A sign marks where the Texas-New Mexico state line road leads to WPX Energy’s Delaware Basin oilfield operations in Loving County, Texas. (Source: Hart Energy)

WPX Energy Inc. on Dec. 16 agreed to acquire private-equity-backed Felix Energy II with a position in the Permian’s Delaware Basin in a cash and stock transaction valued at $2.5 billion.

The Tulsa, Okla.-based company said the announcement, which confirms reports made late last week of the transaction, is consistent with WPX’s five-year vision for shareholders introduced in November as the acquisition is expected to significantly boost free cash flow in 2020 at $50 oil, allowing the company to implement a dividend.

“Meeting the five-year targets we communicated is the absolute standard and benchmark for any investment we make,” said WPX Chairman and CEO Rick Muncrief in a statement. “Now we can accomplish these objectives for shareholders more quickly and efficiently with the irrefutable benefits of the Felix transaction.”

WPX plans to implement a dividend in conjunction with the Felix acquisition, targeting about $0.10 per share on an annualized basis at initiation.

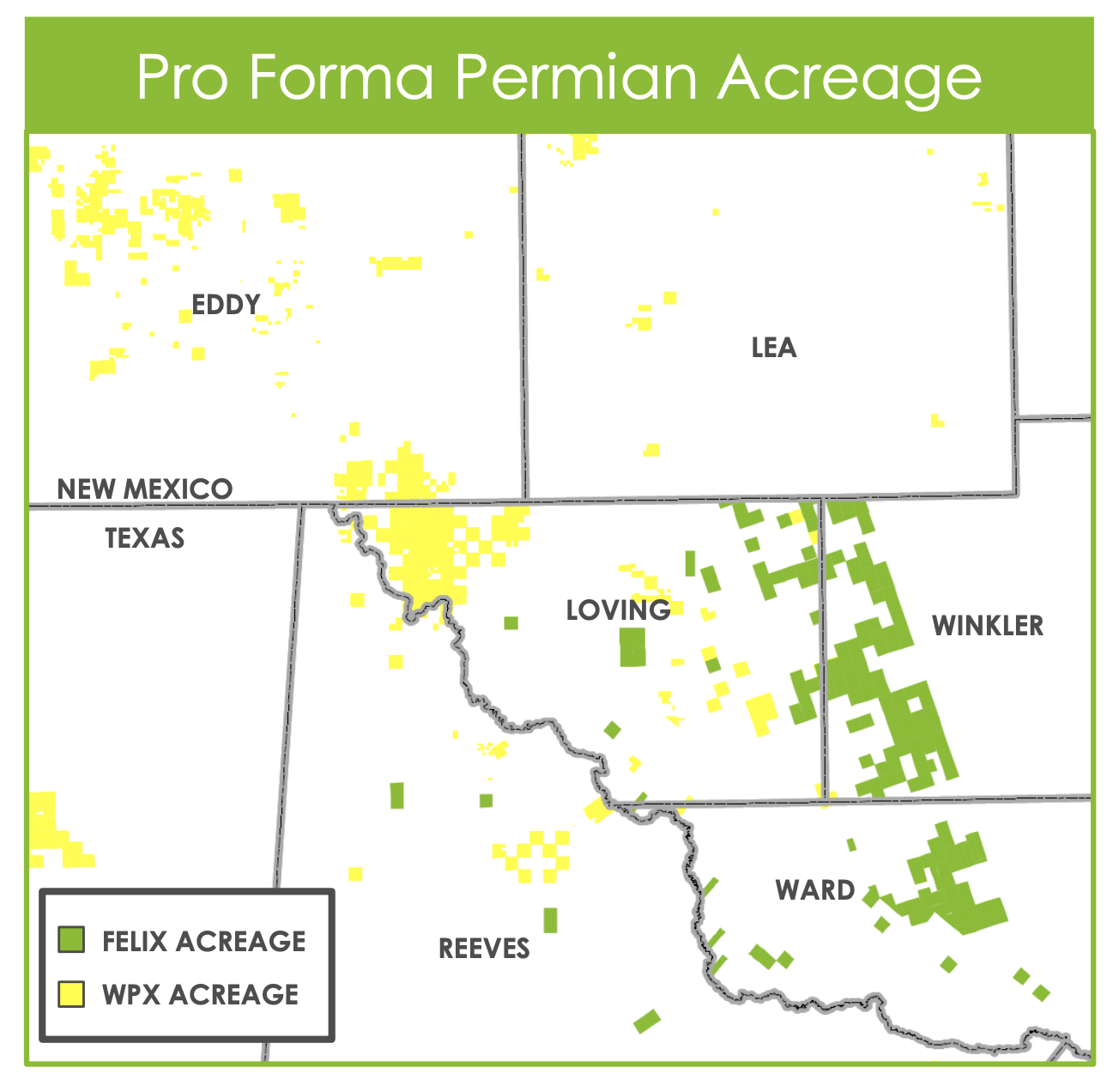

Backed by EnCap Investments LP, Felix has a 58,500 net acre position in an overpressured, oily portion of the Delaware Basin with six productive benches. Production is projected to be about 60,000 barrels of oil equivalent per day (boe/d), 70% oil, at the time of closing anticipated in early second-quarter 2020.

With shares trading down pre-market, the market doesn’t like the Felix acquisition at first blush, said Brian T. Velie, energy equity analyst with Capital One Securities Inc.

Velie believes the negative reaction is likely the result of acreage additions that are not exactly overlapping or adjacent to WPX’s existing position. However, he also noted that Felix’s position is nearby and is in-between acreage largely held by Chevron Corp., Occidental Petroleum Corp. and EOG Resources Inc.

“That being the case, the Felix assets may have been WPX’s last chance to take its Delaware inventory from 10-plus years to 20-plus years of drilling while staying in the same neighborhood all in one deal,” Velie wrote in a Dec. 16 research note.

As part of the acquisition, WPX stands to gain approximately 1,500 gross drillable locations (at predominately two-mile lateral lengths) that compete with the returns from its existing position in the core Stateline area of the Delaware Basin, the company said in its release.

In total, Velie estimates WPX’s gross operated location count in the Delaware Basin will increase by 44% to 4,900 wells as a result of the Felix acquisition.

About 25 additional wells are required to hold nearly all Wolfcamp and Third Bone Springs rights on the Felix acreage, with roughly half of those wells expected to be drilled in 2020. Felix’s average lateral length is 9,200 ft per well.

Assuming a steep 45% first-year production decline, Velie said Capital One values the production at $1.6 billion or roughly $27,000 per flowing boe/d. Backing that out implies about $15,000 of value per acre in the $2.5 billion deal price.

“For perspective, we estimated that WPX paid roughly $18,000 per acre in its initial 2015 entry into the Delaware with the acquisition of RKI,” he wrote.

The purchase price of the Felix acquisition consists of $900 million in cash and $1.6 billion in WPX stock issued to the seller.

WPX plans to fund the cash portion through the issuance of $900 million of senior notes on an “opportunistic basis.” The company said it also obtained committed financing from Barclays in connection with the transaction and has full access to a $1.5 billion revolving credit facility.

New York-based investment bank Siebert Williams Shank & Co. (SWS) views the transaction as a positive all around, said managing director Gabriele Sorbara.

In addition to being accretive on all key metrics including cash margins and oil mix, Sorbara said the transaction does not impair WPX’s financial leverage. SWS models the company’s net debt/EBITDA to improve slightly to 1.2 times by year-end 2020.

“With the Felix acquisition, we believe WPX will be considered a must-own E&P name in 2020,” he wrote in a Dec. 16 research note.

Pending the transaction’s close, WPX expects to add two members to its board from EnCap.

Barclays and Tudor, Pickering, Holt & Co. were financial advisers to WPX on the transaction. Weil, Gotshal & Manges LLP served as the company’s legal adviser. Jefferies LLC was financial adviser to Felix on the transaction and Vinson & Elkins LLP served as its legal adviser.

Recommended Reading

Texas LNG Export Plant Signs Additional Offtake Deal With EQT

2024-04-23 - Glenfarne Group LLC's proposed Texas LNG export plant in Brownsville has signed an additional tolling agreement with EQT Corp. to provide natural gas liquefaction services of an additional 1.5 mtpa over 20 years.

US Refiners to Face Tighter Heavy Spreads this Summer TPH

2024-04-22 - Tudor, Pickering, Holt and Co. (TPH) expects fairly tight heavy crude discounts in the U.S. this summer and beyond owing to lower imports of Canadian, Mexican and Venezuelan crudes.

What's Affecting Oil Prices This Week? (April 22, 2024)

2024-04-22 - Stratas Advisors predict that despite geopolitical tensions, the oil supply will not be disrupted, even with the U.S. House of Representatives inserting sanctions on Iran’s oil exports.

Association: Monthly Texas Upstream Jobs Show Most Growth in Decade

2024-04-22 - Since the COVID-19 pandemic, the oil and gas industry has added 39,500 upstream jobs in Texas, with take home pay averaging $124,000 in 2023.

Shipping Industry Urges UN to Protect Vessels After Iran Seizure

2024-04-19 - Merchant ships and seafarers are increasingly in peril at sea as attacks escalate in the Middle East.