Blackbird Energy Inc. and Pipestone Oil Corp. agreed to merge earlier this week, forming a pure-play, condensate rich company in the Montney shale play in Alberta, Canada.

The Calgary, Alberta-based companies said Oct. 30 they plan to merge through an all-share combination structured as a plan of arrangement forming Pipestone Energy Corp. The companies also announced C$310 million in equity and debt financings, which are expected to fully fund a planned 2019 exit production rate of 14,000 to 16,000 barrels of oil equivalent per day (boe/d).

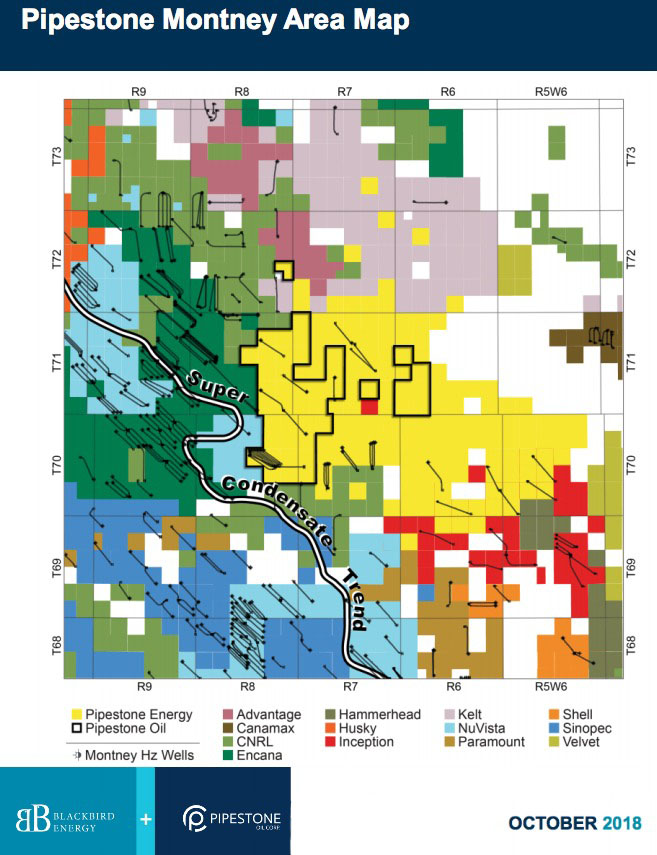

Pipestone Energy is set to have the single largest condensate-rich acreage position in the “sweet spot” of the overpressured window of the Montney fairway, according to the companies’ joint press release.

Paul Wanklyn, president and CEO of Pipestone Oil, said in a statement, “The assets of Blackbird and Pipestone Oil are a perfect fit and we are excited to bring them together at this early stage as it will afford many operational synergies as the company moves into large-scale development.”

Pro forma the merger, Pipestone Energy will control more than 98,000 net acres in the rich gas condensate window of the Montney shale play. The position has proved plus probable reserves of roughly 165 million boe with 555 drilling locations booked. Additionally, management has identified 1,450 potential drilling locations in four Montney development horizons, the release said.

Pipestone Energy will be led by Wanklyn as president and CEO and Bob Rosine as COO. The company’s board of directors will be comprised of the seven members, including Wanklyn and Braun.

Braun said in a statement: “While on the cusp of a significant growth trajectory, we are pleased to provide our shareholders with this transformative opportunity that further de-risks Blackbird’s path to unlock the potential of our Pipestone Montney resource.”

He continued that the combination will create scale and value that will be greater than “the sum of the parts.”

“This next phase of development will see the combined company grow to a level where it will deliver meaningful free cash flow to our shareholder base,” he said.

As part of the merger agreement, the issued and outstanding common shares of Blackbird will be converted to new shares of Pipestone Energy and effectively consolidated on a 10:1 basis. Upon completion, expected in early January, Blackbird shareholders will own roughly 45.1% of Pipestone Energy outstanding shares. Additionally, Pipestone Oil will receive 103.75 million common shares of Pipestone Energy.

Concurrent with the transaction, Blackbird and Pipestone Oil have entered into agreements with certain of their existing shareholders who have committed to common equity financings totaling $111 million. The financings include an C$85 million commitment from Canadian Non-Operated Resources LP, Pipestone Oil’s sole shareholder. GMT Capital Corp., which represents 17% ownership of Blackbird, also committed C$26 million.

Pipestone Oil also has arranged C$198.5 million of debt financing consisting of a C$169 million two-year term loan, C$20 million letter of credit facility and C$10 million revolving credit facility.

Cormark Securities Inc., as Lead, and BMO Capital Markets are acting as financial advisors to Blackbird with respect to the transaction. Bennett Jones LLP is acting as Blackbird’s legal advisor.

Peters & Co. Ltd. is exclusive financial adviser to Pipestone Oil for the transaction. National Bank Financial is Pipestone Oil’s strategic adviser as well as the lead arranger and sole book-runner with respect to the credit facility. CIBC World Markets is a strategic adviser to the CNOR LP board of directors. Osler, Hoskin & Harcourt LLP is Pipestone Oil’s legal adviser.

Recommended Reading

Defeating the ‘Four Horseman’ of Flow Assurance

2024-04-18 - Service companies combine processes and techniques to mitigate the impact of paraffin, asphaltenes, hydrates and scale on production — and keep the cash flowing.

Tech Trends: AI Increasing Data Center Demand for Energy

2024-04-16 - In this month’s Tech Trends, new technologies equipped with artificial intelligence take the forefront, as they assist with safety and seismic fault detection. Also, independent contractor Stena Drilling begins upgrades for their Evolution drillship.

AVEVA: Immersive Tech, Augmented Reality and What’s New in the Cloud

2024-04-15 - Rob McGreevy, AVEVA’s chief product officer, talks about technology advancements that give employees on the job training without any of the risks.

Lift-off: How AI is Boosting Field and Employee Productivity

2024-04-12 - From data extraction to well optimization, the oil and gas industry embraces AI.

AI Poised to Break Out of its Oilfield Niche

2024-04-11 - At the AI in Oil & Gas Conference in Houston, experts talked up the benefits artificial intelligence can provide to the downstream, midstream and upstream sectors, while assuring the audience humans will still run the show.