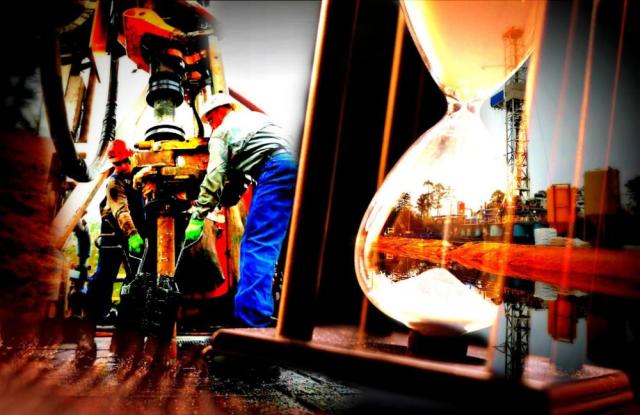

The very existence of the oil and gas industry in the U.S. is now a major political discussion point in the election of our president. That should wake you up, writes Steve Toon, Editor-in-Chief of Oil and Gas Investor, in his monthly column. (Source: Hart Energy/Shutterstock.com)

[Editor's note: A version of this story appears in the October 2019 edition of Oil and Gas Investor. Subscribe to the magazine here.]

Maybe you haven’t noticed, but three of the leading Democratic presidential candidates are vigorously campaigning to straight out ban hydraulic fracturing within the oil and gas industry nationwide if elected in 2020. Sens. Bernie Sanders, Elizabeth Warren and Kamala Harris—Nos. 2, 3 and 5 in the polls, respectively—say they will outright eliminate the technology that has driven America’s oil and gas renaissance.

“On my first day as president, I will sign an executive order that puts a total moratorium on all new fossil fuel leases for drilling offshore and on public lands. And I will ban fracking—everywhere,” said Warren in a Sept. 6 tweet.

“Any proposal to avert the climate crisis must include a full fracking ban on public and private lands,” Sanders tweeted on Sep. 4. “When we are in the White House, we will end the era of fossil fuels, and that includes fracking.”

“There is no question I’m in favor of banning fracking,” Harris said during CNN’s town hall on climate change on Sept. 3.

Six other candidates also would ban “all fracking,” per a Washington Post poll.

What if one of these candidates wins and actually does what they say they will do?

RELATED:

Opinion: Want To Ban Fracking? Think Again

Current frontrunner Joe Biden takes a softer stance, promising to limit or further regulate the practice. But the fact remains that an entire American major political party stands opposed to and ready to go to battle against the industry that fuels the nation—and the proposal has popular groundswell support.

The very existence of the oil and gas industry in the U.S. is now a major political discussion point in the election of our president. That should wake you up.

The issue, of course, is climate change, aka global warming, and the fear that human activity is pumping greenhouse gases into the atmosphere, which will eventually and cataclysmically alter the earth’s climate. Whether or not you believe the science behind that is irrelevant. Enough people do, and more and more so, and are willing to take or enforce drastic actions to stop it at all costs, figuratively and financially.

Take freshman Congresswoman Alexandria Ocasio-Cortez’ proposed Green New Deal, a utopian mission to remove America from all hydrocarbon energy reliance in 10 years. Many scoff at the absurdity and impossibility of such a feat, not to mention the Herculean cost. But look before you dismiss. The idea of it is what attracts believers. The legislation has found traction in Congress, and it is the foundation of all the Democratic presidential candidates’ energy platforms.

Preceding the Democratic debate in Houston, Greenpeace protesters dangled from a bridge spanning the Houston Ship Channel from climbing ropes, disrupting shipping traffic and specifically oil tankers.

A Greenpeace spokesman explained: “We are in a climate emergency, created by the fossil fuel industry and made worse by Trump. We have little more than a decade to take ambitious action to cut fossil fuel use in half and transition to renewable energy. We can either take the bold actions necessary to stave off the climate crisis today, or suffer the radical consequences of climate-fueled disasters—more floods, more megastorms and more fires—for years to come. We’re here because there’s no time to waste.”

This view is quickly becoming the majority.

But what might be some unintended consequences should well stimulation be banned?

Essentially all domestic oil and gas exploration and new production would come to a halt. As about two-thirds of electric power generation is gas-, oil- or coal-fired, coal would likely fill the void, unless additional anti-coal laws scuttle it as well. In that case, the U.S. would need to import the difference. Oil and gas exports would dry up, and we’d once again be reliant on imports from and dependent upon some fairly seedy suppliers.

Costs of electricity and transportation would skyrocket, along with all the goods produced using them. Some 10.3 million jobs would evaporate, per the American Petroleum Institute. Russia and OPEC nations would gain political advantage globally as the primary suppliers of both oil and gas. And, ironically, greenhouse gases would likely increase as U.S. gas supplies are removed from domestic and world markets.

Renewables aren’t going to immediately or likely ever fully replace hydrocarbons, but legislation can still be passed without understanding the consequences. Or caring.

Can a president do that with the stroke of a pen, per Warren? Not likely, as it would take the help of Congress to wipe out an entire industry. But a progressively leaning uprising could shortly gain the advantage in both chambers with noble aspirations to save the planet.

If so, then dust off your seismic or learn a foreign language for new exploration, because political risk is now a factor of operating in the U.S. Don’t underestimate it.

Recommended Reading

Biden Administration Hits the Brake on New LNG Export Projects

2024-01-26 - As climate activists declare a win, the Department of Energy secretary says the pause is needed to update current policy.

Silver Linings in Biden’s LNG Policy

2024-03-12 - In the near term, the pause on new non-FTA approvals could lift some pressure of an already strained supply chain, lower both equipment and labor expenses and ease some cost inflation.

Antero Poised to Benefit from Second Wave of LNG

2024-02-20 - Despite the U.S. Department of Energy’s recent pause on LNG export permits, Antero foresees LNG market growth for the rest of the decade—and plans to deliver.

US Expected to Supply 30% of LNG Demand by 2030

2024-02-23 - Shell expects the U.S. to meet around 30% of total global LNG demand by 2030, although reliance on four key basins could create midstream constraints, the energy giant revealed in its “Shell LNG Outlook 2024.”

US Natgas Prices Hit 5-week High on Rising Feedgas to Freeport LNG, Output Drop

2024-04-10 - U.S. natural gas futures climbed to a five-week high on April 10 on an increase in feedgas to the Freeport LNG export plant and a drop in output as pipeline maintenance trapped gas in Texas.