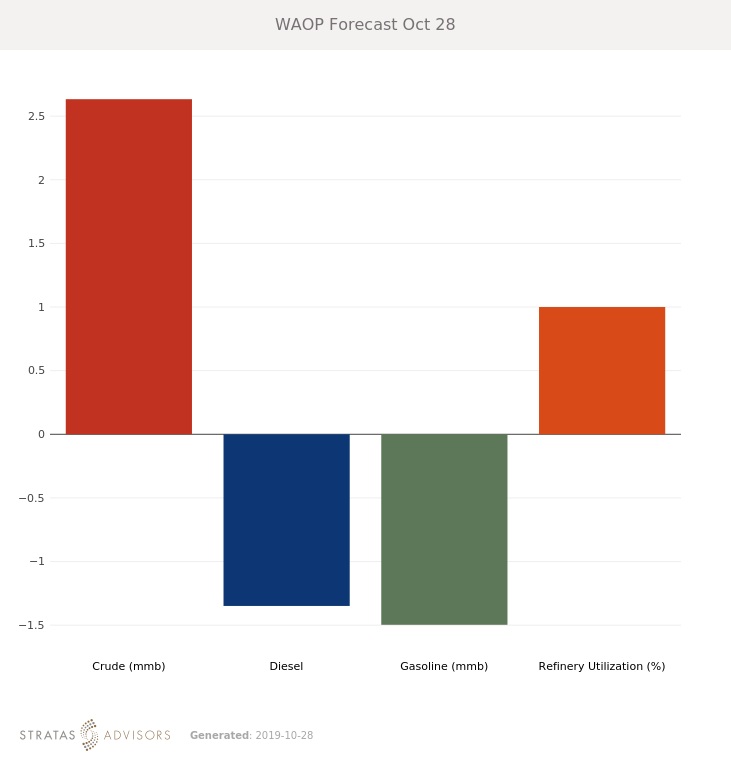

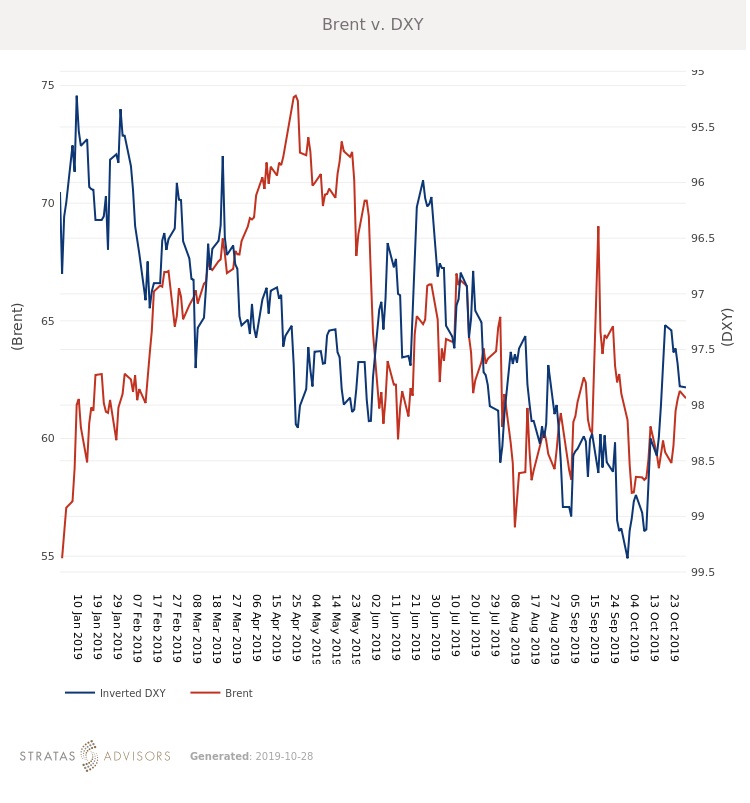

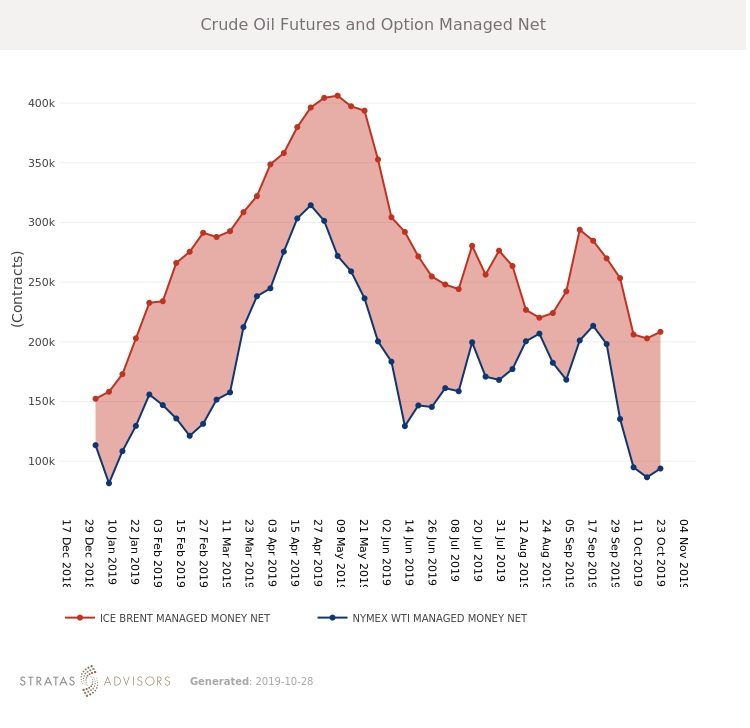

Crude oil saw strength late in the week after a drawdown in U.S. crude stocks. Brent increased $1.34/bbl to average $60.70/bbl while WTI increased $1.77/bbl to average $55.27/bbl. For the week ahead, Stratas Advisors expect prices to maintain their momentum and for Brent to average $61/bbl. However, they want to remind readers that any positive momentum can quickly disappear, and with no new news about progress on the trade deal, current optimism could quickly evaporate.

The U.S. Trade Representative’s Office and the Chinese Ministry of Commerce both independently confirmed that progress has been made on some parts of a Phase One trade deal. This is still a long way from a full deal, but is a positive development. Further details about the exact elements agreed to will be crucial as some variables are bigger sticking points for the White House than others. In Europe, the EU has reportedly agreed to a January 31 extension for Brexit, which puts off the impending hard-Brexit deadline but does mean that uncertainty will continue through the end of the year.

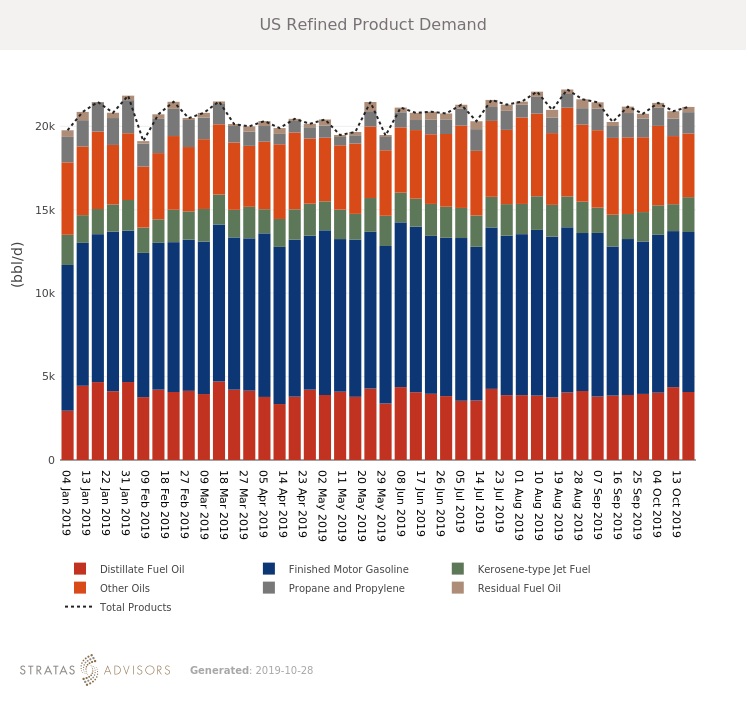

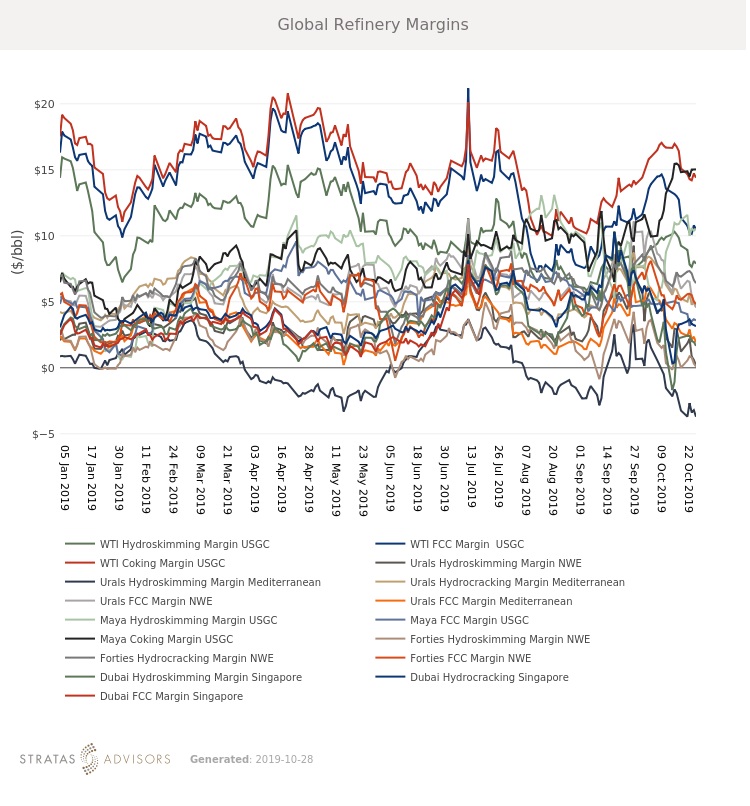

Product demand will be the key driver of oil prices in the weeks ahead. Crude runs have been strong globally, even taking into account seasonal patterns. However, strong runs in China from the start-up of several new facilities are contributing to a product overhang in the region. Rising weekly product stocks are a risk that could weigh on prices. Slowing activity appears inevitable heading into the end-of-the-year and rising product stocks will weigh on prices.

OPEC+ will likely take advantage of current momentum to continue talking-up prices next week although the bulk of the impact has likely been built in at this point. Russia also released a statement reaffirming commitment to the OPEC+ supply agreement.

Geopolitical Unrest – Neutral

Global Economy - Positive

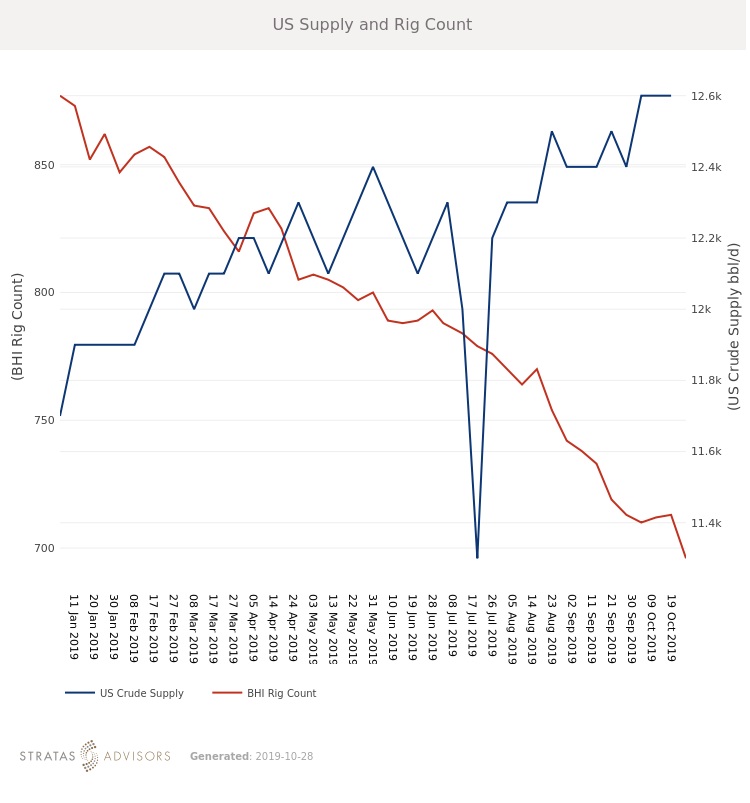

Oil Supply – Neutral

Oil Demand – Negative

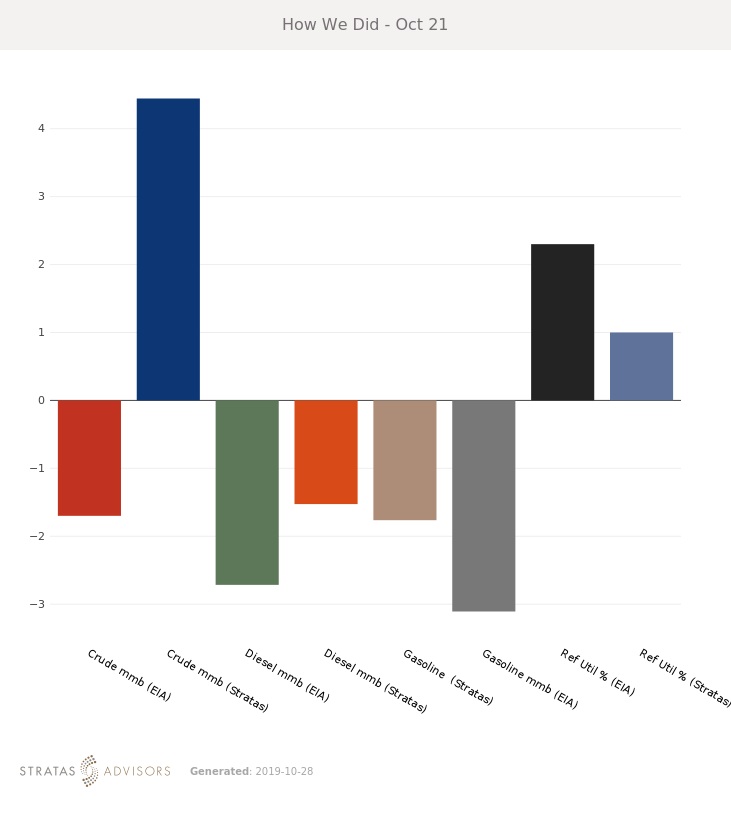

How We Did

Recommended Reading

PHX Minerals’ Borrowing Base Reaffirmed

2024-04-19 - PHX Minerals said the company’s credit facility was extended through Sept. 1, 2028.

SLB’s ChampionX Acquisition Key to Production Recovery Market

2024-04-19 - During a quarterly earnings call, SLB CEO Olivier Le Peuch highlighted the production recovery market as a key part of the company’s growth strategy.

BP Restructures, Reduces Executive Team to 10

2024-04-18 - BP said the organizational changes will reduce duplication and reporting line complexity.

Matador Resources Announces Quarterly Cash Dividend

2024-04-18 - Matador Resources’ dividend is payable on June 7 to shareholders of record by May 17.

EQT Declares Quarterly Dividend

2024-04-18 - EQT Corp.’s dividend is payable June 1 to shareholders of record by May 8.