Marathon Petroleum Corp. (MPC) and its MLP, MPLX LP (MPLX), have positioned themselves to increase raw earnings by nearly $1 billion through the purchase of MarkWest Energy Partners LP (MWE), the companies said July 13.

The deal will merge MPLX and MarkWest into the fourth-largest MLP based on market capitalization, with a value of about $21 billion. MPLX will acquire MarkWest in a unit-for-unit transaction paying a 32% premium. Marathon will supply a one-time cash payment of $675 million. All told, Marathon and MPLX will pay about $15.7 billion for MarkWest, the third and largest U.S. midstream deal this year worth at least $10 billion.

“The announcement is a clear positive to MPC shareholders,” said Jeff Dietert, head of research, Simmons & Co. International. The acquisition of MarkWest, with a $35 billion enterprise value, is expected to close in the fourth quarter of 2015.

Following the deal, the company’s operational scale will include 6.8 billion cubic feet per day (Bcf/d) of processing capacity, 379,000 barrels per day (bbl/d) of fractionation capacity and about 7,600 miles of pipeline.

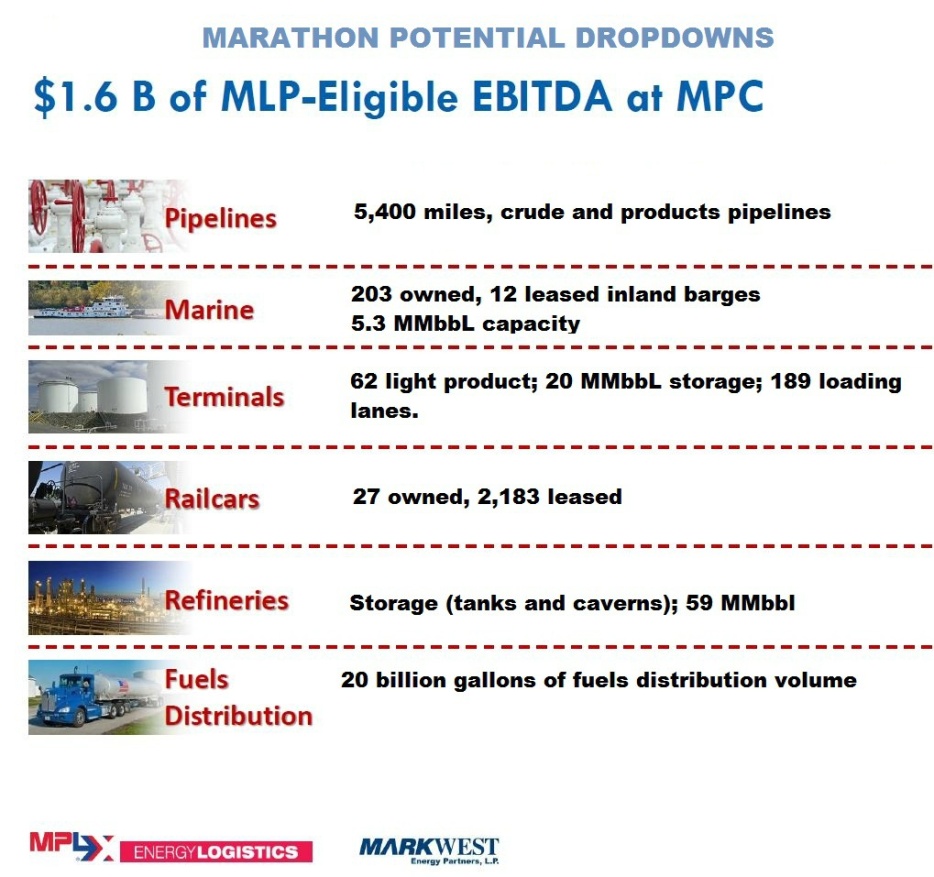

MPLX had set an ambitious goal to generate $450 million EBITDA by year-end 2015, about three times that of 2014 EBITDA. The company was on track to meet guidance largely through a stockpile of dropdown assets from Marathon’s $1.68 billion EBITDA portfolio.

“MPLX is acquiring a company with fiscal year 2015 consensus EBITDA of close to $1 billion, completely changing the scale of the company,” Dietert said.

The transaction is expected to generally be tax-free, with a one-time cash payment to MarkWest unitholders that suggests a total enterprise value for MarkWest of $20 billion, including the assumption of $4.2 billion in debt.

The merger agreement was unanimously approved by the boards of directors of the general partners of MPLX and MarkWest.

The transaction:

- Pays $78.64 for MarkWest units, a 32% premium to the July 10 MPLX closing price of $59.75;

- MarkWest common unitholders receive 1.09 MPLX common units a one-time cash payment of about $3.37;

- Marathon will contribute $675 million of cash to MPLX to fund the one-time cash payment;

- MPLX assumes all of MWE’s cash and $4.2 billion of debt outstanding and $152 million in cash; and

- Ownership will be divided among Marathon (21%), MPLX (8%) and MarkWest (71%).

Marathon will retain control through continued 2% ownership of general partner interest.

Marathon “retains its controlling GP interest as part of the announced transaction with the advantaged 50/50 splits having already been attained,” Dietert said.

The proposed transaction would combine the nation's second-largest processor of natural gas, said Roger Read, senior analyst, Wells Fargo Securities LLC.

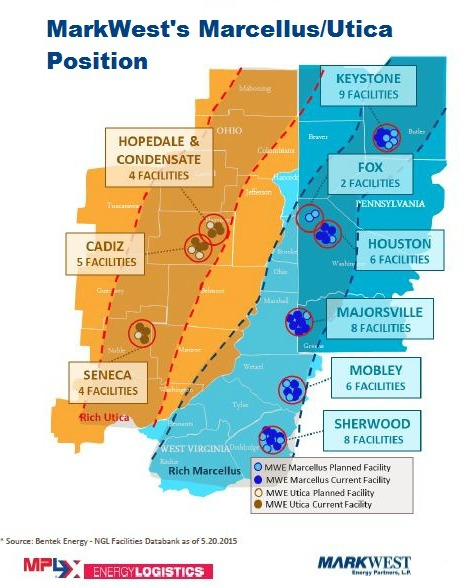

MarkWest’s footprint in the Marcellus and Utica region possesses significant overlap with Marathon’s existing refining footprint in Ohio and Kentucky and to the East Coast via its retail assets.

The deal creates the largest processor and fractionator in the Marcellus and Utica shale plays, led by MarkWest’s leading midstream presence in the shales.

Frank Semple, chairman, president and CEO of MarkWest, said during a conference call that integration potential is notable as the two companies’ operations span across the NGL, crude, condensate and refined projects value chain.

“The volume of NGL production in the Utica and Marcellus shales are expected to increase significantly over the next decade, creating an opportunity to convert NGL into higher-value lending components,” Semple said. “This is more easily done by leveraging the expertise and assets of MarkWest, MPLX and its sponsor MPC.”

“The volume of NGL production in the Utica and Marcellus shales are expected to increase significantly over the next decade, creating an opportunity to convert NGL into higher-value lending components,” Semple said. “This is more easily done by leveraging the expertise and assets of MarkWest, MPLX and its sponsor MPC.”

Dietert said the merged MLP would benefit from MarkWest’s organic growth initiatives and $1.5 billion capex.

The deal would also allow MarkWest's leading midstream presence in the Marcellus and Utica shales to pursue additional dynamic midstream projects. The companies envision large-scale, strategic projects that would allow producer customers to achieve the highest value for their growing production. The merger would also provide significant vertical integration opportunities since Marathon is a large consumer of NGL.

As part of the merger MPLX affirm its anticipated distribution growth of 29% this year, said Gary R. Heminger, MPLX chairman and CEO. MPLX expects a 25% compound annual distribution growth rate for the combined entity through 2017.

The merged entity will have the capacity to support a peer-leading distribution growth profile for an extended period of time.

“Our strategic combination with MarkWest would result in a large-cap, diversified MLP with an exceptional growth profile,” Heminger said.

“We have been business partners with MarkWest for many years. As our teams [worked] more closely on a wide variety of projects in the Utica and Marcellus, it became evident that our companies have a strong confluence of desires and capabilities and some very natural synergies,” Heminger said on a conference call to discuss the merger.

Marathon’s strong balance sheet and liquidity position will enable MarkWest to accelerate organic growth in some of the nation's most economic and prolific natural gas resource plays that it may have been limited in pursuing otherwise, Heminger said.

Company officials anticipate the merger will help the double organic growth. As such, the merger would eliminate the need for MPLX to acquire Marathon’s marine transportation assets in 2015, which will now be returned to the backlog of potential dropdown assets.

Dietert said that after a 12-18 month period in which most refiners were “focused on emphasizing their respective portfolios of MLP-qualified EBITDA as a way of growing their subsidiaries, it looks as though we are now moving on to the next stage of the subsidiaries’ growth plan which involve sizeable third party acquisitions.”

Dietert said that after a 12-18 month period in which most refiners were “focused on emphasizing their respective portfolios of MLP-qualified EBITDA as a way of growing their subsidiaries, it looks as though we are now moving on to the next stage of the subsidiaries’ growth plan which involve sizeable third party acquisitions.”

For instance, Tesoro Logistics LP (TLLP) purchased QEP Field Services in October for $2.5 billion, including 58% ownership in QEP Midstream Partners LP (QEPM). The deal effectively doubled the size of the company, similar to the MPLX and MarkWest deal, he said.

After seeing its offer rejected for Williams Cos. Inc. (WMB), Energy Transfer Equity LP (ETE) again pushed its merger proposal July 7. Energy Transfer Equity has offered to buy all outstanding Williams common stock at a 32.4% premium to the Williams’ closing price as of June 19.

UBS Investment Bank was financial adviser and Jones Day was legal adviser to MPLX in connection with the transaction. Jefferies LLC was financial adviser and Cravath, Swaine & Moore LLP was legal adviser to MarkWest.

Hart Energy’s Frank Nieto contributed to this report. Contact the author, Darren Barbee, at dbarbee@hartenergy.com.

Recommended Reading

E&P Highlights: Jan. 29, 2024

2024-01-29 - Here’s a roundup of the latest E&P headlines, including activity at the Ichthys Field offshore Australia and new contract awards.

Seadrill Awarded $97.5 Million in Drillship Contracts

2024-01-30 - Seadrill will also resume management services for its West Auriga drillship earlier than anticipated.

Oceaneering Won $200MM in Manufactured Products Contracts in Q4 2023

2024-02-05 - The revenues from Oceaneering International’s manufactured products contracts range in value from less than $10 million to greater than $100 million.

E&P Highlights: Feb. 5, 2024

2024-02-05 - Here’s a roundup of the latest E&P headlines, including an update on Enauta’s Atlanta Phase 1 project.

CNOOC’s Suizhong 36-1/Luda 5-2 Starts Production Offshore China

2024-02-05 - CNOOC plans 118 development wells in the shallow water project in the Bohai Sea — the largest secondary development and adjustment project offshore China.