(Source: Shutterstock.com; image of masked travelers at airport courtesy of B.Zhou / Shutterstock.com)

[Editor’s note: This report is an excerpt from the Stratas Advisors weekly Short-Term Outlook service analysis, which covers a period of eight quarters and provides monthly forecasts for crude oil, natural gas, NGL, refined products, base petrochemicals and biofuels.]

The world still needs to navigate through a full winter under a COVID-19 environment. Therefore, the upcoming cold weather could open the door to a substantial uptick in COVID-19 cases, which has the potential to derail oil consumption. As incredible as it seems, the worst might be yet to come in this historic 2020. However, for all the concerns, the upcoming fourth quarter might also see solutions for the pandemic that will create the basis for more favorable market conditions in the following quarters.

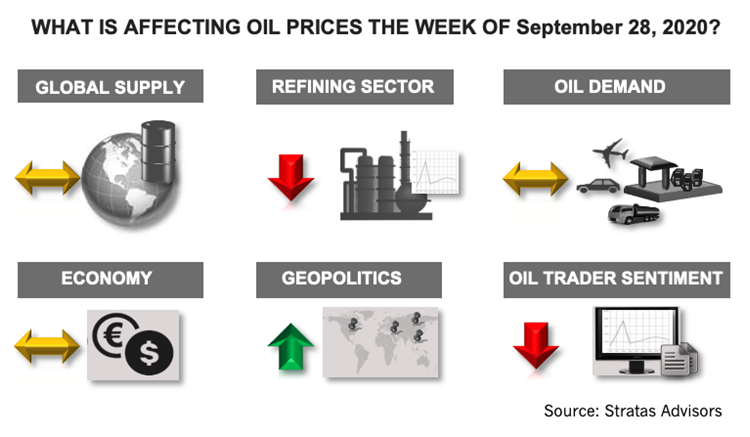

Global Supply—Neutral

Global crude production saw bearish news with the news that Libya could add around 160,000 bbl/d to oil markets this week—and with the potential for significantly more production in the future.

For the upcoming week we see this variable to have a neutral impact on oil prices.

Geopolitics—Positive

It was a hectic UN assembly this week, with the U.S. placing blame on China for the pandemic, and China’s reaction to such statements. This is only the tip of the iceberg on what could be plenty of geopolitical activity over the next few weeks in the run up to the U.S. presidential election.

We see this variable as positive for crude prices.

Economy—Neutral

Ongoing concerns of the pandemic in Europe, and the apparent slowdown of the recovery in the U.S. are being reflected by the downturn in the equity markets seen in the previous weeks. These concerns have been further reinforced by the lack of any new financial or fiscal incentives announced over the last few days.

For this week we expect this variable to have a neutral impact on oil prices.

Oil Demand—Neutral

Oil consumption bodes ill for Spain, France, Italy and other European countries that see their number of infections soaring over the last 10 days. However, the two largest demand markets—U.S. and China—are showing resiliency. China’s consumption has resumed to a relative normalcy for a few months now. The most recent data for the US indicates that the U.S. demand is approaching 5-year normal levels for this time of the year.

For this upcoming week, we expect demand to have a neutral contribution to oil prices.

Refining sector—Negative

Brent prices adjusted upward by around 4.5% last week, after the short-lived profit taking rally. Due to the crude price correction refinery margins declined yet again and simple refiners are showing negative margins, which has been the case since the beginning of the pandemic.

As such, we see a negative contribution of the refining sector.

Oil Trader Sentiment—Negative

Participation in the crude contract was reduced by -5%, whereas open interest for futures contracts and options in clean products declined by -3% (RBOB) and -2% (USLD). It is not common to see a decline for all these different contracts, as usually one them is adjusted down at the expense of the other—and is a sign of the collective wariness of the trading community.

We see this variable as negative for crude prices this week.

About the Author:

Jaime Brito is vice president at Stratas Advisors with over 24 years of experience on refining economics and market strategies for the oil industry. He is responsible for managing the refining and crude-related services, as well as completing consulting.

Recommended Reading

Well Logging Could Get a Makeover

2024-02-27 - Aramco’s KASHF robot, expected to deploy in 2025, will be able to operate in both vertical and horizontal segments of wellbores.

Tech Trends: SLB's Autonomous Tech Used for Drilling Operations

2024-02-06 - SLB says autonomous drilling operations increased ROP at a deepwater field offshore Brazil by 60% over the course of a five-well program.

E&P Highlights: March 15, 2024

2024-03-15 - Here’s a roundup of the latest E&P headlines, including a new discovery and offshore contract awards.

ShearFRAC, Drill2Frac, Corva Collaborating on Fracs

2024-03-05 - Collaboration aims to standardize decision-making for frac operations.

E&P Highlights: March 4, 2024

2024-03-04 - Here’s a roundup of the latest E&P headlines, including a reserves update and new contract awards.