Confirmation in recent days that President Donald Trump is considering imposing sanctions on the Nord Stream 2 (NS2) pipeline project from Russia to Germany will be of interest to LNG exporters as they consider which markets to target. The booming U.S. LNG industry has already suffered a blow thanks to the trade war with China, which would be expected to be a major buyer of U.S. gas under other circumstances. As a result, exporters—primarily on the Gulf Coast—are increasingly seeking other markets as a second wave of LNG project construction begins in the U.S.

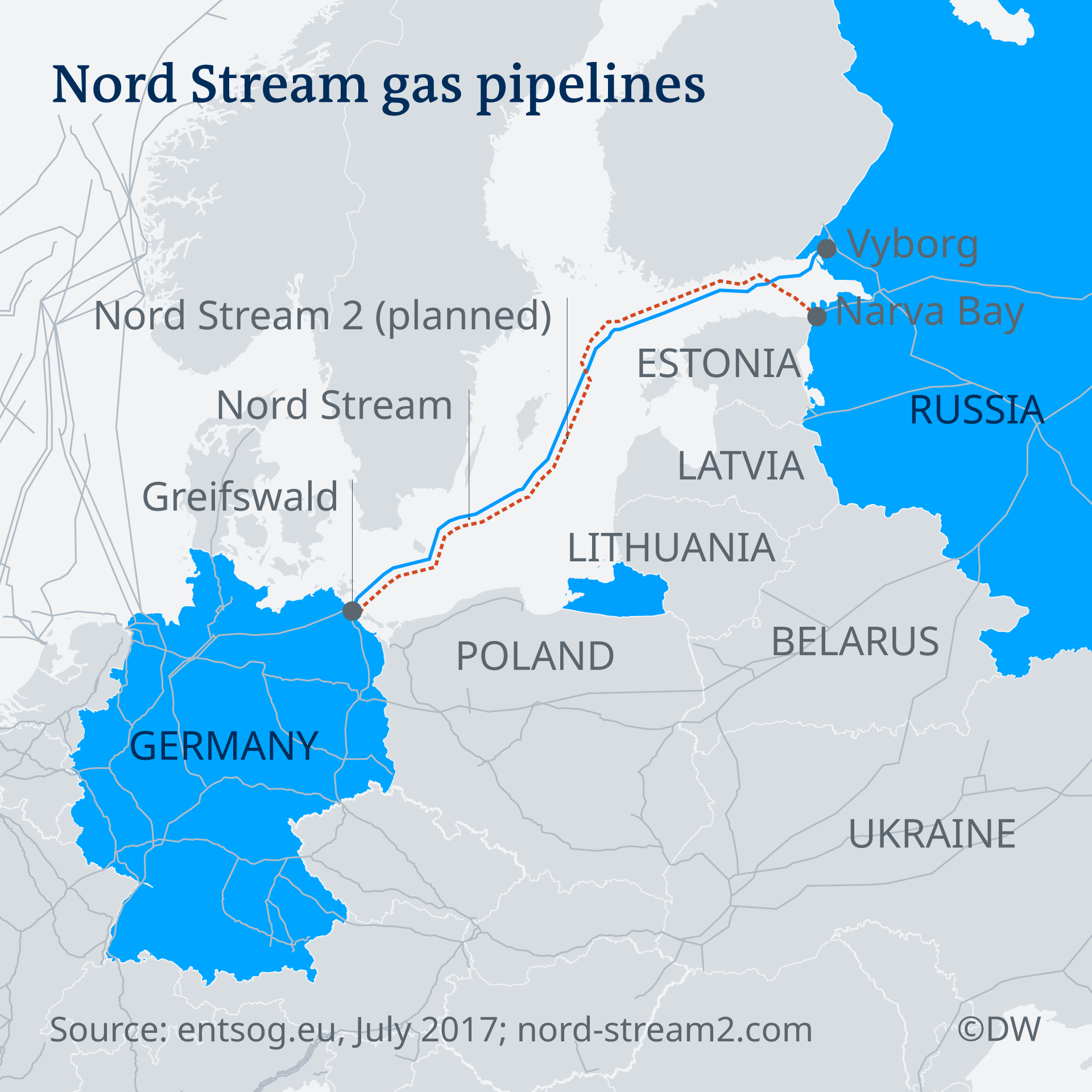

Nord Stream 2 is being developed by Russia’s state-owned Gazprom, with financial backing from Germany’s Uniper and Wintershall, Austria’s OMV, France’s Engie and Anglo-Dutch super-major Royal Dutch Shell. Opinion is divided in Europe on the pipeline, with some—particularly Nordic and Baltic—countries concerned that it would increase the continent’s dependence on Russian gas. But the project enjoys considerable support in Germany, which is seeking stable gas supplies as it reduces its use of coal and nuclear power.

RELATED: Senate Bill Would Impose Sanctions On Nord Stream 2 Builders, Investors

Trump’s June 12 threat echoes comments made in May by Secretary of Energy Rick Perry, who said a sanctions bill putting onerous restrictions on companies involved in Nord Stream 2 would come in the “not too distant future.”

However, Dr. Katja Yafimava, an Oxford Institute of Energy Studies’ senior research fellow, noted that the existing U.S. legislation, known as the Countering America’s Adversaries Through Sanctions Act (CAATSA), enables sanctions to be imposed on investments or loan agreements relating to Russian export pipelines made after August 2, 2017. The State Department has subsequently clarified that investments or loan agreements made prior to this date would not be subject to sanctions.

“Given that financing related to NS2 has been executed, the pipe laying barge leased, and the pipes ordered all prior to 2 August 2017, it is difficult to see how CAATSA sanctions could be applied retroactively,” Yafimava told Hart Energy.

She added that additional draft legislation seeking to broaden the scope of sanctions has been introduced but not yet adopted—including most recently on June 13 by Senator John Barrasso. “To date CAATSA remains the only relevant sanctions-related legislation,” she said.

In addition, the risks to U.S.-European relations and the likelihood that Nord Stream 2 will ultimately be built regardless of sanctions suggest that Trump’s rhetoric could be more of an empty threat.

“It seems to me it’s more of a bargaining tactic than a national security concern,” Poten & Partners’ head of business intelligence, Jason Feer, told Hart Energy. He noted that Germany was now looking into building LNG import terminals, which could end up receiving U.S. LNG.

“I think the American concerns have been, to a certain extent, considered, and there’s clearly been some movement on the European side in response to those concerns,” he said.

Marco Giuli, a policy analyst at the European Policy Centre, a think tank, agreed that Germany is hopeful a push to build LNG import capacity will defuse tensions with the U.S.

“The idea is that energy could partly contribute to rebalancing EU-U.S. trade accounts, reducing the case for U.S. tariffs,” he told Hart Energy. He warned, however, that while some believed light sanctions—for example those only applied to contractors and not investors—would be less diplomatically problematic, this was not necessarily the case.

“First, investors may not trust any sanctions regime and withdraw anyway,” he said. “Second, the German establishment would anyway interpret sanctions as a clear attack on German economic interests.”

LNG market dynamics will also play a part, regardless of whether the U.S. manages to impose sanctions or not.

Consultancy Facts Global Energy’s (FGE) European LNG and gas analyst, Samuel Dunn, told Hart Energy that “the main benefit would likely be a higher profit on spot cargo for sellers of LNG to the market due to a rise in gas hub prices in Europe” if sanctions were ultimately imposed on Nord Stream 2.

“However, currently there is a surplus of LNG in the global market that has in part been entering the European market and depressing gas prices in Europe,” he noted. Many countries are seeking to take advantage of the current competitive prices, according to Dunn, and strong European interest in increasing LNG imports can be partly attributed to this. He cited countries wishing to enhance their security of supply through gas source diversification as being the other major factor behind the growing European appetite for LNG.

While U.S. LNG exporters would gain an advantage if the export capacity out of Russia was artificially limited by sanctions, this may only be a short-term impact as Europe is forced to step up its search for additional sources of gas.

“Some of this LNG could be coming from the US but this commercial benefit for the U.S. would be short-lived and its image as a supplier of gas to Europe might become tainted, thus casting a shadow on long-term prospects of U.S. LNG sales in Europe,” Yafimava said. She noted that from the European perspective, sanctions “also would not guarantee the U.S. LNG coming, as if the price is higher in Asia it will go to Asia.”

“Historically the best market—the people who pay the highest prices —have been major Asian importers,” Feer agreed. “There’s always a preference to sell to the highest buyer, so I think in general that still holds that project developers in the United States would like to have customers in Asia.”

He added, however, that balancing this out is a need for geographic diversity. “Demand is demand,” he said, regardless where it comes from.

“For some of the projects on the Gulf Coast you have no choice, you have to pre-sell or you can’t get project finance,” he noted. “So I think anybody looking to develop an LNG project is probably going to have to have some European customers. Over the past 5 to 7 years people have been targeting Asia so heavily that some of the best prospects for demand I think are in Europe, where you haven’t seen that big wave of long-term, big-volume contracts.”

Such prospects—particularly in the face of European domestic gas output declines—suggest that U.S. exporters will find buyers in Europe regardless of sanctions. Finding a way forward that does not damage the U.S.-European relationship in the longer term would be the preferable option.

Recommended Reading

TPG Adds Lebovitz as Head of Infrastructure for Climate Investing Platform

2024-02-07 - TPG Rise Climate was launched in 2021 to make investments across asset classes in climate solutions globally.

Air Products Sees $15B Hydrogen, Energy Transition Project Backlog

2024-02-07 - Pennsylvania-headquartered Air Products has eight hydrogen projects underway and is targeting an IRR of more than 10%.

NGL Growth Leads Enterprise Product Partners to Strong Fourth Quarter

2024-02-02 - Enterprise Product Partners executives are still waiting to receive final federal approval to go ahead with the company’s Sea Port Terminal Project.

Sherrill to Lead HEP’s Low Carbon Solutions Division

2024-02-06 - Richard Sherill will serve as president of Howard Energy Partners’ low carbon solutions division, while also serving on Talos Energy’s board.

Magnolia Appoints David Khani to Board

2024-02-08 - David Khani’s appointment to Magnolia Oil & Gas’ board as an independent director brings the board’s size to eight members.