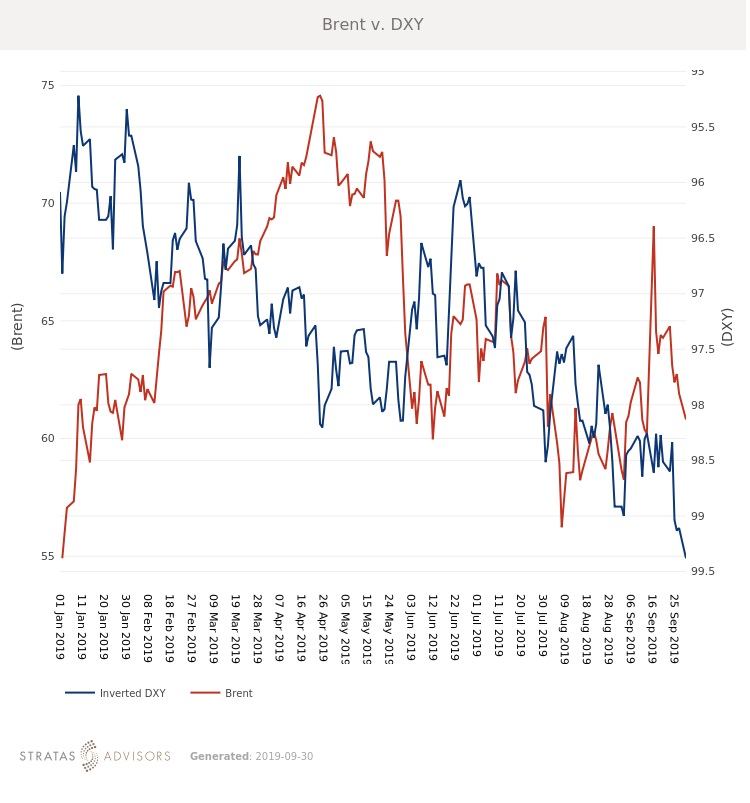

Brent fell $2.19/bbl last week to average $62.98/bbl. WTI fell $2.37/bbl to average $56.95/bbl. Brent is now only $1.69/bbl above pre-Saudi attack levels and will continue to fall until reaching pre-crisis levels. The question then becomes whether or not negative momentum carries prices even farther down. For the week ahead, Stratas Advisors expect Brent to average $60.50/bbl.

A raft of European economic data is due out this week, including unemployment, consumer prices and retail sales from Germany. As the engine of growth in the EU lately, any slowdown in German data bodes poorly for the rest of the region. Disappointing numbers out of Germany could reignite fears about demand and push crude even lower.

The biggest threat to demand continues to be the U.S.-China trade war. Almost lost in the noise about the attack on Saudi Arabia and impeachment in the U.S. have been updates on trade discussions. Preliminary discussions between delegations from each nation appear to have gone well. China’s Vice-Commerce Minister, Wang Shouwen, announced that Beijing will send Vice-Premier Liu He to lead negotiations in early October. By sending such a high-ranking official, Chinese leadership is signaling confidence in the direction of discussions. However, the next week could be tricky as China prepares to celebrate the 70th anniversary of the founding of the People’s Republic of China. Leadership will celebrate with military parades and a series of speeches touting the nation’s success. While no dramatic pronouncements are expected, any statements seen as too inflammatory or derogatory to U.S. power could sour attitudes in the White House.

Geopolitical Unrest – Positive

Global Economy – Negative

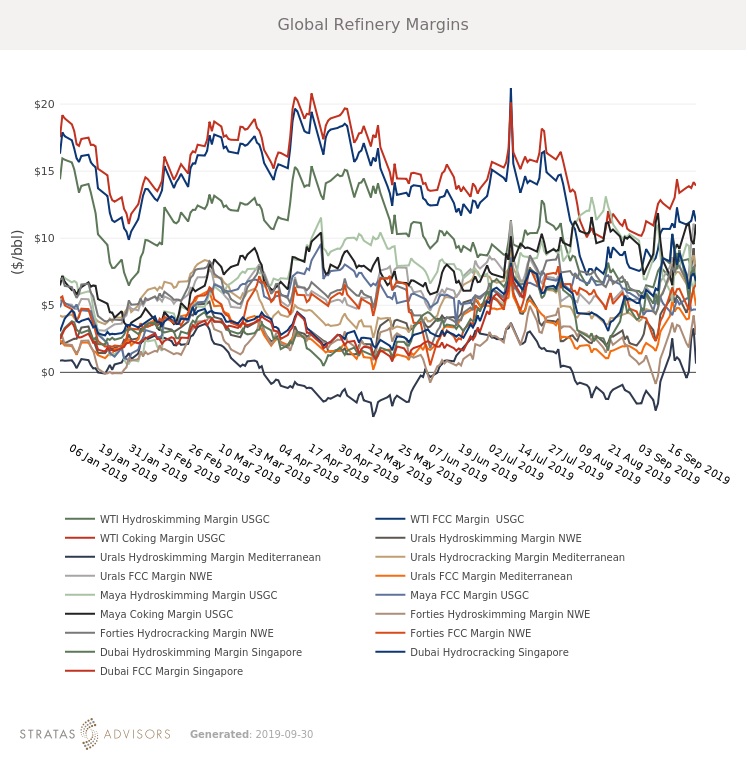

Oil Supply – Negative

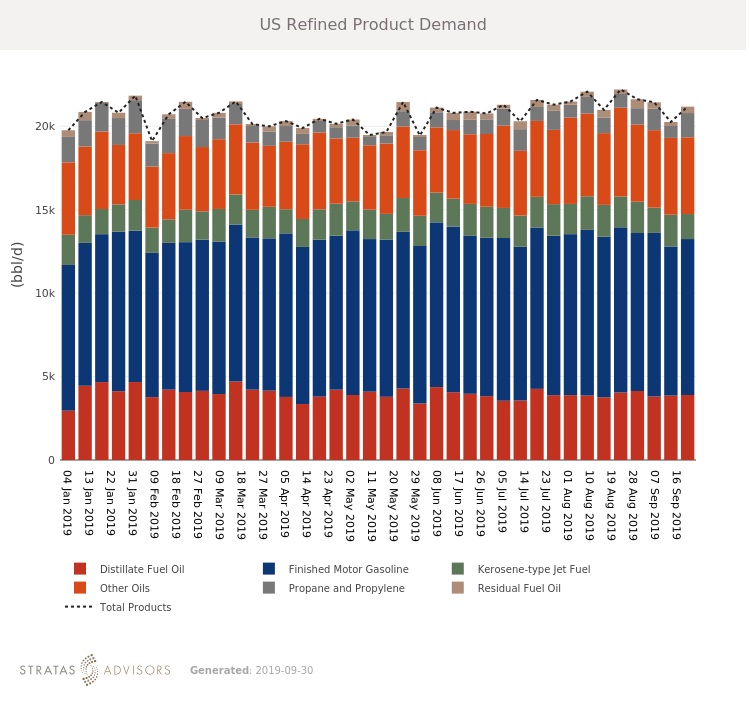

Oil Demand – Neutral

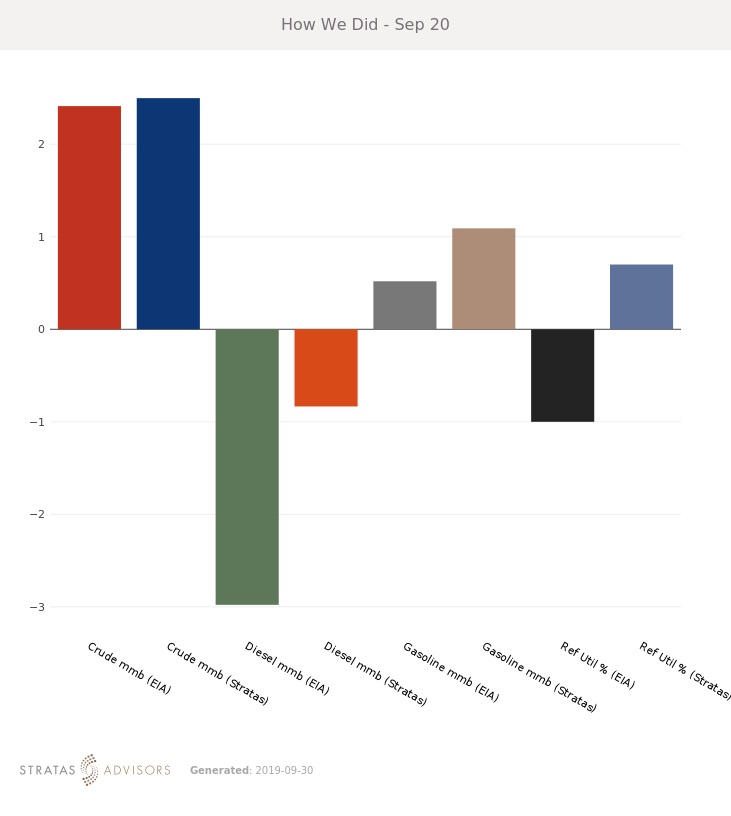

How We Did

Recommended Reading

Baker Hughes Awarded Saudi Pipeline Technology Contract

2024-04-23 - Baker Hughes will supply centrifugal compressors for Saudi Arabia’s new pipeline system, which aims to increase gas distribution across the kingdom and reduce carbon emissions

Air Products Sees $15B Hydrogen, Energy Transition Project Backlog

2024-02-07 - Pennsylvania-headquartered Air Products has eight hydrogen projects underway and is targeting an IRR of more than 10%.

Air Liquide Eyes More Investments as Backlog Grows to $4.8B

2024-02-22 - Air Liquide reported a net profit of €3.08 billion ($US3.33 billion) for 2023, up more than 11% compared to 2022.

From Restructuring to Reinvention, Weatherford Upbeat on Upcycle

2024-02-11 - Weatherford CEO Girish Saligram charts course for growth as the company looks to enter the third year of what appears to be a long upcycle.

TechnipFMC Eyes $30B in Subsea Orders by 2025

2024-02-23 - TechnipFMC is capitalizing on an industry shift in spending to offshore projects from land projects.