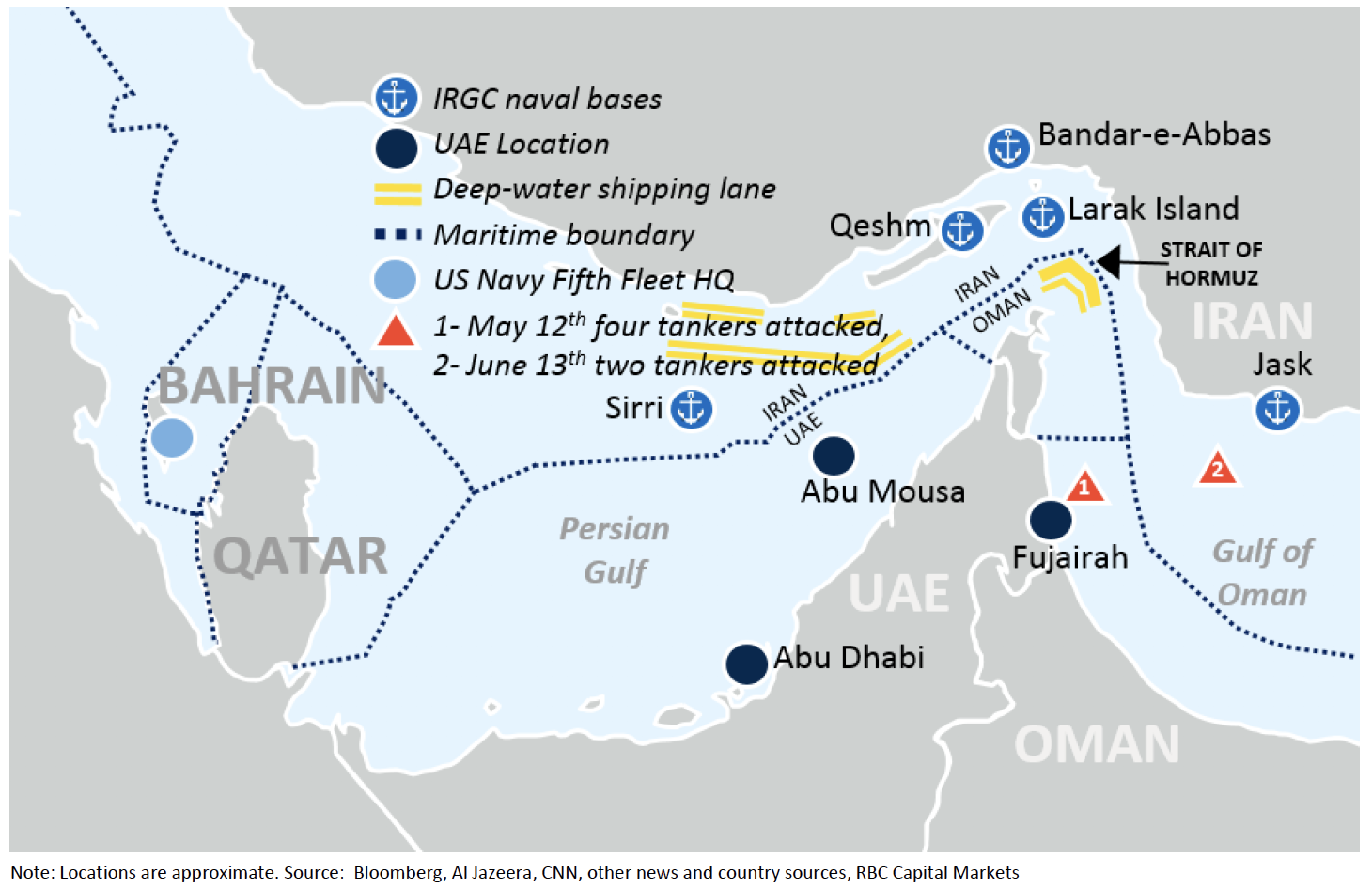

Oil prices rose June 13 following attacks on two Asia-bound tankers plying the Gulf of Oman, just east of the Strait of Hormuz, a major choke point for global crude markets. Oil rose on the NYMEX to close at $ 52.20 per barrel.

A Japanese tanker headed for Singapore was carrying methanol and a Norwegian tanker bound for Taiwan carried naphtha, according to CNN and other media reports. They were bombed early on the morning of June 13 while traversing the Gulf of Oman. A U.S. Naval ship and a South Korean cargo ship rescued all 44 sailors from the two damaged tankers.

Authorities speculated that mines or torpedoes may have been involved.

RELATED ARTICLE: Strait Of Hormuz And The Risk Of Uncontrolled Escalation

Secretary of State Mike Pompeo blamed Iran for the latest attacks, which were condemned by the U.N. Ironically, the incident occurred while Japanese Prime Minister Shinzo Abe was in Tehran to mediate the standoff between the U.S. and Iran on the now-abandoned nuclear deal and sanctions targeting the Iranian economy.

Roughly 30% of the world’s ocean-borne crude must pass through the narrow Strait of Hormuz and Gulf of Oman. No wonder the White House in May sent the USS Abraham Lincoln and some 1,500 additional troops to the region.

Energy analysts who monitor the Middle East weighed in on the situation.

In the past month, six tankers carrying crude oil or products have been attacked in the Middle East. In May four tankers anchored at a port in the United Arab Emirates were damaged by mines or some other kind of explosive, possibly attached to the ships’ hulls at the water line.

Other signs of escalating tension have appeared. On May 14, bomb-laden drones attacked an east-west oil pipeline in Saudi Arabia. And on June 12, just one day before these latest attacks, a missile hit an airport in southwest Saudi Arabia, injuring 26 people. Yemeni rebels have been blamed.

Continued tensions between the U.S. and Iran would be no surprise to RBC Capital Markets’ Helima Croft, global head of commodity strategy.

“We believe that escalation will likely be the order of the day as long as the United States continues its ‘maximum pressure’ policy and insists that Iran completely abandon its revolutionary agenda in order to receive economic relief. As we have noted before, hardline elements in Iran have become ascendant since the US exited the 2015” nuclear agreement with Iran, Croft said in a research note June 13.

RELATED VIDEO: 25 Influential Women In Energy: Helima Croft, Managing Director, RBC Capital Markets

She warned that the next date that warrants close watching is July 7.

“This is the day that the 60-day deadline Iran gave to the Europeans, to find a work-around arrangement in order to allow them to sell their oil and do banking transactions, expires. The Iranian government has already recommenced building their stockpile of low-grade enriched uranium and will likely soon breach the levels allowed under the [2015] nuclear deal.”

Iranian officials have warned the West that sanctions will not be accepted lightly, calling them an act of war.

“We think the attacks are a big deal,” said Mizuho analyst and managing director Paul Sankey in a note June 13. “But whether it was Iran-proxy Houthi (most likely), directly Iran, or double-thinking Iranian enemies who are seeking escalation of action against Iran (no names), remains a complete mystery.

“As has been said many times of the Middle East, those who know don’t talk, and those who talk don’t know.”

Recommended Reading

DXP Enterprises Buys Water Service Company Kappe Associates

2024-02-06 - DXP Enterprise’s purchase of Kappe, a water and wastewater company, adds scale to DXP’s national water management profile.

ARM Energy Sells Minority Stake in Natgas Marketer to Tokyo Gas

2024-02-06 - Tokyo Gas America Ltd. purchased a stake in the new firm, ARM Energy Trading LLC, one of the largest private physical gas marketers in North America.

California Resources Corp., Aera Energy to Combine in $2.1B Merger

2024-02-07 - The announced combination between California Resources and Aera Energy comes one year after Exxon and Shell closed the sale of Aera to a German asset manager for $4 billion.

DNO Acquires Arran Field Stake, Continuing North Sea Expansion

2024-02-06 - DNO will pay $70 million for Arran Field interests held by ONE-Dyas, and up to $5 million in contingency payments if certain operational targets are met.

Report: Devon Energy Targeting Bakken E&P Enerplus for Acquisition

2024-02-08 - The acquisition of Enerplus by Devon would more than double the company’s third-quarter 2023 Williston Basin production.