Sen. Elizabeth Warren (D-Mass.) (Source: Shutterstock.com)

Democratic presidential candidate Elizabeth Warren recently said, if elected, she would call for an immediate nationwide ban on hydraulic fracturing. Other candidates have hinted at similar positions. According to Michael Cemblest of JP Morgan Asset Management, who says it doesn’t matter, it’s what it may mean that is important.

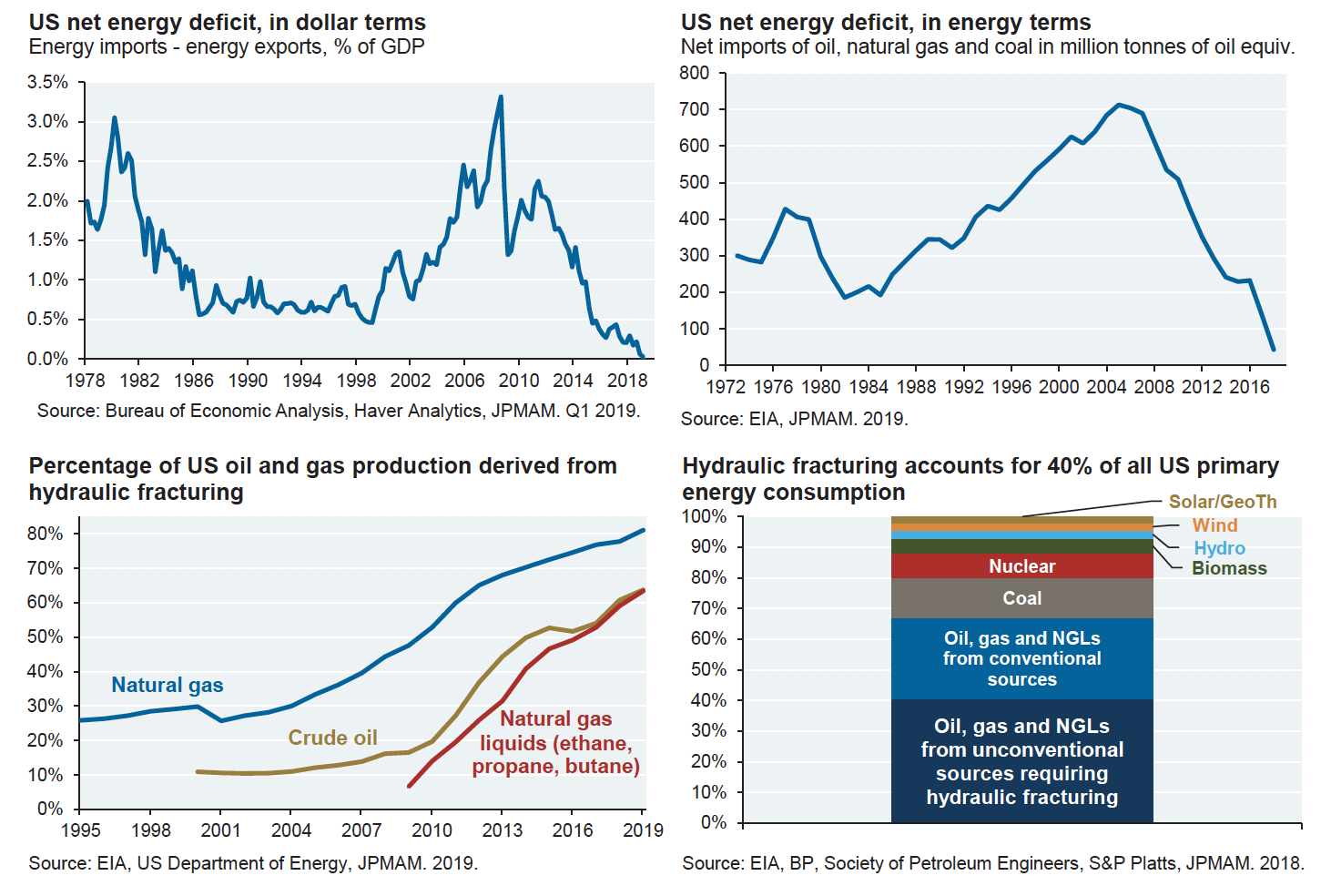

“The United States has undergone an energy boom recently which has finally erased the long-standing U.S. net energy deficit,” Cemblest wrote in an analyst note Sept. 13. “This outcome is mostly the consequence of hydraulic fracturing.”

He released charts to prove it.

“Hydraulic fracturing now accounts for 60% to 80% of U.S. oil, natural gas and natural gas liquid (NGL) production,” he continued. “Furthermore, domestically produced oil and gas derived from hydraulic fracturing accounts for an enormous 40% of total U.S. primary energy consumption.”

Cemblest has written on risks and rewards of hydraulic fracturing before. He’s pointed out that the U.S. is practically the only country hydraulic fracturing, with the exception of minor amounts in Canada, China and Argentina.

He argued that many of the issues associated with hydraulic fracturing can be addressed through regulation and oversight, rather than via an outright ban. “Hydraulic fracturing and wastewater handling is much less complex than other industrial and energy processes such as crude oil refining and nuclear power,” he wrote.

“While U.S. renewable power generation is growing, the pace is not fast enough to abandon fractured natural gas and oil given U.S. goals of decommissioning aging coal and nuclear power plants, and reducing reliance on foreign oil,” he continued. “Natural gas is a critical complement to intermittent renewable energy in the absence of a nationwide electricity grid and cheap energy storage.”

And then he asks a poignant question, “Have proponents of an immediate ‘cold turkey’ ban on 40% of the U.S. energy supply thought through possible consequences for growth, employment, energy prices, energy independence, the dollar, geopolitical/military risks and productivity? For a variety of economic and geological reasons the U.S. energy boom will not last for decades, but the consequences

of bringing it to an abrupt end are almost certainly not well understood.”

Senator Warren’s neighbors in New Hampshire recently prevented grid upgrades and renewable energy projects from happening. Cemblest points out the proposed 1 GW Northern Pass transmission line connecting Hydro-Quebec to Southern New England was supported by regulators in Warren’s home state of Massachusetts and the sate’s Department of Energy Resources to reduce reliance on fossil fuels and increase renewable energy (hydro) use.

However, a New Hampshire siting committee unanimously rejected the proposal since it worried that the 192-mile transmission line would disrupt streets and harm tourism.

Concessions by the Northern Pass group to bury 52 miles of the route and set aside 5,000 acres of preservation and recreation land were insufficient to change the outcome.

In July 2019, the New Hampshire Supreme Court rejected and killed the proposal.

The non-profit grid regulator ISO New England warned last year that the region's power system may soon be unable to meet electricity demand and maintain reliability without some degree of emergency actions such as rolling blackouts and controlled outages.

And Cemblest pointed out, “the U.S. generates over 4 billion MWh of electricity each year, but only has around 1,500 MWh of utility-scale energy storage. Pumped-storage hydropower in geological reservoirs accounts for 95% of storage capacity.”

Recommended Reading

President: Financial Debt for Mexico's Pemex Totaled $106.8B End of 2023

2024-02-21 - President Andres Manuel Lopez Obrador revealed the debt data in a chart from a presentation on Pemex at a government press conference.

Some Payne, But Mostly Gain for H&P in Q4 2023

2024-01-31 - Helmerich & Payne’s revenue grew internationally and in North America but declined in the Gulf of Mexico compared to the previous quarter.

Uinta Basin: 50% More Oil for Twice the Proppant

2024-03-06 - The higher-intensity completions are costing an average of 35% fewer dollars spent per barrel of oil equivalent of output, Crescent Energy told investors and analysts on March 5.

In Shooting for the Stars, Kosmos’ Production Soars

2024-02-28 - Kosmos Energy’s fourth quarter continued the operational success seen in its third quarter earnings 2023 report.

M4E Lithium Closes Funding for Brazilian Lithium Exploration

2024-03-15 - M4E’s financing package includes an equity investment, a royalty purchase and an option for a strategic offtake agreement.