As gas plays go, the Haynesville has long played second fiddle to the Marcellus; the latter has historically yielded larger wells and contributed more to U.S. gas supply.

Learn more about Hart Energy Conferences

Get our latest conference schedules, updates and insights straight to your inbox.

Editor's note: this story was originally published in the November/December 2017 edition of Midstream Business magazine.

As gas plays go, the Haynesville has long played second fiddle to the Marcellus; the latter has historically yielded larger wells and contributed more to U.S. gas supply.

This, in addition to gas ventures generally falling out of favor with public operators during the past five years, has placed the Haynesville squarely in a bucket of perceived Tier II opportunities.

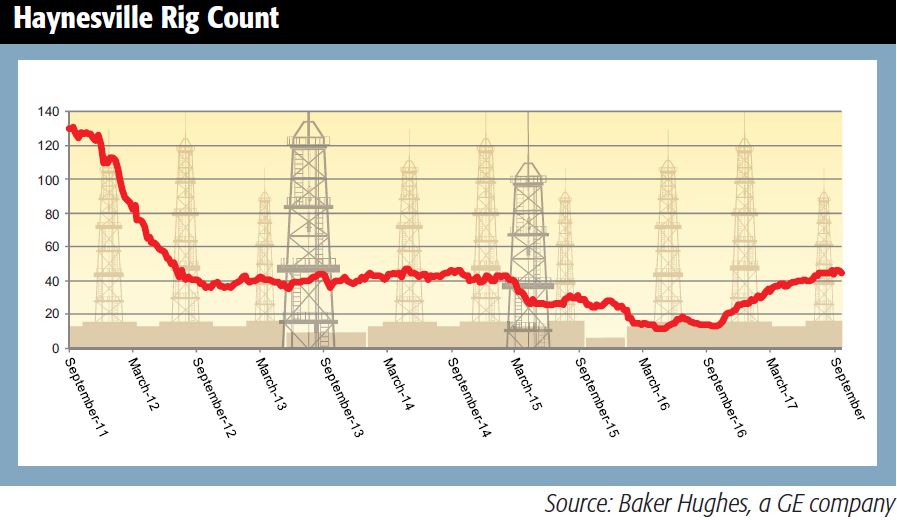

But as 2017 began, the Haynesville was quietly clawing its way back as its rig count suddenly topped 20. This was an 80% increase from lows and a stark contrast to trends across other gas plays that struggled to rebound amid stagnating prices. Rigs in the play have since doubled again to 44, virtually equal to the 45 currently operating in the Marcellus.

Improving economics

All of this occurred during a 12-month period when the Henry Hub gas price hovered near $3 per thousand cubic feet, demonstrating that wellhead economics have continued to improve across the ArkLaTex Basin’s premier shale play.

But will this resurgence last?

Much of the progress in the Haynesville since 2014 has been driven by private-equity-backed operators. This matters because their development schedules are likely to change upon their next financing event. Multiple companies already have filed S-1 documents to qualify for an IPO. If they indeed go public, which now seems likely, it could mean a piece of the ramp-up in activity was in large part to set the stage for public sale by proving their competencies and showing the ability to aggressively grow organically.

The Haynesville’s inherent qualities are sufficiently attractive to sustain current rig activity in the near term. In fact, production in the play is expected to top its 2011 peak of 7.16 billion cubic feet equivalent per day next year, making it the first U.S. unconventional play to roll over in earnest and then peak again years later.

Infrastructure and more

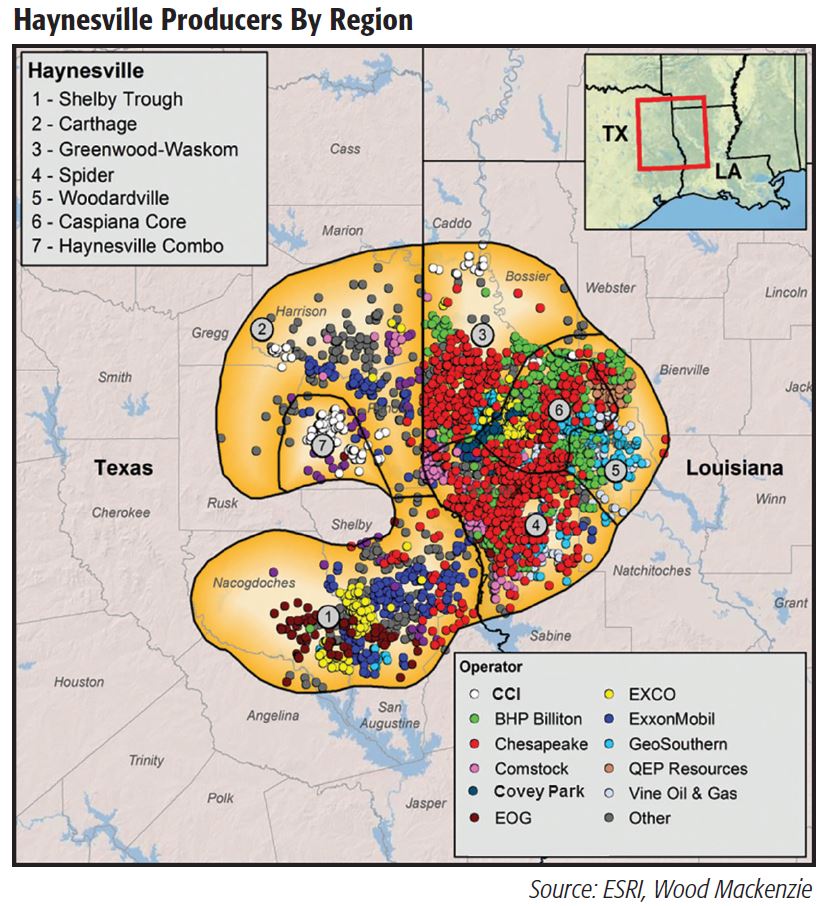

This is attributable to its sizeable resource base, proximity to Gulf Coast markets, ample infrastructure, rising regional industrial and power demand, and relative safety compared to rival Northeast plays that have grappled with challenges in takeaway capacity. Moreover, as Permian acreage continues to price many out of the basin, operators with a bent toward natural gas may actively seek quality Tier II opportunities in which to allocate capital, placing the Haynesville in the spotlight.

Ultimately, however, the play faces some market headwinds as an onslaught of new pipeline capacity is set to come online in the Northeast through 2019, improving netbacks in the Marcellus.

Further, enduring efficiency improvements are the Haynesville’s best shot at keeping pace with the Marcellus over the long term. The current season of well design experimentation now taking place across the Haynesville suggests technology can, in fact, drive the required progress. If service costs can be managed and midstream liabilities contained, wellhead breakevens may fall by another $0.15/Mcf.

Taken from a Wood Mackenzie play report.

Recommended Reading

Aramco Reports Second Highest Net Income for 2023

2024-03-15 - The year-on-year decline was due to lower crude oil prices and volumes sold and lower refining and chemicals margins.

Thanks to New Technologies Group, CNX Records 16th Consecutive Quarter of FCF

2024-01-26 - Despite exiting Adams Fork Project, CNX Resources expects 2024 to yield even greater cash flow.

Cheniere Energy Declares Quarterly Cash Dividend, Distribution

2024-01-26 - Cheniere’s quarterly cash dividend is payable on Feb. 23 to shareholders of record by Feb. 6.

Marathon Petroleum Sets 2024 Capex at $1.25 Billion

2024-01-30 - Marathon Petroleum Corp. eyes standalone capex at $1.25 billion in 2024, down 10% compared to $1.4 billion in 2023 as it focuses on cost reduction and margin enhancement projects.

Humble Midstream II, Quantum Capital Form Partnership for Infrastructure Projects

2024-01-30 - Humble Midstream II Partners and Quantum Capital Group’s partnership will promote a focus on energy transition infrastructure.