(Source: Maximov Denis/Shutterstock.com)

[Editor's note: A version of this story appears in the November 2020 issue of Oil and Gas Investor magazine. It was originally published Sept. 23, 2020. Subscribe to the magazine here.]

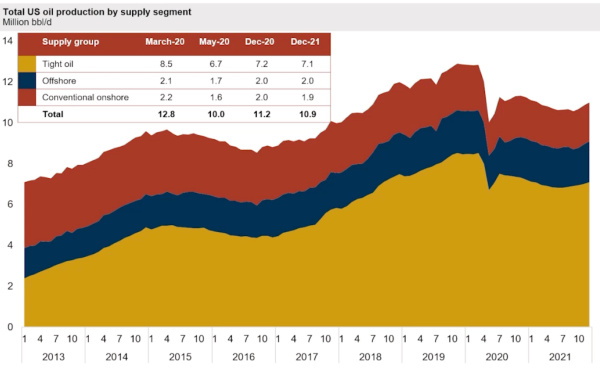

The U.S. saw its oil output hit a high of about 13 million bbl/d at the end of 2019 before the coronavirus-driven market collapse sent production into a nosedive earlier this year.

By the end of May, production had fallen to 10.3 MMbbl/d, triggered by widespread curtailments in an effort to help bring the global market closer to balance and improve tanking oil prices. U.S. producers of unconventional, offshore and conventional resources alike cut output along with other major oil- and gas-producing regions across the world.

In the months since, nearly all of the curtailed barrels have come back online, according to Leslie Wei, vice president of E&P research for the Norway-based energy consultancy Rystad Energy.

“It’s interesting to note that the production cut from the U.S. was the largest among all countries, even higher than Saudi Arabia, which cut 2.5 million barrels,” Wei said. “This highlights the flexibility of shale and the market working as intended, in which producers are able to quickly remove volumes from a mark in response to oil prices.”

However, will the United States produce ever return to 13 MMbbl/d again?

That was the question Wei posed Sept. 22 during Rystad’s Americas annual summit. A crucial determining factor could involve what happens in other parts of the world.

Tracking Fracking

Speaking during the virtual event, she explained how the number of frac jobs in U.S. shale plays plummeted by 75% to 326 in June, compared to 2019. Activity has started to return, with 400 frac jobs in July and again in August, she said.

“The Permian Basin experienced the largest recovery, more than doubling from the bottom of 101 frac jobs in June to 227 and 246 frac jobs in July and August,” she said. “Eagle Ford also shows signs of sustained recovery with about 50 new frac jobs in both July and August. On the other hand, fracking in the Bakken region is expected to return to the bottom as some producers are likely to revisit their plans after the potential shutdown of the Dakota Access pipeline.”

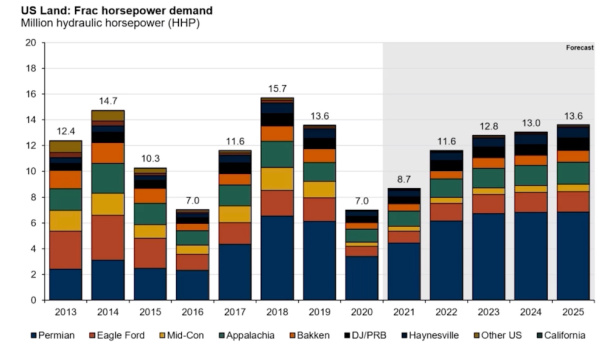

Rystad forecasts demand for frac equipment, which saw utilization hit record lows of 15% this year, will rise toward the end of the year—exiting at about 30%—as completion activity picks up and older equipment leaves the market.

“There won’t be any surprises in activity for the remainder of the year,” Thomas Jacob, vice president of research for Rystad, said based on conversations the firm has had with operators and oilfield service companies.

Oil prices below $40/bbl don’t help.

“We are expecting a 5% to 7% percent decline in completions activity in the fourth quarter due to the typical seasonality that you see frac holidays and end budget exhaustion,” Jacob said.

Rystad doesn’t expect hydraulic horsepower demand to recover to 2019 levels until 2025. “The road to recovery will be slow and painful,” according to Jacob.

“Moving into 2021, demand will continue to go up, hitting 10 million at the end of the year,” Wei said. “At the same time, the fleet size will remain constant at around 15 million. Therefore, implying a utilization rate of about two-thirds.”

Currently, just over 100 frac fleets are working in the U.S., Jacob said. Demand is expected to rise to between 180 and 190 next year.

The segment remains oversupplied.

“We think the industry will easily be able to meet demand using 250 to 300 fleet, even in a sustained $60-plus WTI-type environment,” Jacob said. “So, the days of requiring 350 to 400 fleets are pretty much done.”

Looking Ahead

Efficiency gained through the use of zipper fracs and simul-frac operations are driving down fleet demand as operators, working with oilfield service companies, cut nonproductive time.

“Capital discipline, well design optimization, service price deflation, efficiency improvements and a focus on ESG” will shape the decade ahead, according to Jacob. “The oilfield service segment has changed quite a lot in the last few months but it needs to change a lot more before the market can get to where it really needs to be,” he said.

Add base decline rates of existing wells to the mix, Rystad’s outlook shows production from shale plays dropping until mid-2021.

At that time, Wei said an “oil price recovery should be sufficient to see a new wave of investments in shale and production will gradually increase again and exit the year around 7 million barrels per day.”

Offshore is expected to help lift overall production for the U.S., given Rystad forecasts the sector will fully recover by the year’s end. Yet, the boost won’t be enough for the U.S. to recover to its peak output this year or in 2021.

What happens after that will depend on what happens globally in terms of supply and demand.

“In the short term, global production is expected to recover even without shale. But in the medium term, global production looks grim,” Wei said. “We see that in 2025 global production cannot exceed even 94 million barrels. You might argue that OPEC could fill this gap. But in reality, OPEC’s spare capacity is only one to 2 million barrels. So even OPEC can’t save us.”

Shale volumes will be needed, the analysts said.

Wei said between 6-11 MMbbl will need to come from shale wells not yet drilled. Analysts believe an oil price around $60/bbl would incentivize shale players to ramp up activity, commencing a new upcycle.

Rystad’s outlook shows WTI averaging about $40/bbl in first-quarter 2021, exiting next year around $50/bbl and rising to the to mid-$60s/bbl by 2025.

“We expect to see investments start to recover in 2022 before reaching $155 billion U.S. dollars per year by the middle of the decade,” Wei said before turning to production. “In 2022, we’ll see an uptake in production again before returning to the 1 million barrels per day growth rate that we saw after the recovery from the previous downfall. So to answer the question, we believe by 2024 for the U.S. has a possibility to reach new all-time highs and hit 13.5 million barrels per day.”

Recommended Reading

TotalEnergies Starts Production at Akpo West Offshore Nigeria

2024-02-07 - Subsea tieback expected to add 14,000 bbl/d of condensate by mid-year, and up to 4 MMcm/d of gas by 2028.

Seadrill Awarded $97.5 Million in Drillship Contracts

2024-01-30 - Seadrill will also resume management services for its West Auriga drillship earlier than anticipated.

Remotely Controlled Well Completion Carried Out at SNEPCo’s Bonga Field

2024-02-27 - Optime Subsea, which supplied the operation’s remotely operated controls system, says its technology reduces equipment from transportation lists and reduces operation time.

Shell Brings Deepwater Rydberg Subsea Tieback Onstream

2024-02-23 - The two-well Gulf of Mexico development will send 16,000 boe/d at peak rates to the Appomattox production semisubmersible.

Less Heisenberg Uncertainty with Appraisal Wells

2024-03-21 - Equinor proves Heisenberg in the North Sea holds 25 MMboe to 56 MMboe, and studies are underway for a potential fast-track tieback development.