While there is increasing noise about oil prices going to $90 and higher, at this time, Statas Advisors is still holding to the view that there will be factors that will put downward pressure on oil prices, the firm said in its latest forecast. (Source: Shutterstock.com)

[Editor’s note: This report is an excerpt from the Stratas Advisors weekly Short-Term Outlook service analysis, which covers a period of eight quarters and provides monthly forecasts for crude oil, natural gas, NGL, refined products, base petrochemicals and biofuels.]

The price of Brent crude ended the week at $77.20 after closing the previous week at $75.49—with the price rebounding after falling to $73.92 on Sept. 27. The price of WTI followed a similar path ending the week at $73.95 after closing the previous week at $71.97.

The price of Brent crude and WTI crude are now both higher than our forecast from early July of this year, which includes a fourth-quarter average price of $76 for Brent and $72 for WTI. Furthermore, prices are approaching levels not seen since September 2018, when the price of Brent reached $82.73 (before quickly falling to $53.80 by Dec. 1, 2018).

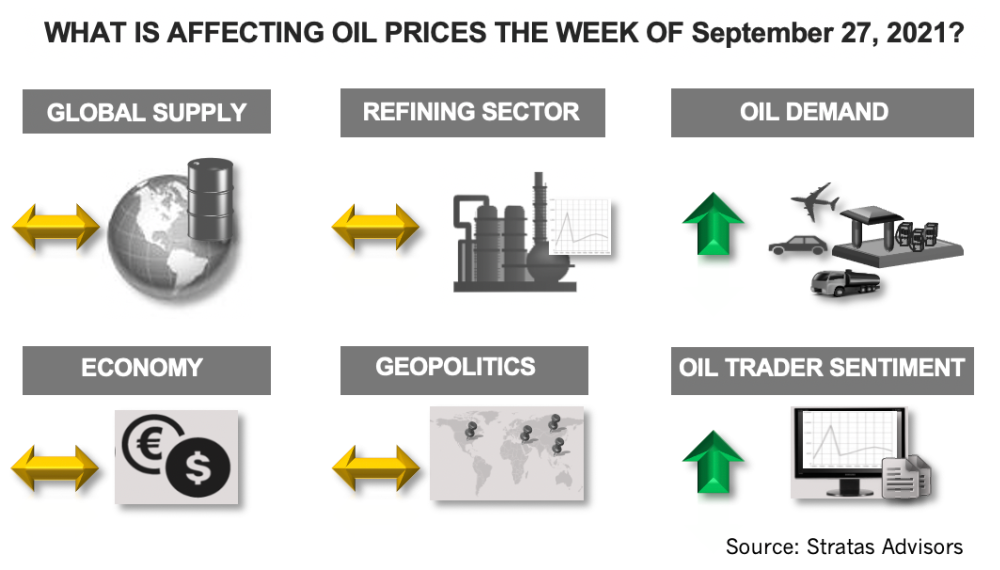

For the upcoming week, we think it is likely that prices will continue to move upwards, in part, because the sentiment of traders (especially with respect to Brent crude) is becoming more bullish—as long as there are no unexpected developments. Currently, the biggest risk is associated with U.S. debt ceiling, which needs to be increased by Oct. 1 or there will be a shutdown of the U.S. federal government. It has been estimated that the U.S. Treasury will run out of funds to pay bills sometime between Oct. 15 and Nov. 4. Another risk, but to a lesser extent, is associated with China and the situation involving Evergrande, the second-largest Chinese property developer. While the Chinese government likely want to insert more discipline into the debt markets, the Chinese leadership does not want to disrupt the overall economy, which is still overly dependent on capital formation (represents more than 40% of China’s GDP in comparison to about 20% for the U.S. economy) of which the housing market represents a significant portion of the investments. As such, we are expecting that China will resolve the issue without disrupting the housing market or the overall economy.

While there is increasing noise about oil prices going to $90 and higher, at this time, we are still holding to our view that there will be factors that will put downward pressure on oil prices. There remain uncertainties about the ongoing recovery in the global economy—and the growth in oil demand. And while the latest wave of COVID-19 is waning, the northern hemisphere needs to get past the upcoming winter months. From a supply perspective, the biggest factor remains the response from OPEC+ to increasing oil prices. While the OPEC+ members are no longer that concerned about high prices resulting in an outsized increase in shale-related activity in the U.S., some OPEC+ members are still concerned about the impact of high oil prices on the recovery of the global economy and the pushback from major consuming countries. With the recovery in oil prices, OPEC+ members are now more likely to be thinking about the longer-term stability of the oil market.

About the Author:

John E. Paise, president of Stratas Advisors, is responsible for managing the research and consulting business worldwide. Prior to joining Stratas Advisors, Paisie was a partner with PFC Energy, a strategic consultancy based in Washington, D.C., where he led a global practice focused on helping clients (including IOCs, NOC, independent oil companies and governments) to understand the future market environment and competitive landscape, set an appropriate strategic direction and implement strategic initiatives. He worked more than eight years with IBM Consulting (formerly PriceWaterhouseCoopers, PwC Consulting) as an associate partner in the strategic change practice focused on the energy sector while residing in Houston, Singapore, Beijing and London.

Recommended Reading

US Refiners to Face Tighter Heavy Spreads this Summer TPH

2024-04-22 - Tudor, Pickering, Holt and Co. (TPH) expects fairly tight heavy crude discounts in the U.S. this summer and beyond owing to lower imports of Canadian, Mexican and Venezuelan crudes.

US Gulf Coast Heavy Crude Oil Prices Firm as Supplies Tighten

2024-04-10 - Pushing up heavy crude prices are falling oil exports from Mexico, the potential for resumption of sanctions on Venezuelan crude, the imminent startup of a Canadian pipeline and continued output cuts by OPEC+.

Paisie: Economics Edge Out Geopolitics

2024-02-01 - Weakening economic outlooks overpower geopolitical risks in oil pricing.

Oil Broadly Steady After Surprise US Crude Stock Drop

2024-03-21 - Stockpiles unexpectedly declined by 2 MMbbl to 445 MMbbl in the week ended March 15, as exports rose and refiners continued to increase activity.

US Oil Stockpiles Surge as Prices Dip, Production Remains Elevated

2024-02-14 - EIA reported crude oil stocks increased by 12.8 MMbbl as February began, far outstripping expectations.