(Source: HartEnergy.com, Pakhnyushchy/Shutterstock.com)

For a sunnier natural gas production outlook, look to the Haynesville Shale, an analyst from S&P Global Platts Analytics said on a recent webinar.

For a sunnier gas price outlook, well, you’ll just have to wait, perhaps for a couple of years until oil markets are on a stronger footing, especially in the Permian Basin.

“While the oil market has recovered since the crash, WTI crude prices for next year remain weak, around the low- to mid-$20s range, and this is expected to keep oil activities subdued,” Veda Chowdhury, senior pricing specialist for S&P Global Platts, said during the webinar. “This weakness in production might stay to 2022, calling into question the immediate need for additional pipeline capacity to move gas out of the region.”

Prices have strengthened at Waha, hub for Permian gas, since the collapse in global oil prices triggered a steep reduction in rig activity, and therefore associated gas in the play. The Haynesville dry gas play has experienced a decline in its rig count, too, but its 25% reduction since the start of 2020 puts it in a much stronger position relative to the average 50% drop in rigs in associated gas plays.

“Production actually has been very steady and actually even grew after the COVID-19 price oil collapse,” Jack Winters, energy analyst for S&P Global Platts Analytics, said on the webinar. Unlike the Permian, however, the play is still susceptible to infrastructure constraints. “We will need to see a strong rig increase in the basin, as well as some infrastructure projects. Production takeaway capacity out of Haynesville currently is not constrained, but it is getting close to capacity as far as the key corridors to get gas out of the Haynesville and to the demand centers along the Gulf.”

Weak Prices

In mid-November 2018, the Henry Hub price crested at $4.84/MMBtu, well above the five-year average at that time of about $3/MMBtu. The cause was tight inventories, which at the time were 15.3% below the five-year average. By comparison, the U.S. Energy Information Administration’s (EIA) storage report for the week ending May 22 showed a 42.4% increase over the same period in 2019 and 19.3% above the five-year average.

The Henry Hub price has been below its five-year average for the last year but mostly because it has experienced infrastructure constraints, particularly in the Permian Basin and in Appalachia. No longer.

“Despite the recent regulatory setbacks to the Permian Highway projects, the future continues to be bullish as production drops in the Permian,” Chowdhury said.

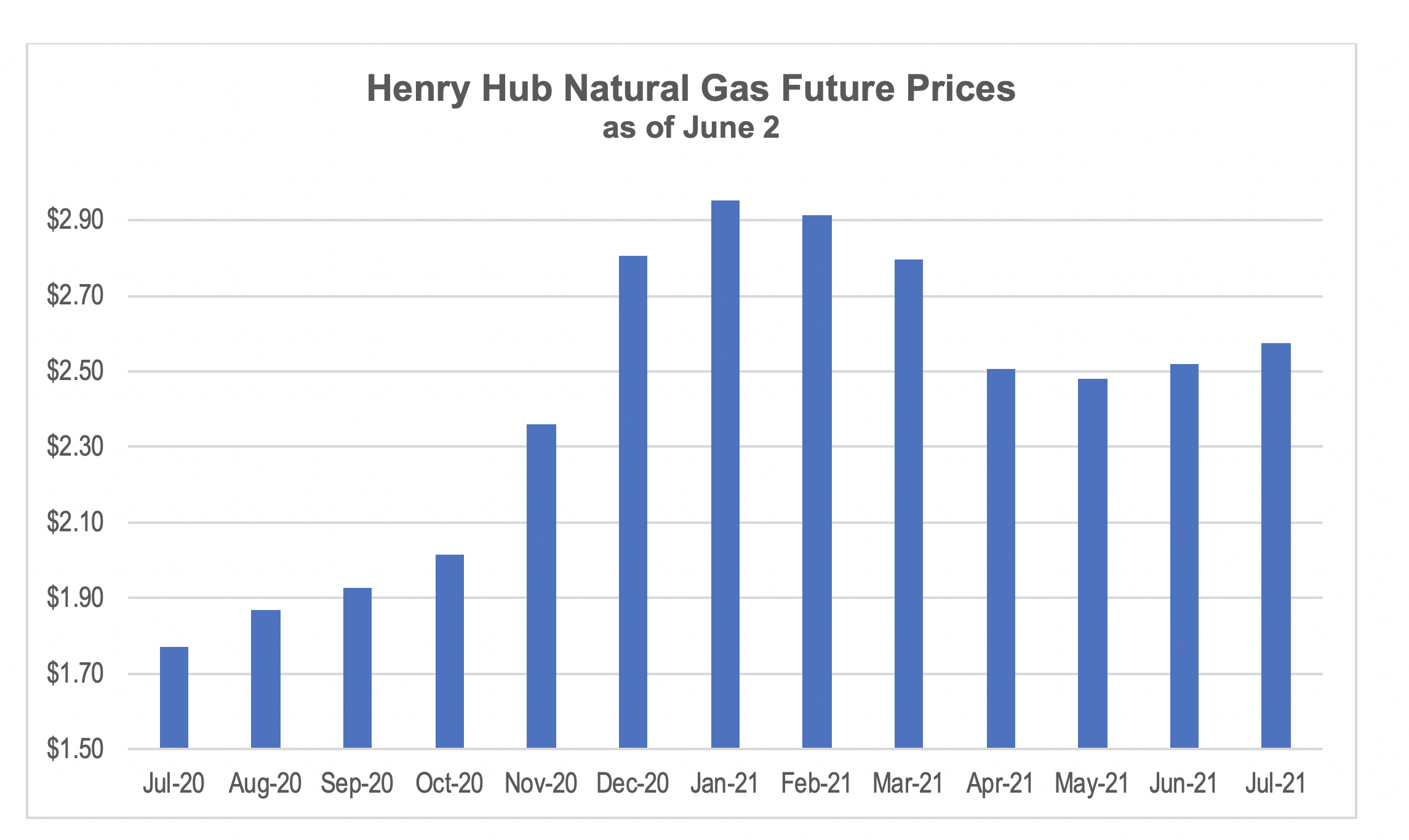

(Source: Globex)

The bullishness is reflected by traders on NYMEX. On June 2, the Henry Hub price of natural gas for January 2021 delivery was $2.95/MMBtu. While that is the peak of winter, the July 2021 futures price on June 2 was $2.58/MMBtu, compared to the near-month July 2020 price of $1.77/MMBtu.

‘Not as Bullish’

But the bullishness is also predicated on the rig count, which has steadily declined since the start of 2019 and tumbled by more than 50% this year in the Permian and 70% in the Eagle Ford, SCOOP/STACK and Denver-Julesberg plays. It is also tied to the assumption that low oil prices will persist, keeping crude production and therefore associated gas production low.

John Jacobi, non-executive director at Comstock Resources, isn’t convinced.

“I’m a little mixed on what a prognosticator of a commodity thinks the price is going to be,” he told Hart Energy’s Jessica Morales during a recent video interview.

“I think as oil begins to reach a plateau at least and oil producers think they now can breathe a little easier and make money, I’m not sure they’re going to be disciplined to not continue to produce their oil,” he said. “So with that will come more associated gas, so I’m not as bullish.”

The commodity price will take care of itself, he said, unless oil producers ramp up without heeding demand and markets, allowing associated gas output to spike and gluts to reappear.

Ironically, one of the industry’s bugaboos—the tendency to overbuild infrastructure—could be seen as a positive sign. Two gas pipelines that are scheduled to enter service in 2021, Kinder Morgan Inc.’s Permian Highway and the JV Whistler Pipeline, could well be underutilized, at least to start.

“That production story, which was bearish, is bullish right now,” Chowdhury said. “That is expected to upgrade Waha prices because we are seeing the forwards for Q1 right now pricing higher and moving up.”

Recommended Reading

Brett: Oil M&A Outlook is Strong, Even With Bifurcation in Valuations

2024-04-18 - Valuations across major basins are experiencing a very divergent bifurcation as value rushes back toward high-quality undeveloped properties.

Marketed: BKV Chelsea 214 Well Package in Marcellus Shale

2024-04-18 - BKV Chelsea has retained EnergyNet for the sale of a 214 non-operated well package in Bradford, Lycoming, Sullivan, Susquehanna, Tioga and Wyoming counties, Pennsylvania.

Defeating the ‘Four Horseman’ of Flow Assurance

2024-04-18 - Service companies combine processes and techniques to mitigate the impact of paraffin, asphaltenes, hydrates and scale on production — and keep the cash flowing.

Santos’ Pikka Phase 1 in Alaska to Deliver First Oil by 2026

2024-04-18 - Australia's Santos expects first oil to flow from the 80,000 bbl/d Pikka Phase 1 project in Alaska by 2026, diversifying Santos' portfolio and reducing geographic concentration risk.

Ozark Gas Transmission’s Pipeline Supply Access Project in Service

2024-04-18 - Black Bear Transmission’s subsidiary Ozark Gas Transmission placed its supply access project in service on April 8, providing increased gas supply reliability for Ozark shippers.