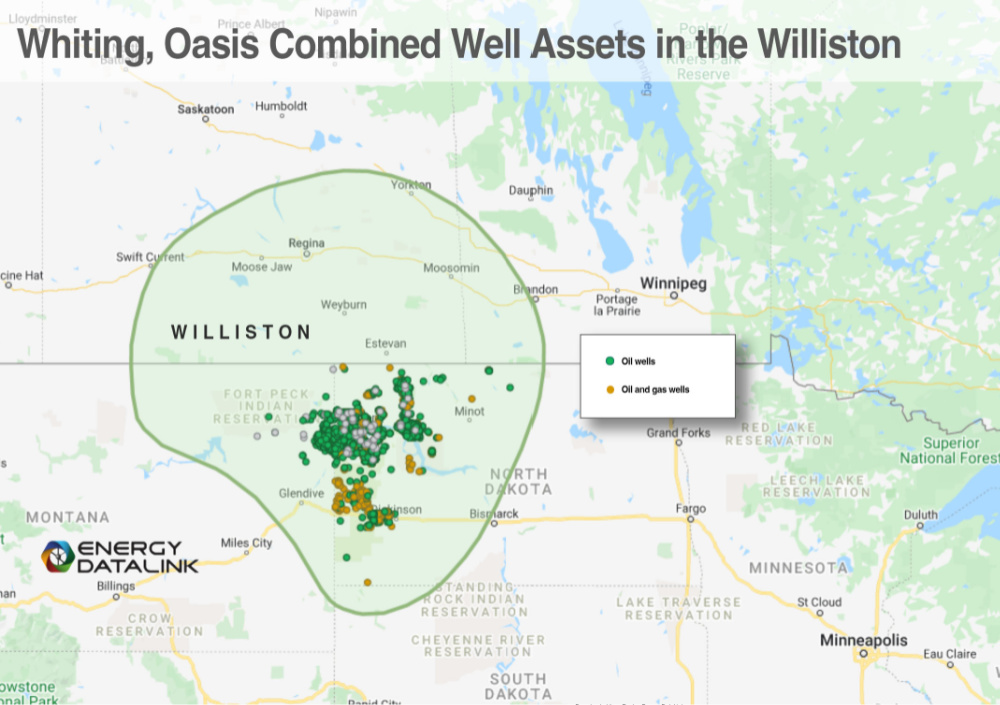

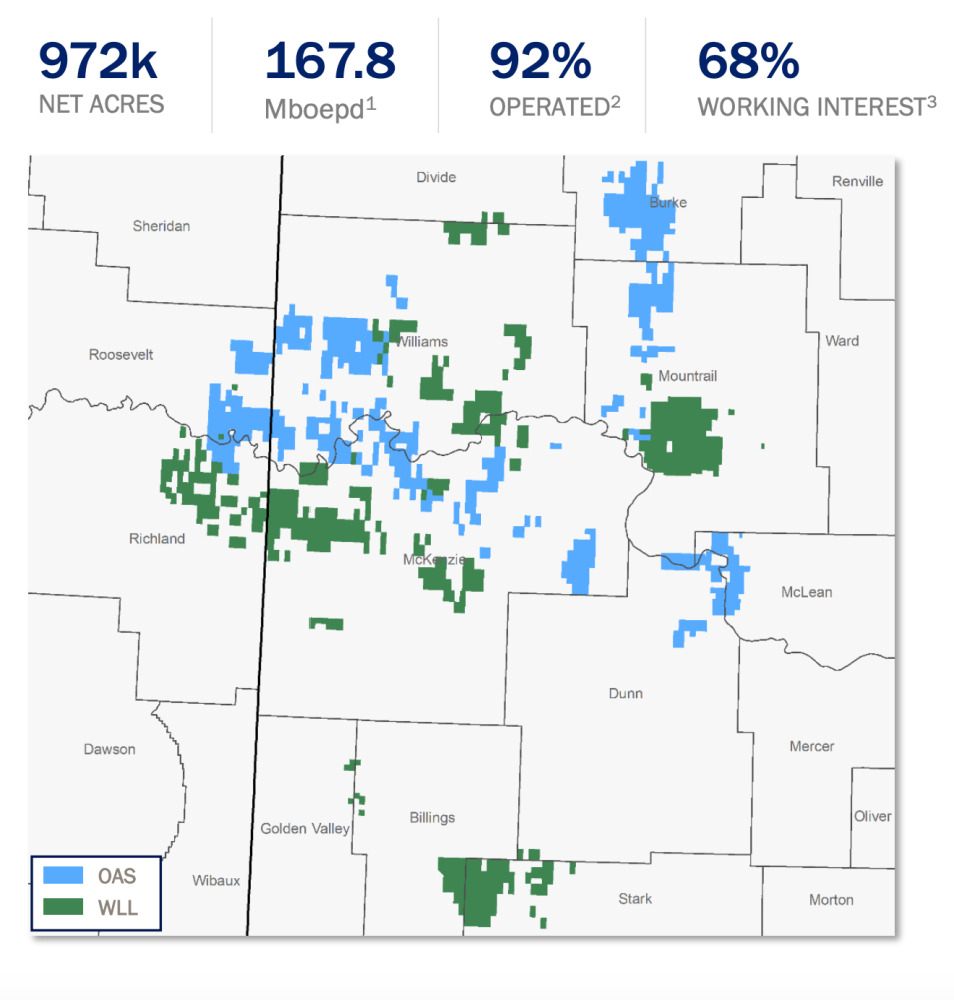

The combined company will have an enterprise value of roughly $6 billion with approximately 972,000 net acres and production of 167,800 boe/d in the Williston Basin. (Source: Hart Energy)

Whiting Petroleum Corp. and Oasis Petroleum Inc. agreed to combine in a $6 billion “mergers of equals” transaction, the two Bakken shale producers said in a joint release on March 7.

Under the terms of the agreement, Whiting shareholders will receive 0.5774 shares of Oasis common stock and $6.25 in cash for each share of Whiting common stock owned. The combined company, to be led by Oasis CEO Danny Brown, will operate under a new name and is expected to trade on the NASDAQ under a new ticker to be announced prior to closing.

“The combination will bring together two excellent operators with complementary and high-quality assets to create a leader in the Williston Basin, poised for significant and resilient cash flow generation,” Brown commented in a joint company release.

Combined, the company will have a premier Williston Basin position with top tier assets across approximately 972,000 net acres, production of 167,800 boe/d, significant scale and enhanced free cash flow generation to return capital to shareholders, according to the release.

Both Denver-based Whiting and Houston-based Oasis filed for Chapter 11 bankruptcy in 2020 following a historic crash in oil prices. Reuters on March 6 had reported about their impending merger, citing a source familiar with the matter.

“Over the last year, both companies have executed a series of deliberate strategic transactions, reducing costs and establishing a leading framework for ESG and return of capital,” Brown added. “The combination of the two companies, together with the ongoing momentum from these strategic actions, will accelerate our efforts and ideally position the combined company to generate strong free cash flow, execute a focused strategy and enhance the return of capital.”

Upon closing, Brown will serve as president and CEO and as a member of the board of the combined company, which will be headquartered in Houston upon closing but will retain the Denver office for the foreseeable future. Whiting’s President and CEO, Lynn Peterson, will serve as executive chair of the board of directors.

“We are bringing together two like-minded companies and cultures through a merger-of-equals transaction,” Peterson commented in the joint release. “Both organizations have outstanding talent and operational practices that we are excited to integrate to create an even stronger combined company.”

“This is also an exciting and very positive development for the communities in which we operate and the great states of North Dakota and Montana,” he continued. “We look forward to unlocking the enormous potential of our assets and organizations for the benefit of our stakeholders.”

The remainder of the combined company’s leadership team includes Oasis CFO Michael Lou, Whiting COO Chip Rimer and Scott Regan, Whiting’s general counsel, who will serve in their respective capacities. The board of directors of the combined company upon closing will consist of 10 directors, comprising four independent directors from the current Whiting board, as well as Peterson, and four independent directors from the current Oasis board, along with Brown.

The transaction, which is expected to close in the second half of 2022, has been unanimously approved by the boards of directors of both companies. The closing of the transaction is subject to customary closing conditions, including, among others, approval by Whiting and Oasis shareholders.

Kimmeridge Energy Management Co. LLC, a significant owner of Oasis with a 4.9% stake in the company, is “highly supportive” of the announced transaction, according to Mark Viviano, managing partner and lead portfolio manager of the firm’s public investment team.

“We have advocated for industry consolidation as there are too many undersized and irrelevant companies drilling shale wells,” Viviano commented in an emailed statement. “This merger of equals amongst offsetting operators will help the combined company gain operational scale, with synergies accruing to both sets of shareholders.”

“Following bankruptcy, the new Oasis management team and board has executed a shareholder friendly strategy, consistent with Kimmeridge’s vision for the company. They should be applauded for taking swift action,” he added.

Upon completion of the transaction, Whiting shareholders will own approximately 53% and Oasis shareholders will own roughly 47% of the combined company on a fully diluted basis. In connection with the closing of the transaction, Oasis shareholders will receive a special dividend of $15 per share.

During the second half of 2022, the combined company will target a return of capital program representing 60% of free cash flow. The combined company is expected to increase its aggregate base dividend at close to roughly $25 million per quarter, or $0.585 per share, using variable dividends and share repurchases to return the full targeted amount. Both companies will continue their respective formally announced programs before the transaction closes, according to the release.

The combined company will also have a peer-leading balance sheet, the release said, with expected leverage of ~0.2x at close, including the impact of the merger consideration and special dividend. Additionally, the combined company expects to have minimal borrowings under its $900 million borrowing base, resulting in strong liquidity at close.

Citi is financial adviser and Kirkland & Ellis LLP is serving as legal adviser to Whiting for the transaction. Tudor, Pickering, Holt & Co. and RBC Capital Markets LLC are serving as financial advisers and Vinson & Elkins LLP is legal adviser to Oasis.

Recommended Reading

Texas LNG Export Plant Signs Additional Offtake Deal With EQT

2024-04-23 - Glenfarne Group LLC's proposed Texas LNG export plant in Brownsville has signed an additional tolling agreement with EQT Corp. to provide natural gas liquefaction services of an additional 1.5 mtpa over 20 years.

US Refiners to Face Tighter Heavy Spreads this Summer TPH

2024-04-22 - Tudor, Pickering, Holt and Co. (TPH) expects fairly tight heavy crude discounts in the U.S. this summer and beyond owing to lower imports of Canadian, Mexican and Venezuelan crudes.

What's Affecting Oil Prices This Week? (April 22, 2024)

2024-04-22 - Stratas Advisors predict that despite geopolitical tensions, the oil supply will not be disrupted, even with the U.S. House of Representatives inserting sanctions on Iran’s oil exports.

Association: Monthly Texas Upstream Jobs Show Most Growth in Decade

2024-04-22 - Since the COVID-19 pandemic, the oil and gas industry has added 39,500 upstream jobs in Texas, with take home pay averaging $124,000 in 2023.

What's Affecting Oil Prices This Week? (Feb. 5, 2024)

2024-02-05 - Stratas Advisors says the U.S.’ response (so far) to the recent attack on U.S. troops has been measured without direct confrontation of Iran, which reduces the possibility of oil flows being disrupted.