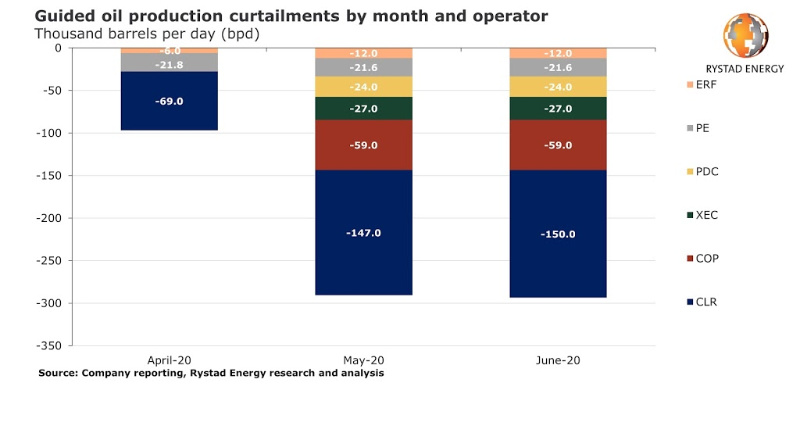

Analysts at Rystad Energy said April 28 at least 300,000 barrels per day (bbl/d) of U.S. oil production will be shut in during May and June with low oil prices likely to force more production offline.

The outlook, which is up from about 100,000 bbl/d in projected cuts for April, was based on early communication from U.S. oil producers, including Continental Resources, Cimarex Energy, ConocoPhillips, PDC Energy, Parsley Energy and Enerplus Corp.

Though cuts will be spread across the Lower 48, Williston Basin is expected to be impacted the most, according to Veronika Akulinitseva, vice president of North American shale and upstream for Rystad Energy.

“The Bakken play accounts for a high share of combined output, closely followed by Permian Delaware,” Akulinitseva said in a news release. “Yet given the single-digit wellhead prices seen in the region recently, and overall commerciality, the shut-ins in Bakken are likely to be more pronounced.”

Analysts said they believe shale producers will try to deliver the cuts mainly by lowering the number of new wells put into production with base decline making up a “material portion of the reported cut.”

However, “given typical shale operational patterns, the decline in started jobs that began in March will result in a lower number of wells put on production in May, which ultimately will not lead to a drop in peak production until June,” Rystad said.

Recommended Reading

TPG Adds Lebovitz as Head of Infrastructure for Climate Investing Platform

2024-02-07 - TPG Rise Climate was launched in 2021 to make investments across asset classes in climate solutions globally.

Air Products Sees $15B Hydrogen, Energy Transition Project Backlog

2024-02-07 - Pennsylvania-headquartered Air Products has eight hydrogen projects underway and is targeting an IRR of more than 10%.

NGL Growth Leads Enterprise Product Partners to Strong Fourth Quarter

2024-02-02 - Enterprise Product Partners executives are still waiting to receive final federal approval to go ahead with the company’s Sea Port Terminal Project.

Sherrill to Lead HEP’s Low Carbon Solutions Division

2024-02-06 - Richard Sherill will serve as president of Howard Energy Partners’ low carbon solutions division, while also serving on Talos Energy’s board.

Magnolia Appoints David Khani to Board

2024-02-08 - David Khani’s appointment to Magnolia Oil & Gas’ board as an independent director brings the board’s size to eight members.