The two transactions result in a “significantly deeper drilling inventory” in Whiting’s key Sanish operating area in the Williston Basin, while divesting of properties in Colorado that were not going to compete internally for capital, said President and CEO Lynn A. Peterson. (Source: Hart Energy)

Learn more about Hart Energy Conferences

Get our latest conference schedules, updates and insights straight to your inbox.

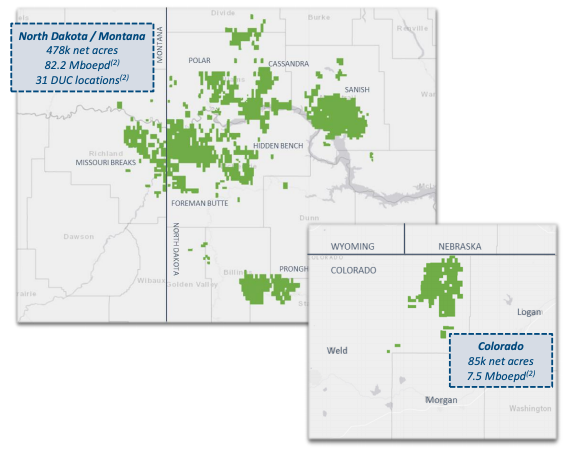

Whiting Petroleum Corp. is wishing its home state of Colorado goodbye in an A&D double play disclosed by the Denver-based company on July 21.

In a company release, Whiting said it had entered into separate definitive agreements totaling $458 million to acquire oil and gas assets in the Williston Basin of North Dakota and divest all its oil and gas assets in the Denver-Julesburg (D-J) Basin of Colorado.

“These two transactions result in a significantly deeper drilling inventory in our key Sanish operating area, while divesting of properties in Colorado that were not going to compete internally for capital,” commented Lynn A. Peterson, president and CEO of Whiting, in the company release.

Whiting is acquiring the Williston Basin assets, which adjoin and complement its existing operations in the Sanish Field, from an undisclosed private company for total cash consideration of $271 million, before typical closing adjustments.

The acquisition include 8,752 net acres in North Dakota’s Mountrail County with net daily production of approximately 4,200 boe/d (80% oil). Additionally, the purchase adds 5 gross (2.3 net) DUCs and 61 gross (39.5 net) undrilled locations (100% operated), which the company said will immediately compete for capital within its existing portfolio.

For the sale of its D-J Basin asset, a private entity agreed to acquire the position, including associated midstream assets, located in Colorado’s Weld County for total cash consideration of $187 million, before typical closing adjustments. The assets span 67,278 net acres with daily production of approximately 7,100 boe/d (51% oil).

“These transactions demonstrate our strategy to focus our attention on value-enhancing opportunities that compete for capital in a $50 oil environment,” Peterson continued in his statement.

“Including these transactions,” he said, “the company now estimates that in a mid-$50s oil environment it has over 6 years of high-quality drilling inventory, assuming a two rig drilling program.”

Both transactions are expected to close third-quarter 2021 with the difference in acquisition costs and divestiture proceeds funded with existing availability on the company’s revolver.

Recommended Reading

NAPE: Turning Orphan Wells From a Hot Mess Into a Hot Opportunity

2024-02-09 - Certain orphaned wells across the U.S. could be plugged to earn carbon credits.

Tech Trends: Halliburton’s Carbon Capturing Cement Solution

2024-02-20 - Halliburton’s new CorrosaLock cement solution provides chemical resistance to CO2 and minimizes the impact of cyclic loading on the cement barrier.

Comstock Continues Wildcatting, Drops Two Legacy Haynesville Rigs

2024-02-15 - The operator is dropping two of five rigs in its legacy East Texas and northwestern Louisiana play and continuing two north of Houston.

NAPE: Chevron’s Chris Powers Talks Traditional Oil, Gas Role in CCUS

2024-02-12 - Policy, innovation and partnership are among the areas needed to help grow the emerging CCUS sector, a Chevron executive said.

Chevron Hunts Upside for Oil Recovery, D&C Savings with Permian Pilots

2024-02-06 - New techniques and technologies being piloted by Chevron in the Permian Basin are improving drilling and completed cycle times. Executives at the California-based major hope to eventually improve overall resource recovery from its shale portfolio.