For the remainder of the year, Stratas Advisors expects the price of Brent crude will stay slightly about $90 with supply and demand being essentially balanced, the firm wrote. (Source: Shutterstock.com)

Editor’s note: This report is an excerpt from the Stratas Advisors weekly Short-Term Outlook service analysis, which covers a period of eight quarters and provides monthly forecasts for crude oil, natural gas, NGL, refined products, base petrochemicals and biofuels.]

The price of Brent crude ended the week at $91.35 after closing the previous week at $92.84. The price of WTI ended the week at $85.11 after closing the previous week $86.79.

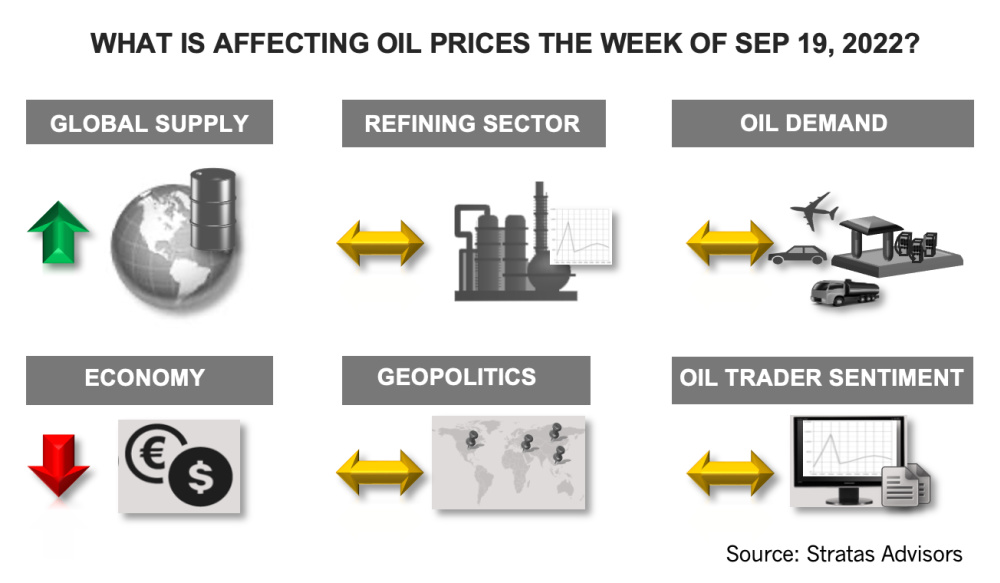

For the remainder of the year, we are expecting price of Brent crude will stay slightly about $90 with supply and demand being essentially balanced. Additionally, our reference case includes the following:

- We are forecasting that global oil demand in the third quarter will increase by 1.5 million bbl/d in comparison to the second quarter of this year and by an additional 1.1 million bbl/d in the fourth quarter.

- From a supply perspective, we are expecting that the withdrawals from the Strategic Petroleum Reserve (SPR) will end in October, but that refilling of the SPR will not happen until later in 2023. We are also expecting that the impact on the volumes of Russian oil-related exports will continue to be muted. Additionally, we are expecting that other members of OPEC+ will adjust supply to align with demand to provide support for oil prices.

- As has been the case since the beginning of Biden’s presidency, we remain skeptical of a renewal of the Iran nuclear deal. On Sept. 16, the Deputy U.S. Secretary of State Wendy Sherman stated that the latest round of talks had reached a stalemate. Concurrently, Iranian President Ebrahim Raisi is demanding that the U.S. lift all sanctions and issue guarantees to ensure that the sanctions will not be reimposed. While the Biden Administration is facing a difficult task of arriving at an agreement that would gain the support of voters, Congress, and key allies, it is our view that Iran is becoming least interested in compromising to reach a deal, but instead is more interested in creating closer ties with China and Russia.

- The strength of the U.S. dollar will continue to put downward pressure on oil prices. The U.S. Dollar Index ended the week at 109.76 after closing the previous week at 109. In contrast, the Chinese Yuan has weakened substantially since April of this year moving from 6.36 to the U.S. dollar to slightly above 7 to the U.S. dollar.

About the Author: John E. Paise, president of Stratas Advisors, is responsible for managing the research and consulting business worldwide. Prior to joining Stratas Advisors, Paisie was a partner with PFC Energy, a strategic consultancy based in Washington, D.C., where he led a global practice focused on helping clients (including IOCs, NOC, independent oil companies and governments) to understand the future market environment and competitive landscape, set an appropriate strategic direction and implement strategic initiatives. He worked more than eight years with IBM Consulting (formerly PriceWaterhouseCoopers, PwC Consulting) as an associate partner in the strategic change practice focused on the energy sector while residing in Houston, Singapore, Beijing and London.

Recommended Reading

Oceaneering Won $200MM in Manufactured Products Contracts in Q4 2023

2024-02-05 - The revenues from Oceaneering International’s manufactured products contracts range in value from less than $10 million to greater than $100 million.

E&P Highlights: Feb. 5, 2024

2024-02-05 - Here’s a roundup of the latest E&P headlines, including an update on Enauta’s Atlanta Phase 1 project.

CNOOC’s Suizhong 36-1/Luda 5-2 Starts Production Offshore China

2024-02-05 - CNOOC plans 118 development wells in the shallow water project in the Bohai Sea — the largest secondary development and adjustment project offshore China.

TotalEnergies Starts Production at Akpo West Offshore Nigeria

2024-02-07 - Subsea tieback expected to add 14,000 bbl/d of condensate by mid-year, and up to 4 MMcm/d of gas by 2028.

US Drillers Add Oil, Gas Rigs for Third Time in Four Weeks

2024-02-09 - Despite this week's rig increase, Baker Hughes said the total count was still down 138 rigs, or 18%, below this time last year.