Presented by:

In this issue, 40 years after Oil and Gas Investor debuted, we’ve asked the question: What do the next 40 years look like? What should they look like?

No one can really predict this, especially when one factors in the increasingly common and frenzied anti-fossil fuel sentiments and net-zero pledges of governments, industries and big banks. But we are optimistic. We have to believe amazing technical breakthroughs are no doubt coming in the next 40 years, of which we have no clue at the moment.

Change is inevitable, but it rarely takes on the form we think it will, or fear it will. Surprises can be exciting or dreadful. No one could have dreamed back in 1981 that such a thing as the iPhone would exist, nor become so widely used around the world. It was launched in 2007. Now it seems we hardly recall a time when we didn’t have our phone close at hand. In fourth-quarter 2020 alone, Apple sold $65.6 billion worth of iPhones globally, according to Gartner. There were 200 million iPhones sold in the entire year! Then again, Samsung sold even more, some 235 million. This tricky little device has changed the game, for good and for not so good.

Similarly, no one could have dreamed in 1981 that a shale revolution was possible, brewing in North Texas right under our noses while the rest of the industry drilled hundreds of conventional vertical wells everywhere. Shale also changed the game. Now we must look forward to guess at what the ideal independent should look like in order to thrive in the decades ahead. Naturally, no independent we talked to was likely, or willing, to say that the future is in peril. Forty years hence, there will still be demand for oil, although the quantity can’t yet be known. This could change if some new energy source emerges that is economic, safe and scalable.

A few things are a given, and this is knowledge borne out of some hard-won lessons of the past. Maintaining low debt or no debt is a must. Achieving free cash flow to give back a large portion of that to investors is a must. (How in heck did CEOs drift away from doing that in the first place?) The ideal independent will deliver yields comparable to the best in other U.S. industries.

In the office, relying on digital analytics to make decisions and prevent bad maintenance problems from occurring will be the norm. Remote operations from a central computer will be common. Drilling out of cash flow will be a no-brainer. The employees will be highly educated, motivated and diverse, with more women and minorities in charge, thus bringing fresh perspectives to boardroom and staff conversations.

Flaring will be done only in exceptional, short-lived instances. Drilling and production equipment will be amazingly advanced, and wastes from drilling and completions of all kinds will be recycled and treated. Water will be protected. Costs will be minimal as technology continues to reduce downtime and errors and to increase productivity in the office and in the field.

The independents (and majors) will have figured out how to make their natural gas, crude oil and NGL “responsibly sourced,” and this will be a true, scientific description as monitored by the Securities and Exchange Commission or someone else, not PR “greenwashing.”

A new industry sector that is growing fast will be plugging all the old, leaky, abandoned wells throughout the U.S. in a robust campaign that is adequately funded by the industry, state and federal governments. It will employ thousands of environmental engineers who know how to mitigate problems, protect wildlife habitats and reclaim land. Indeed, all ESG matters will be handled appropriately and be so commonplace that they elicit few headlines and few complaints. Standard operating procedure. Just another line item in the budget.

Luckily for consumers, energy will be cheap and plentiful, coming from oil, natural gas, biomass, other renewables and wave power. Companies will have figured out how to harness, store and transport these in a safe manner that is also economic. Don’t give it another thought.

Sure, there are bound to be many challenges and new business models will emerge that we may not have envisioned today. A report from the non-profit Energy Systems Integrated Group said recently that if the U.S. were to achieve net-zero emissions by 2050, we’d need to first double, or even triple, the electric transmission grid to handle what will be needed. That’s a tall order, and where will the money come from? And what about the landowners who object to power lines, or solar and wind farms, for that matter?

There are no easy answers—yet—but if we can dream it, we can achieve it. Someone somewhere is going to figure all of this out. For that reason, we eagerly look forward to what the next 40 years will bring.

Recommended Reading

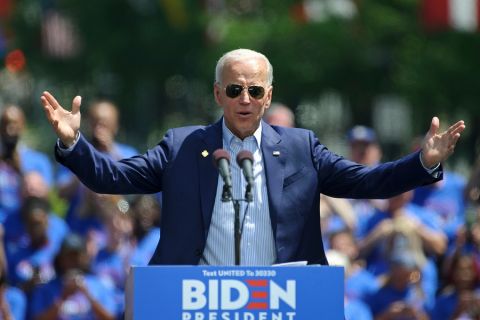

Belcher: Election Year LNG ‘Pause’ Will Have Huge Negative Impacts

2024-03-01 - The Biden administration’s decision to pause permitting of LNG projects has damaged the U.S.’ reputation in ways impossible to calculate.

Belcher: Our Leaders Should Embrace, Not Vilify, Certified Natural Gas

2024-03-18 - Recognition gained through gas certification verified by third-party auditors has led natural gas producers and midstream companies to voluntarily comply and often exceed compliance with regulatory requirements, including the EPA methane rule.

Exclusive: The Politics, Realities and Benefits of Natural Gas

2024-04-19 - Replacing just 5% of coal-fired power plants with U.S. LNG — even at average methane and greenhouse-gas emissions intensity — could reduce energy sector emissions by 30% globally, says Chris Treanor, PAGE Coalition executive director.

Vietnam Seeks Delicate Balance Among US, China, Russia

2024-02-08 - Ongoing U.S. tensions with China and Russia offer Vietnam an opportunity to boost economic ties with the former if American investors can steer past geopolitical smokescreens and destine funds for infrastructure, power and LNG projects all somewhat tied to Vietnam’s manufacturing sector.

Pitts: Producers Ponder Ramifications of Biden’s LNG Strategy

2024-03-13 - While existing offtake agreements have been spared by the Biden administration's LNG permitting pause, the ramifications fall on supplying the Asian market post-2030, many analysts argue.