Among the emerging positive factors for oil prices are signs that the latest wave of COVID-19 is rolling over, according to Stratas Advisors in its latest oil price forecast. (Source: Shutterstock.com)

[Editor’s note: This report is an excerpt from the Stratas Advisors weekly Short-Term Outlook service analysis, which covers a period of eight quarters and provides monthly forecasts for crude oil, natural gas, NGL, refined products, base petrochemicals and biofuels.]

The price of Brent crude ended the week at $72.48 after closing the previous week at $71.67. The price of WTI crude ended the week at $69.10 after closing the previous week at $68.67.

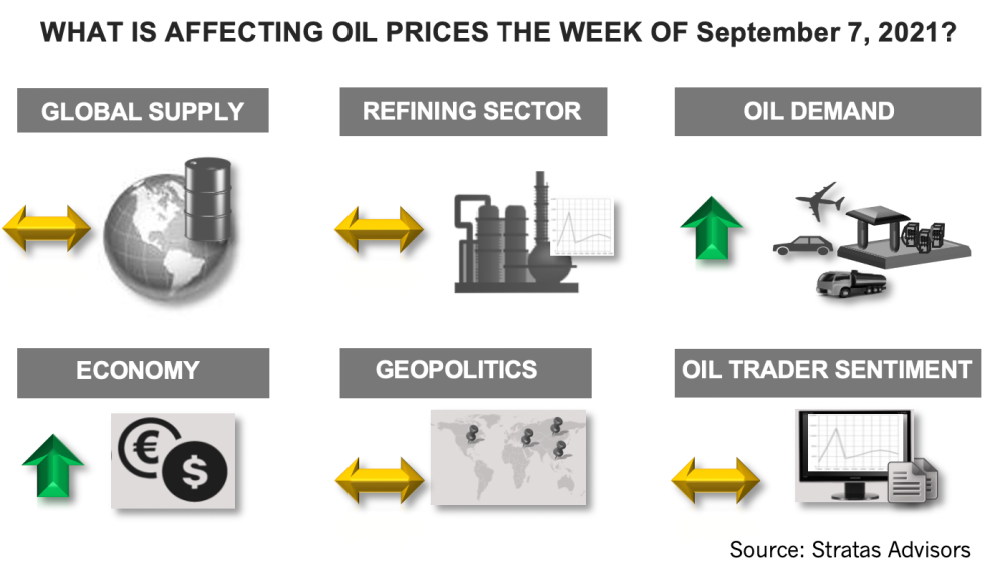

While there remains plenty of uncertainty, there are some emerging positive factors for oil prices.

- It has been our view all year (and a contrarian view for the last several months) that the Federal Reserve will maintain its accommodating policies with no changes. We maintained the view before the recent speech given by the chairman of the Federal Reserve, and afterward. And it is still our view in the aftermath of the recent jobs report (the number of nonfarm jobs in August only increased by 235,000, while expectations were for more than 700,000 jobs being added) that the Federal Reserve will maintain its accommodating monetary policies through the rest of the year, given that the risks associated with moving away from the accommodating policies is not worth the benefits. Some good news is that wages increase by 4.3% on a year-on-year basis, which is positive for future demand, and possibly an indication that once the additional unemployment benefits disappear in September more workers will rejoin the labor force.

- We also see other regions continue to provide support for economic growth. The central bank of European Union, ECB, is facing similar dilemma of the U.S. Federal Reserve, with inflation reaching 3%, which is the highest level in 10 years, while the economy is slowing down, as indicated by forward-looking indicators declining in August. There has been talk of the ECB deciding to reduce its asset purchasing program at its next policy meeting to be held this week on Sept. 9. However, we think the ECB will maintain the program without change. China is also providing additional support for its economy, include support for small businesses, in response to economic growth slowing down.

- There continue to be signs that the latest wave of COVID-19 is rolling over. From a global standpoint, cases over the last 14 days declining by 7% and deaths are declining over the last 14 days by 4%. Cases are now declining in the Middle East, Latin America, Africa and Asia. Cases in Europe are moving sideways. Meanwhile, the situation in the U.S., which currently is the center of COVID-19, is continuing to show signs of plateauing. The average number of cases have reached 160,901, but the rate of increase has fallen to 7% (compared to 20% for the previous week). The same goes for hospitalization, which has reached 102,285 with the rate of increase falling to 12% (compared to 25% for the previous week). The number of daily deaths is now averaging 1,544 and has increased by 53% in the last 14 days. The number of deaths is on-track to approach 1,800—about half of the peak in January. The good news is that with the slowdown in the rate of increase, the number of hospitalizations is now likely to stay below the level of January when hospitalizations were around 135,000.

These factors (if the current trends hold) reinforce our expectations that demand will continue to outpace supply, and that the oil prices have a good chance of drifting upwards—and that the price of Brent will average around $76 in the fourth quarter of this year and that the price of WTI will average around $72—as we forecasted back in the first half of this year.

About the Author:

John E. Paise, president of Stratas Advisors, is responsible for managing the research and consulting business worldwide. Prior to joining Stratas Advisors, Paisie was a partner with PFC Energy, a strategic consultancy based in Washington, D.C., where he led a global practice focused on helping clients (including IOCs, NOC, independent oil companies and governments) to understand the future market environment and competitive landscape, set an appropriate strategic direction and implement strategic initiatives. He worked more than eight years with IBM Consulting (formerly PriceWaterhouseCoopers, PwC Consulting) as an associate partner in the strategic change practice focused on the energy sector while residing in Houston, Singapore, Beijing and London.

Recommended Reading

Texas LNG Export Plant Signs Additional Offtake Deal With EQT

2024-04-23 - Glenfarne Group LLC's proposed Texas LNG export plant in Brownsville has signed an additional tolling agreement with EQT Corp. to provide natural gas liquefaction services of an additional 1.5 mtpa over 20 years.

US Refiners to Face Tighter Heavy Spreads this Summer TPH

2024-04-22 - Tudor, Pickering, Holt and Co. (TPH) expects fairly tight heavy crude discounts in the U.S. this summer and beyond owing to lower imports of Canadian, Mexican and Venezuelan crudes.

What's Affecting Oil Prices This Week? (April 22, 2024)

2024-04-22 - Stratas Advisors predict that despite geopolitical tensions, the oil supply will not be disrupted, even with the U.S. House of Representatives inserting sanctions on Iran’s oil exports.

Association: Monthly Texas Upstream Jobs Show Most Growth in Decade

2024-04-22 - Since the COVID-19 pandemic, the oil and gas industry has added 39,500 upstream jobs in Texas, with take home pay averaging $124,000 in 2023.

Shipping Industry Urges UN to Protect Vessels After Iran Seizure

2024-04-19 - Merchant ships and seafarers are increasingly in peril at sea as attacks escalate in the Middle East.