Whiting Petroleum Corp. completed its previously announced exit from the Denver-Julesburg (D-J) Basin on Sept. 27 that included the redetermination of its borrowing base under its revolving credit facility.

The exit, initially announced in July, included the sale of Whiting’s D-J Basin position for total cash consideration of $187 million. A private entity agreed to acquire the assets, which span 67,278 net acres in Colorado’s Weld County with daily production of approximately 7,100 boe/d (51% oil).

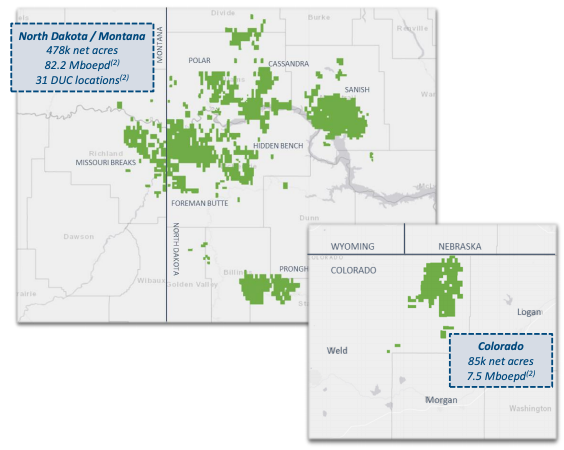

Concurrent with the sale, Whiting also announced an acquisition of Williston Basin assets that the company said “adjoins and complements” its existing Bakken operations in the Sanish Field of North Dakota. The $271 million cash transaction with an undisclosed private company was completed on Sept. 27 as well.

“These two transactions result in a significantly deeper drilling inventory in our key Sanish operating area, while divesting of properties in Colorado that were not going to compete internally for capital,” Lynn A. Peterson, president and CEO of Whiting, commented in a July 21 release announcing the transactions.

The Williston transaction included 8,752 net acres in North Dakota’s Mountrail County with net daily production of approximately 4,200 boe/d (80% oil). Meanwhile, the D-J Basin transaction comprised of the divestiture of Whiting’s Redtail leasehold interests and associated midstream assets.

The transactions had an immaterial effect on current production but resulted in the addition of approximately 60 drillable locations that compete for capital immediately, according to a company release on Sept. 27.

Commensurate with the closing of the two transactions, Whiting also announced in the release the completion of its revolver redetermination.

The borrowing base and aggregate commitments were both reaffirmed at the previous amount of $750 million. The difference in the acquisition costs and divestiture proceeds of the two transactions of approximately $90 million was funded with the revolver.

Whiting continues to expect to have a positive cash balance and no outstanding borrowings on the revolver by the end of the year, the release said.

Recommended Reading

BP’s Kate Thomson Promoted to CFO, Joins Board

2024-02-05 - Before becoming BP’s interim CFO in September 2023, Kate Thomson served as senior vice president of finance for production and operations.

Magnolia Oil & Gas Hikes Quarterly Cash Dividend by 13%

2024-02-05 - Magnolia’s dividend will rise 13% to $0.13 per share, the company said.

TPG Adds Lebovitz as Head of Infrastructure for Climate Investing Platform

2024-02-07 - TPG Rise Climate was launched in 2021 to make investments across asset classes in climate solutions globally.

HighPeak Energy Authorizes First Share Buyback Since Founding

2024-02-06 - Along with a $75 million share repurchase program, Midland Basin operator HighPeak Energy’s board also increased its quarterly dividend.

Occidental Increases Annual Dividend by 22%

2024-02-11 - Occidental Petroleum Corp.’s newly declared dividend is at an annual rate of $0.88 per share, compared to the previous annual rate of $0.72 per share.