Oilfield workers break down and haul off pipe after testing a well WPX Energy’s Delaware Basin position in Loving County, Texas, in March 2017. (Source: Hart Energy)

WPX Energy Inc. on March 6 completed its $2.5 billion acquisition of Felix Energy II, growing its position in the Permian’s Delaware Basin which CEO Rick Muncrief believes will help the U.S. shale producer generate shareholder returns.

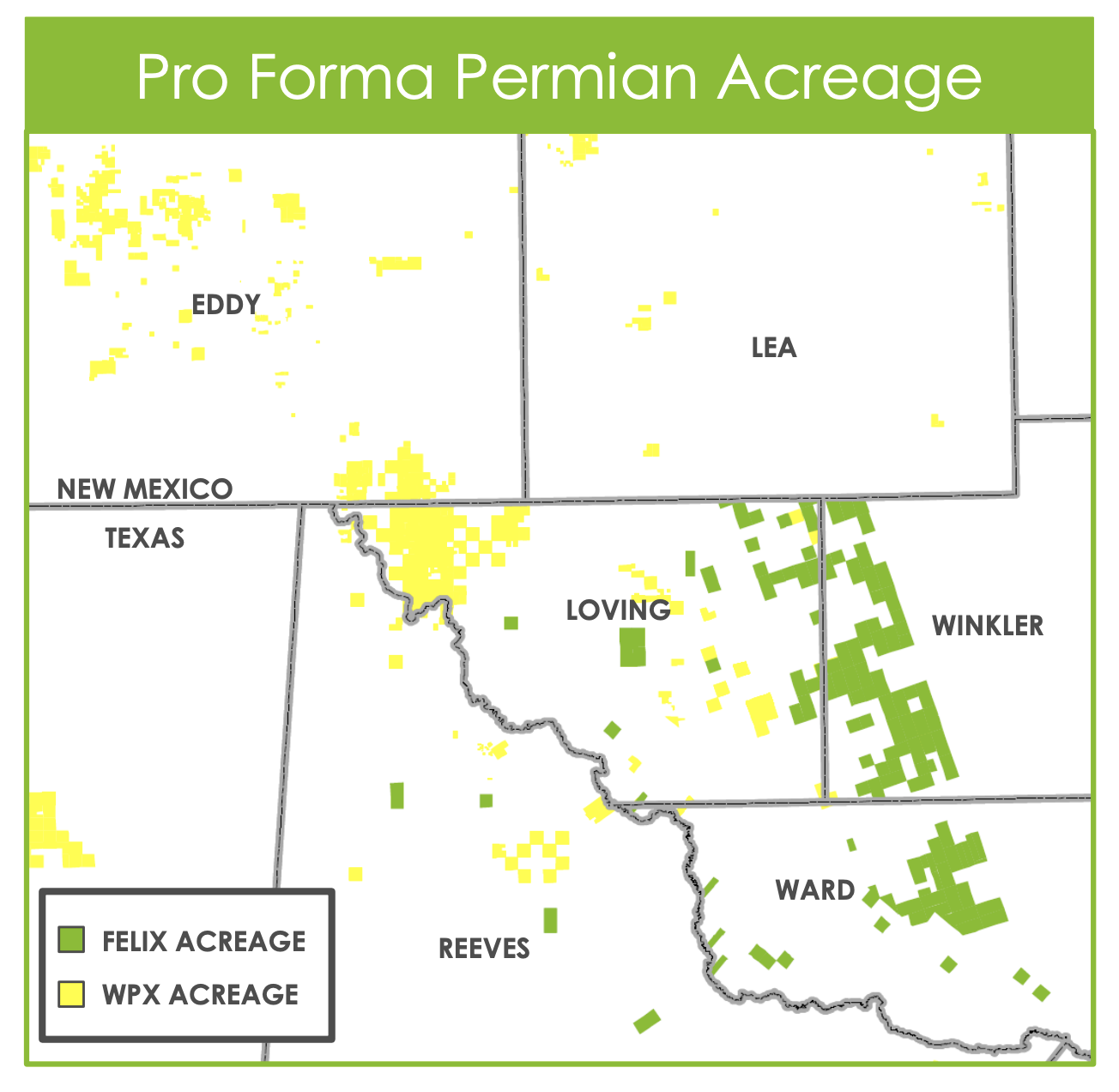

Backed by EnCap Investments LP, Felix Energy has a 58,500 net acre position in an overpressured, oily portion of the Delaware Basin in West Texas. Tulsa, Okla.-based WPX had entered an agreement to acquire the company in mid-December.

WPX expected the transaction—the largest E&P deal announced in the U.S. during the fourth quarter—to significantly boost its free cash flow in 2020 at $50 oil, allowing the company to implement a dividend.

“We remain absolutely convinced about the accretive nature of the transaction and the outstanding quality of these assets,” Muncrief said in a statement on March 6. “They overlie a tremendous resource that clearly gives us the means for accelerating our ability to achieve our five-year targets for shareholders.”

In a news release, WPX said the Felix acquisition was “overwhelmingly” approved by its shareholders at a special meeting held March 5, where more than 99.6% of votes cast were in favor of the transaction.

WPX plans to implement a dividend after integrating its Felix acquisition, targeting about $0.10 per share on an annualized basis at initiation. The first payment is planned for third-quarter 2020.

The company has core positions in the Permian and Williston basins, where it now expects to produce more than 150,000 bbl/d of oil.

WPX entered the Permian Basin in 2015 with the $2.75 billion acquisition of RKI Exploration & Production. The company has since added onto its Permian position with a $775 million deal for Panther Energy, which closed in 2017.

Including the Felix acquisition, WPX’s position in the Permian Basin now spans about 184,000 net acres and 4,900 gross operated locations. The company also expects its Permian production to increase to 240,500 boe/d when combined with Felix’s 60,000 boe/d (70% oil) of production at closing.

The purchase price of the Felix acquisition consists of $1.6 billion in WPX stock issued to an entity controlled by EnCap plus $900 million in cash, which the company said in December it planned to fund through the issuance of senior notes on an “opportunistic basis.”

Additionally, two representatives from EnCap—the firm’s founder D. Martin Phillips and managing partner Douglas E. Swanson Jr.—joined the WPX board effective immediately.

Barclays and Tudor, Pickering, Holt & Co. were financial advisers to WPX on the transaction. Weil, Gotshal & Manges LLP served as the company’s legal adviser. Jefferies LLC was financial adviser to Felix on the transaction and Vinson & Elkins LLP served as its legal adviser.

Recommended Reading

Baker Hughes Declares Increased Quarterly Dividend

2024-02-02 - Baker Hughes’ dividend represents a 5% growth rate, or $0.01, over the previous quarter’s dividend.

Petrie Partners: A Small Wonder

2024-02-01 - Petrie Partners may not be the biggest or flashiest investment bank on the block, but after over two decades, its executives have been around the block more than most.

The OGInterview: Petrie Partners a Big Deal Among Investment Banks

2024-02-01 - In this OGInterview, Hart Energy's Chris Mathews sat down with Petrie Partners—perhaps not the biggest or flashiest investment bank around, but after over two decades, the firm has been around the block more than most.

Bobby Tudor on Capital Access and Oil, Gas Participation in the Energy Transition

2024-04-05 - Bobby Tudor, the founder and CEO of Artemis Energy Partners, says while public companies are generating cash, private equity firms in the upstream business are facing more difficulties raising new funds, in this Hart Energy Exclusive interview.

E&P Earnings Season Proves Up Stronger Efficiencies, Profits

2024-04-04 - The 2024 outlook for E&Ps largely surprises to the upside with conservative budgets and steady volumes.