Learn more about Hart Energy Conferences

Get our latest conference schedules, updates and insights straight to your inbox.

Stratas Advisors expects Brent to average $64/bbl this week and for WTI to average closer to $58/bbl, but these prices are subject to a broad band of possibilities based on damage assessments and political developments. The most important factor to note will be higher strength on international markers, particularly Brent and Dubai, and a wider spread between Brent and WTI.

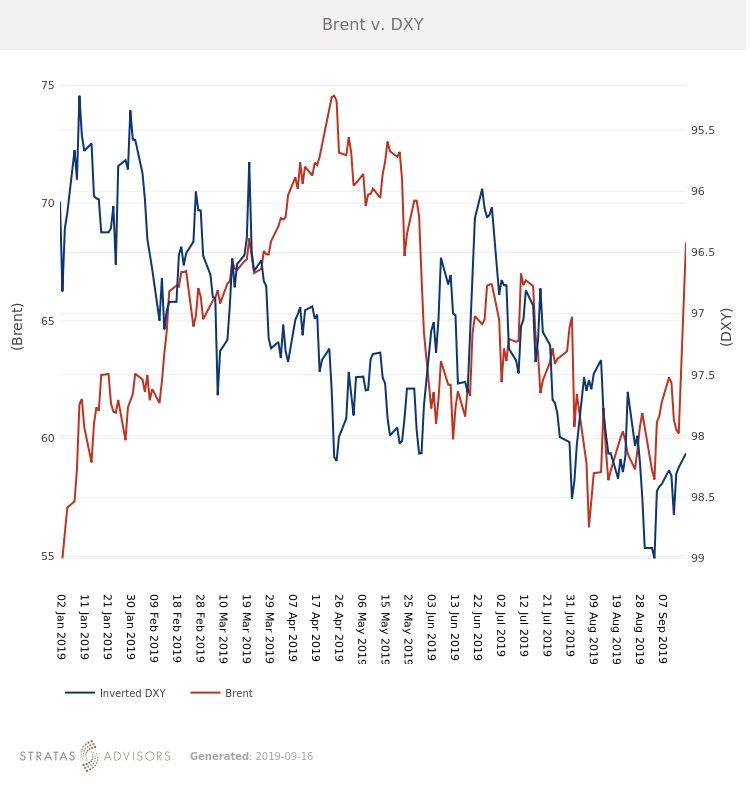

Brent and WTI both increased last week, although Brent saw more support. Brent increased $1.25/bbl to average $61.28/bbl. WTI increased $0.43/bbl to average $56.19/bbl. As expected, Brent lost momentum at the end of the week. The International Energy Agency’s latest Oil Market Report revealed their expectation that rebalancing would need to continue through 2020 based on current stock levels and lackluster demand growth. Reports that President Trump was considering a sit-down meeting with Iran’s President Rouhani pushed down prices at the end of the week on fears of higher supply.

But that all changed over the weekend, when a coordinated aerial drone strike on Saudi Arabia’s Abqaiq processing facility and the Khurais oil field removed 5.7 MMb/d of oil production from global markets. Prices swiftly rose in Monday morning, and as of this writing are $5.21/bbl (Brent) and $4.59/bbl (WTI) above their Friday close. Dubai is also up $5.23/bbl. Gains have moderated from their initial opening levels and could back off slightly more as Asian refiners and governments release data about crude and product storage levels in an effort to reassure markets.

Until Saudi Aramco releases a more complete damage assessment, prices will maintain significant strength. Although Saudi Aramco can maintain exports for at least a week with current stocks, traders are already sourcing oil products to meet demand. In Asia, advantageous stock-building during the period of low prices has helped grow inventories, but with little visibility into current stock levels these inventories do not do much to reassure markets. South Korea’s government has joined the United States in standing ready to release Strategic Petroleum Reserves if needed, and the IEA is presumably studying whether a coordinated global release will be necessary. A coordinated global release was last seen at the advent of the Libyan Civil War.

Until a damage assessment is released, prices $3-5 higher than their recent norms are expected. If the damage assessment indicates that even half of the affected output will be offline for a significant period of time, then price gains could increase and remain in place for a prolonged period. Saudi Arabia has not yet officially linked the attack to Iran, and Houthi rebels have taken responsibility but the investigation of exactly where the attack originated is still ongoing. The possibility of follow-on attacks and retaliatory actions are both high and will also dictate pricing direction. Stratas Advisors will be releasing further analysis on the situation to our clients throughout the week and will also release a special Friday edition of What’s Affecting Oil Prices to review the week’s events.

Geopolitical Unrest – Positive

Global Economy – Negative

Oil Supply – Positive

Oil Demand – Neutral

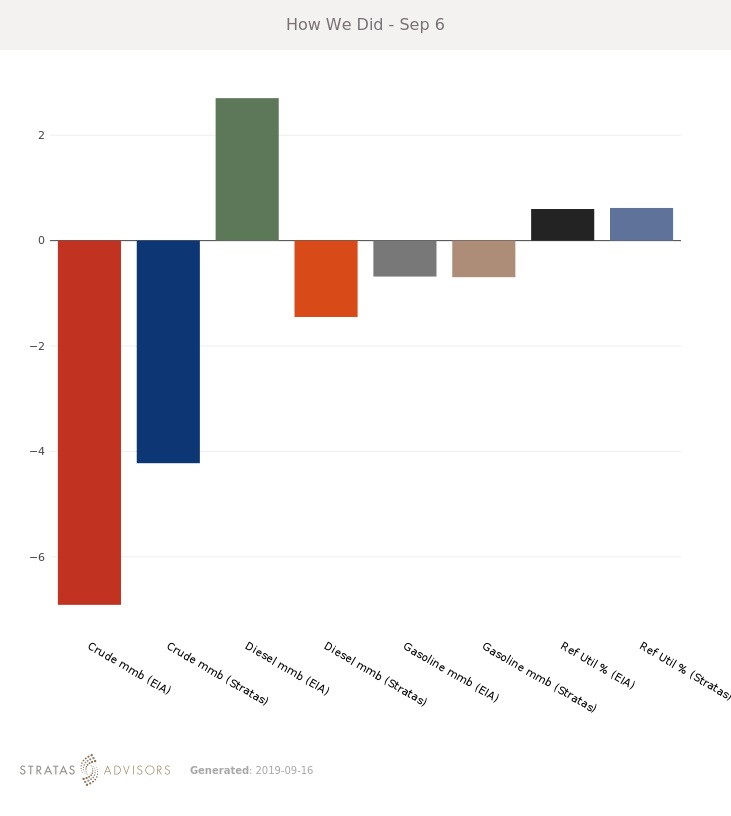

How We Did

Recommended Reading

US Drillers Add Oil, Gas Rigs for Second Week in a Row

2024-01-26 - The oil and gas rig count, an early indicator of future output, rose by one to 621 in the week to Jan. 26.

Second Light Oil Discovery in Mopane-1X Well

2024-01-26 - Galp Energia's Avo-2 target in the Mopane-1X well offshore Namibia delivers second significant column of light oil.

CNOOC Sets Increased 2024-2026 Production Targets

2024-01-25 - CNOOC Ltd. plans on $17.5B capex in 2024, with 63% of that dedicated to project development.

E&P Highlights: Jan. 29, 2024

2024-01-29 - Here’s a roundup of the latest E&P headlines, including activity at the Ichthys Field offshore Australia and new contract awards.

Seadrill Awarded $97.5 Million in Drillship Contracts

2024-01-30 - Seadrill will also resume management services for its West Auriga drillship earlier than anticipated.