

"The border tax would probably have a big impact on the Canadian dollar, would drop our costs ... we may be indifferent," President Steve Laut said, adding the tax and its terms are still uncertain.

Canadian Natural said oil and gas production rose marginally to 859,577 boe/d from 855,800 boe/d.

However, average realized prices before hedging rose nearly 33% for crude oil and 6% for natural gas. Its operating costs were a record low CA$22.53/bbl in the quarter.

That helped Canadian Natural's net income jump more than fourfold to CA$566 million. On an adjusted basis, it posted a profit of CA$439 million in the quarter ended Dec. 31, compared with a loss of CA$49 million a year earlier.

On a per share basis, its adjusted profit of 40 Canadian cents easily beat the 12 Canadian cents analysts on average were expecting, according to Thomson Reuters I/B/E/S.

The Calgary-based company said it expects crude oil production to rise to a range of 550 Mbbl/d-590 Mbbl/d in 2017 from 523,873 bbl/d in 2016.

Its natural gas output is expected to rise to a range between 1,700 million cubic feet per day (MMcf/d) and 1,760 MMcf/d this year from 1,691 MMcf/d in 2016. (US$1 = CA$1.3367)

Recommended Reading

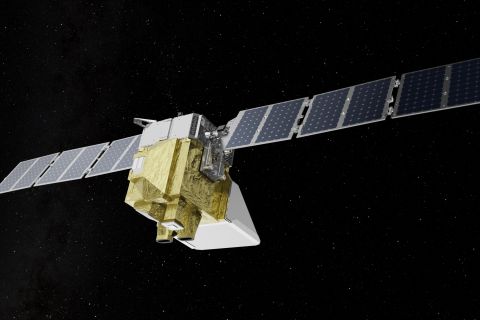

Markman: Is MethaneSAT Watching You? Yes.

2024-04-05 - EDF’s MethaneSAT is the first satellite devoted exclusively to methane and it is targeting the oil and gas space.

Tax Credit’s Silence on Blue Hydrogen Adds Uncertainty

2024-01-31 - Proposed rules for the 45V hydrogen production tax credit leave blue hydrogen up in the air, but producers planning to use natural gas with carbon capture and storage have options.

US Finalizes Big Reforms to Federal Oil, Gas Drilling

2024-04-12 - Under the new policy, drilling is limited in wildlife and cultural areas and oil and gas companies will pay higher bonding rates to cover the cost of plugging abandoned oil and gas wells, among other higher rates and costs.

US EPA Expected to Drop Hydrogen from Power Plant Rule, Sources Say

2024-04-22 - The move reflects skepticism within the U.S. government that the technology will develop quickly enough to become a significant tool to decarbonize the electricity industry.

Exclusive: Dan Romito Urges Methane Mitigation Game Plan

2024-04-08 - Dan Romito, the consulting partner at Pickering Energy Partners, says evading mitigation responsibility is "naive" as methane detection technology and regulation are focusing on oil and gas companies, in this Hart Energy Exclusive interview.