CPPIB will invest roughly $1.34 billion in exchange for a 35% ownership stake in the midstream JV in the western Marcellus and Utica shale basins. (Source: Williams/Hart Energy)

[Editor's note: This story was updated at 10:26 a.m. CST March 19.]

Williams (NYSE: WMB) unveiled plans on March 18 to optimize its midstream operations in the western Marcellus and Utica basins through a $3.8 billion joint venture (JV) with Canada Pension Plan Investment Board (CPPIB).

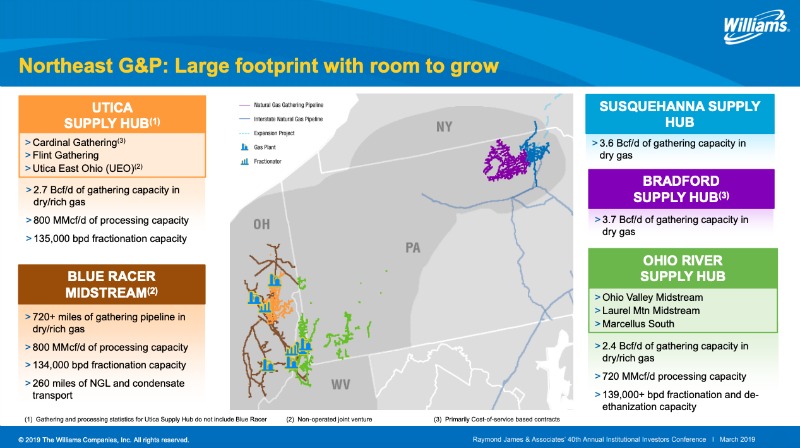

The JV will include Williams’ 100% owned Ohio Valley Midstream system (OVM) and 100% of Utica East Ohio Midstream system (UEO). The Tulsa, Okla.-based company expects synergies through common ownership by combining UEO and OVM ultimately benefiting shale producers in the Northeast.

UEO is involved primarily in the processing and fractionation of natural gas and NGL in the Utica Shale play in eastern Ohio. Williams said March 18 it had purchased the remaining 38% stake in UEO from Momentum Midstream LLC and took over operatorship concurrently with signing the JV agreement with CPPIB. Total consideration for the UEO midstream for roughly $740 million, according to analysts with Tudor, Pickering, Holt & Co. (TPH).

“Acquiring the remaining interest in UEO and forming a partnership with CPPIB continues to advance our already strong position in the Northeast,” Alan Armstrong, president and CEO of Williams, said in a statement. “These transactions create a platform for continued optimization and growth, provide deleveraging, reduce capital spending on processing and fractionation capacity for OVM, and unlock further synergies through combined operatorship of the systems.”

CPPIB will invest roughly $1.34 billion in exchange for a 35% ownership stake in a combined UEO-OVM JV. Williams will retain 65% ownership, will operate the combined business, and will consolidate the financial results of the JV in the company’s financial statements.

The JV follows an earlier investment made by CPPIB in the Utica Shale.

In June 2017, the Toronto-based investment fund committed up to $1 billion to form Encino Acquisition Partners, which ultimately used that capital to acquire Chesapeake Energy Corp.’s Utica Shale position for about $2 billion last year. Encino is an anchor customer on UEO.

Avik Dey, managing director and head of energy and resources for CPPIB, said the firm’s JV with Williams in the Marcellus and Utica will provide additional exposure to the North American natural gas market and aligns with its growing focus on energy transition.

“The joint venture complements our recent investment in Encino Acquisition Partners, an anchor customer on UEO and other Williams gathering assets,” Dey said in a statement. “Through these unique operations in highly attractive basins, we will further our strategy to establish U.S. midstream exposure alongside highly regarded and experienced operating partners such as Williams.”

Williams said it expects the CPPIB investment to provide a net of about $600 million, after transaction fees and paying for the UEO interest, allowing for debt reduction and funding growth capital in the Northeast region.

TPH analysts said the CPPIB investment provides Williams with net proceeds to be used for additional deleveraging beyond its year-end 2019 4.75x D/EBITDA target.

“While we continue to like self-help initiatives undertaken by management, recent equity outperformance coupled with [the] level setting of throughput expectations on [the] back of producer budget revisions across [its] G&P footprint screens as a reasonable time to take some gains,” the TPH analysts said in a March 19 research note.

The JV excludes Williams’ ownership interests in Flint Gathering, Cardinal Gathering, Marcellus South Gathering, Laurel Mountain Midstream and Blue Racer Midstream.

Closing of CPPIB’s investment in the JV, which is expected to occur in the second or third quarter of 2019, is subject only to customary closing conditions, including regulatory approvals. The UEO acquisition was signed and closed on March 18.

For the combined transactions, Morgan Stanley and CIBC Capital Markets were financial advisers to Williams. Gibson Dunn served as legal counsel to Williams.

Emily Patsy can be reached at epatsy@hartenergy.com.

Recommended Reading

Going with the Flow: Universities, Operators Team on Flow Assurance Research

2024-03-05 - From Icy Waterfloods to Gas Lift Slugs, operators and researchers at Texas Tech University and the Colorado School of Mines are finding ways to optimize flow assurance, reduce costs and improve wells.

Defeating the ‘Four Horsemen’ of Flow Assurance

2024-04-18 - Service companies combine processes and techniques to mitigate the impact of paraffin, asphaltenes, hydrates and scale on production—and keep the cash flowing.

Tech Trends: Autonomous Drone Aims to Disrupt Subsea Inspection

2024-01-30 - The partners in the project are working to usher in a new era of inspection efficiencies.

Haynesville’s Harsh Drilling Conditions Forge Tougher Tech

2024-04-10 - The Haynesville Shale’s high temperatures and tough rock have caused drillers to evolve, advancing technology that benefits the rest of the industry, experts said.

Betting on the Future: Chevron Technology Ventures’ Investment Strategy

2024-04-09 - After a quarter century, Chevron Technology Ventures seeks both incremental and breakthrough technologies with its early-stage investment program.