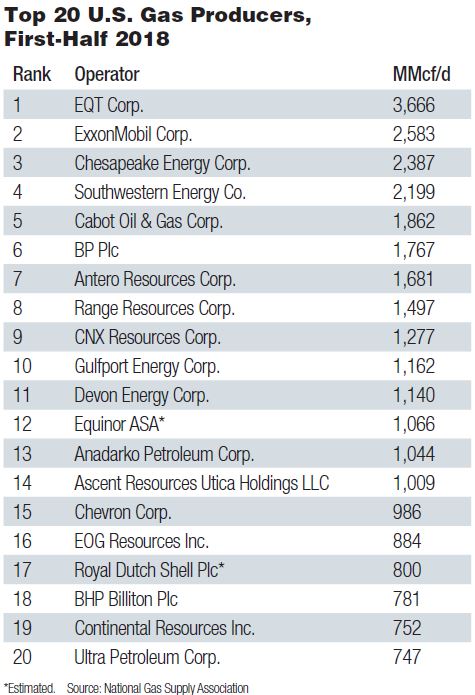

Into mid-August, U.S. gas-storage injections continued to sputter despite record U.S. dry-gas production of 80.4 billion cubic feet per day (Bcf/d), based on Energy Information Administration (EIA) data. May production was 8.6 Bcf/d more than in May 2017.

Meanwhile, added to storage since this past winter was an average of 9.7 Bcf/d into mid-August, suggesting little would have been added this year if not for the growth in supply.

That iconic, gray-wave, EIA graph indicating the five-year highs and lows of storage levels vs. current? Well, the line indicating the Aug. 17 level left the wave; it was the lowest level at that time of year than in any of the past five years.

That’s despite the fact that May was the 12th consecutive month to set a new U.S. year-over-year production record.

Is a winter of hurt in store? Gas-futures traders didn’t think so in late August. Winter-month futures were trading at $3.07 and less; the prompt-month (October) contract was $2.87.

“Price action in the futures market would indicate the market is little concerned about the deficit at the moment,” Sheetal Nasta, an analyst with RBN Energy, told Investor. “There’s been little movement at the front of the curve.”

Samuel Phillips, an analyst with Barclays Capital Inc., reported, “End-October storage is set to be the lowest in a decade.” He and colleagues were expecting a “fundamentally tight start to the 2018-2019 winter,” estimating storage would total 3.4 Tcf entering November.

However, the futures market, he added, “appears content to bank on further production gains to meet demand this winter.”

Capital One Securities Inc. analysts wrote that, while “extrapolation is perilous and we are a long way from Halloween,” the trajectory was indicating 3.12 Tcf in storage entering November. “That would be the lowest pre-winter inventory level since 2000.”

According to EIA data, U.S. dry gas production in 2000 averaged 52.55 Bcf/d. That year, November began with 2.75 Tcf in storage; the season ended in March 2001 with 738 Bcf. EIA data showed the U.S. averaged approximately 2,650 heating degree days (HDDs) that December through February. This past December through February, HDDs averaged some 2,680; drawn from storage was that of the 2000-2001 season: 2 Tcf.

John Walker, CEO of EnerVest Ltd., and other operators have long held that the demand side—gas-fired power generation, industrial use, LNG exports and piped exports to Mexico—of the U.S. gas equation would catch up to growth in supply.

Walker told Investor in late August that the consensus—particularly as indicated by the strip—is that natgas will remain in the $2.50 to $3 range for the next several years “and not rise above that to any great extent.” Further out, the August 2028 contract was $2.81 per million British thermal units (MMBtu).

But winter

Long term, he’s onboard with the consensus, but this particular winter might be interesting, he said—if it’s a “normal” winter. The call on gas during the last real winter, which was the one that ended in March of 2014, was 3 Tcf—an amount that would have emptied the 2.75-Tcf working storage of 2000. (There’s more gas—called “base” or “cushion” gas—but it’s needed for maintaining reservoir pressure.)

Spare production preceding the winter of 2013-2014 was 10.1 Bcf/d, based on the 2.16 Tcf added, according to EIA data.

Since 2014, the past four winters have been relatively warm. In particular, the 2015-2016 season was the warmest in recorded history, according to NOAA. (A mosquito bite was confirmed that Christmas morning in South Louisiana; that winter is known as “the winter that wasn’t.”) The season ending in 2017 was the sixth-warmest on record, according to NOAA.

This past winter, which was cooler, Walker said, “People thought we had a normal winter. It was actually 11% warmer than normal. So we haven’t even had a normal winter in four years.”

Storage entering winter the past eight years has been between 3.6 and 4 Tcf, according to EIA data. “We’re going into this winter with the probability of that we’ll have something like 3.3 Tcf in storage,” Walker said. “If we have a normal winter, we could be in trouble. Winter is so impactful, so we’re going to be more vulnerable than we’ve been in the past four years.”

Should there be, say, a draw of 3 Tcf like the winter of 2013-2014, could producers hedge that higher one-year strip and add a rig? “Yes, of course,” he said.

The strip in August was backwardated, but a short scenario would “probably change the backwardation and create some opportunities.” The strip beyond 2019 probably wouldn’t change, “but it would for a year, so you could lock in some of your production for the next year at good pricing.

“You probably could lock in some things that you couldn’t drill at $3.”

Where’s it going?

U.S. natgas moved to the supply-long column after discovery of the wet gas Marcellus shale play in late 2007, followed by the dry-gas Haynesville in early 2008. Further, growth in Permian oil production has led to growth in Permian associated-gas production.

Appalachian Basin supply was 29.0 Bcf/d in August, up from about 2 Bcf/d before 2009, according to EIA records. Haynesville production was 9.4 Bcf/d, up from about 4; Permian, 11.3 Bcf/d, up from less than 6.

EIA gas analyst Mike Kopalek and summer associate Kiefer Mueller reported in late August, “These three regions collectively accounted for less than 15% of total U.S. natural gas production as recently as in 2007, but now they account for nearly 50%.”

May production was the highest rate in EIA’s 45-year history of tracking it, according to its “Natural Gas Monthly” report. That month, 13.1 Bcf/d was added to storage.

First-five-month electric-power consumption was 3.77 Tcf, up from 3.22 Tcf during that timeframe in 2017. In full-year comparisons, 2017 demand was 9.25 Tcf; 10 years earlier, demand was 6.84 Tcf.

Net exports during the first five months of this year were 128 Bcf. In 2017, the U.S. was a net importer of a total of 9 Bcf; in 2016, 364 Bcf. In 2007, net imports totaled 3,786 Bcf.

Industrial demand was 1 Bcf/d more in May than in May 2017. The rate was the highest since using the current definition beginning in 2001, according to the EIA monthly summary. It added, “May was the 13th month in a row that industrial deliveries set a new high for the given month.”

While LNG exports were 3.1 Bcf/d in May, EIA gas analyst Victoria Zaretskaya wrote in August that exports to Mexico averaged 4.4 Bcf/d during the first five months of this year and, citing Genscape Inc. data, exceeded 5 Bcf/d in July.

“By the end of 2018,” she added, “an additional four of six major pipelines identified as strategic in Mexico’s five-year natural gas infrastructure expansion plan are scheduled to begin commercial operations.”

RBN Energy’s Nasta added that additional LNG exports are near. Cheniere Energy Inc.’s Sabine Pass, Louisiana, facility “has begun commissioning activities on Train 5,” she told Investor. Its Corpus Christi, Texas, facility’s first train is near start-up. “And Freeport [LNG]Development LP’s facility at Freeport, Texas,) was just approved to begin commissioning its first train.”

Barclays’ Phillips added that, with Kinder Morgan Inc.’s Elba Island, Georgia, facility starting up this year too, it, Sabine 5 and Corpus 1 alone will add 1.5 Bcf/d in demand by early 2019.

More pipe

As for new supply, Permian takeaway is expected to grow, but capacity was full at press time. Walker said, “If you can’t move the gas and the [Texas] Railroad Commission won’t let you just permanently flare, then you have to shut it in.”

EIA analyst Nicholas Skarzynski reported that Permian gas pipelines Comanche Trail and Trans-Pecos are ready to send gas to Mexico—combined, 2.6 Bcf/d. These may begin flowing later this year or in early 2019 once Mexico-side infrastructure is completed.

New supply to U.S. consumers that is near, though, is expected from Appalachia—via Rover, Atlantic Sunrise and Nexus—Nasta said. These are expected online by November.

Of Rover’s 1.75 Bcf/d of capacity, up to 32% may be sent to storage in Dawn, Ontario, for use in Canada or for sending back into the U.S. The amount will vary based on how much of the 32% taken at its last U.S. stop—in Michigan. Likewise, Nexus’ 1.5 Bcf/d will also deliver to Dawn what isn’t consumed en route—also via Michigan.

Rob Turnham, president and CEO of Haynesville-focused Goodrich Petroleum Corp., told Investor that the company’s core acreage makes good returns down to $2.50 gas. A forward curve below that, “we would slow down.”

If an injection-season-end storage level of 3.3 to 3.4 Tcf “with any cold weather early in the season, we would not be surprised to see the prompt months move to $3.50 and the 12-month forward curve move toward $3.”

This could translate to a “moderate” increase in capex by Goodrich and other operators in the Haynesville sweet spots as well as those in the Marcellus, he said.

There are some wildcards, such as oilfield-service availability. But, any real weather this winter, “at a minimum, would be setting us up for a bullish 2019 storage season, if not sooner,” he said.

Nasta also noted weather. “Weather will likely be the bigger factor here,” she said. While the pace of adding to storage traditionally picks up in September and October, she and her RBN colleagues are in the camp of draw season kicking off after October with between 3.3 and 3.4 Tcf.

More precisely, RBN is estimating 3.37 Bcf, “which would be about 400 Bcf lower than last year and about 480 Bcf below the five-year average.”

Barclays’ Phillips wrote that, on the other hand, if the winter draw is mild—that of the 10-year average—and production continues to grow, “the storage deficit is likely to be erased by end-March 2019.” Entering April, storage may be 1.7 Tcf, he estimated.

Overall, “we expect a fundamentally tight start to the 2018/2019 winter and, then, a gradual giving way to a looser market in the spring and summer.”

The 'lingering angst'

Walker said additional supply will balance the continuing increased demand. “I’m not saying I think we have a long-term price of $3.50 or $4. I just think we have some near-term vulnerability that could make the market wake up and say, ‘It’s not here.’

“And no one’s drilling for gas unless you’re in the Haynesville or the Marcellus.”

While EnerVest has Appalachian and other gassy acreage and production, it doesn’t have a gas-directed rig at work right now, except in its shallow, coalbed-methane Nora Field.

In a blogpost, “Dog Days Are Over,” Nasta wrote that “few would disagree that the single-most striking feature of the 2018 gas market has been the rampant supply growth that’s happened over the past six months or so.” Meanwhile, “gas demand also has seen impressive, record-setting growth on several fronts.”

Net, “the resulting balance this year [through July] has been 1.7 Bcf/d tighter compared with the same period in 2017.”

Gas-futures prices suggest the market could be betting on a mild winter coupled with more gas supply. “There is a lingering angst that oversupply conditions are around the corner and it’s not unfounded, despite the bullish inventory levels …,” she wrote.

“Lower 48 demand hasn’t reached a point where it can absorb all the new supply growth without the help of some extreme weather conditions.”

Recommended Reading

TPG Adds Lebovitz as Head of Infrastructure for Climate Investing Platform

2024-02-07 - TPG Rise Climate was launched in 2021 to make investments across asset classes in climate solutions globally.

Air Products Sees $15B Hydrogen, Energy Transition Project Backlog

2024-02-07 - Pennsylvania-headquartered Air Products has eight hydrogen projects underway and is targeting an IRR of more than 10%.

NGL Growth Leads Enterprise Product Partners to Strong Fourth Quarter

2024-02-02 - Enterprise Product Partners executives are still waiting to receive final federal approval to go ahead with the company’s Sea Port Terminal Project.

Sherrill to Lead HEP’s Low Carbon Solutions Division

2024-02-06 - Richard Sherill will serve as president of Howard Energy Partners’ low carbon solutions division, while also serving on Talos Energy’s board.

Magnolia Appoints David Khani to Board

2024-02-08 - David Khani’s appointment to Magnolia Oil & Gas’ board as an independent director brings the board’s size to eight members.