(Image of OPEC Secretary-General Mohammad Barkindo courtesy of Prometheus72 / Shutterstock.com; OPEC headquarters by Sodel Vladyslav / Shutterstock.com)

[Editor’s note: This report is an excerpt from the Stratas Advisors weekly Short-Term Outlook service analysis, which covers a period of eight quarters and provides monthly forecasts for crude oil, natural gas, NGL, refined products, base petrochemicals and biofuels.]

Stratas Advisors provided a forecast in early April for 2020 global demand anticipating it would be reduced by 8.5 million bbl/d because of the pandemic, while the rest of the available public forecasts were much more optimistic. The latest International Energy Agency and OPEC forecasts have converged now toward our view, and highlights the potential need for additional cuts in early 2021—especially if the winter-season experiences an uptick of both influenza and COVID-19 cases, which would wreak additional havoc on global demand.

RELATED:

Saudi Arabia Chafes at ‘False Promises’ on Oil Cuts from OPEC Partners

IEA: Except for China, Oil Demand Recovery Slow for Rest of 2020

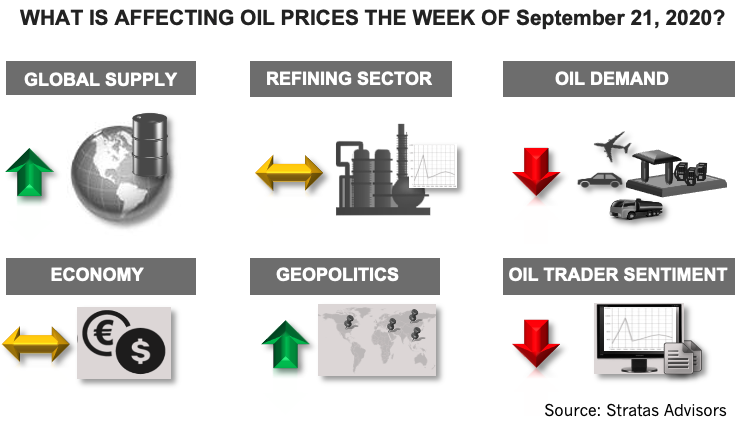

Global Supply—Positive

The U.S. Energy Information Administration reported a crude supply uptick of 900,000 bbl/d, which along with the prior week’s increase, brings U.S. crude production up by 1.2 million bbl/d.

Stability and equilibrium for U.S. crude producers is a relevant indicator for the global upstream industry, as it provides a glimpse of how conventional might need to react in response to weakening demand.

In light of the stability of supply, for the upcoming week we see crude supply as a positive variable.

Geopolitics—Positive

Evidence of additional gasoline being shipped from Iran and to Venezuela is likely to spark a strong reaction from the U.S. government. Three ships are allegedly in transit to Venezuela despite the latest rounds of U.S. sanctions.

The above development adds to the ongoing geopolitical issues including the China-India border conflicts, and the ongoing U.S.-China trade feud, and which have the potential to provide support for crude prices.

Economy—Neutral

Outside of the US other major economies continue to monitor the effectiveness of their respective incentive programs in the context infection surges being seen numerous countries—including Spain, France, the U.K., Indonesia, and India.

From the point of view that there are no major new policy initiatives being implemented, we expect this variable to be neutral for the upcoming week.

Oil Demand—Negative

U.S. diesel consumption has continuously plummeted since August and it is now almost 30% lower than a month ago, after showcasing a resiliency since the beginning of the pandemic.

Therefore, we expect oil demand to be a negative variable for crude prices this week.

Refining Sector—Neutral

Refining margins increased worldwide thanks to a downward correction on crude prices over the last week, underpinned by global jitters about the additional impact of the pandemic in overall oil demand. Margins in for simple configurations in Europe are positive across different crudes, after several weeks with negative results due to a higher crude price. For the upcoming week we see this variable as neutral, as we enter seasonal doldrums in the northern hemisphere, where oil demand typically loses momentum and puts downward pressure on refining margins for the next two months.

Oil Trader Sentiment—Negative

There is the likelihood of profit-taking activity prior to the WTI October contract expiration, so we see this variable having a negative effect for prices, although the effect will mainly be on prompt prices during the first two days of the week.

About the Author:

Jaime Brito is vice president at Stratas Advisors with over 24 years of experience on refining economics and market strategies for the oil industry. He is responsible for managing the refining and crude-related services, as well as completing consulting.