Further, Stratas Advisors noted in its latest forecast the more important outcome of high natural gas and coal prices will be the restrictions on power usage and power outages—and reduced economic activity. (Source: Hart Energy)

[Editor’s note: This report is an excerpt from the Stratas Advisors weekly Short-Term Outlook service analysis, which covers a period of eight quarters and provides monthly forecasts for crude oil, natural gas, NGL, refined products, base petrochemicals and biofuels.]

As we expected, crude prices continued going up last week. The price of Brent crude ended the week at $79.24 after closing the previous week at $77.20. The price of ended the week at $75.25 after closing the previous week at $73.95.

The price of Brent crude is edging closer to levels not seen since September 2018, when the price of Brent reached $82.73 (before quickly falling to $53.80 by Dec. 1, 2018). The price of WTI has already exceeded the price during that period in 2018, when WTI reached $74.34 before declining to $45.41 by Dec. 1, 2018. The decline in prices stemmed, in part, from the significant increase in U.S. production that occurred over the course of the year (in January, 2018, U.S. production was 9.5 million bbl/d and by the end of the year had reached 11.7 million bbl/d—with the increase in production from Sept. 1 through Dec. 1 alone being 700,000 bbl/d) coupled with the increase in U.S. crude inventories, which increased by some 48 million barrels during the period of Sept. 1-Dec. 1, 2018.

The increase in prices week was not unexpected with traders becoming more bullish as the world moves past the latest wave of COVID-19. Traders of WTI increased their long positions, while their short positions were essentially unchanged. For the fifth straight week, traders of Brent crude increased their net long positions with the increase in their long positions outpacing the increase in short positions. During these five weeks, traders of Brent crude have increased their net long positions by around 28%.

Additionally, there were no negative surprises with the U.S. avoiding a government shutdown by passing a stopgap funding bill, which will keep the U.S. federal government funded through Dec. 3, 2021, and China taking steps to avoid widespread fallout from debt issue pertaining to Evergrande, the second largest property developer in China.

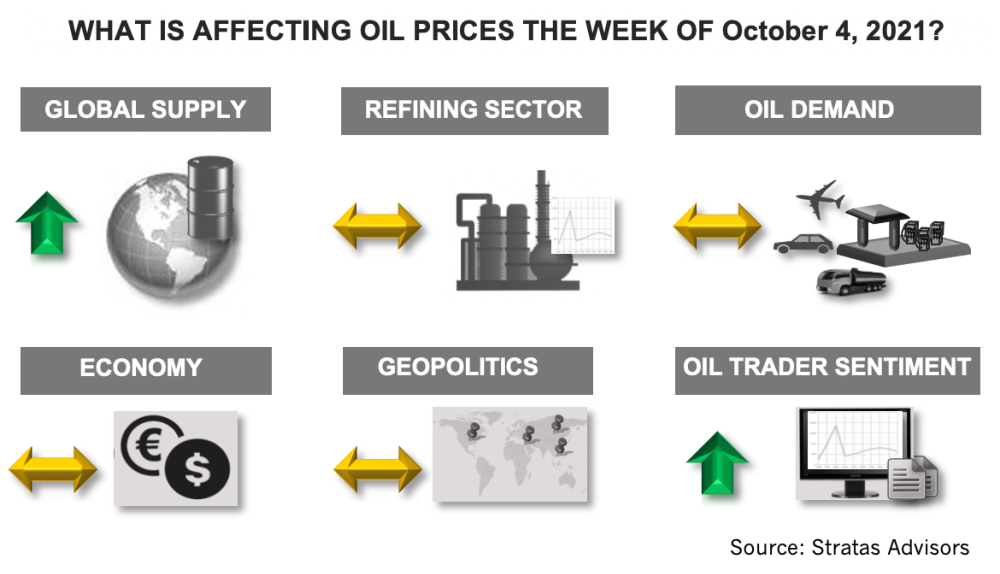

For the upcoming week, there is plenty of news that will affect the oil price.

- Of most importance will be the outcome from the OPEC+ meeting. We are expecting that OPEC+ will not announce at this meeting any changes to its current plans of increasing supply by 400,000 b/d over the next several months, but will wait for further evidence that global economy and oil demand are back on the path of more reliable growth, which warrants further supply increases.

- Another significant datapoint to watch for is the upcoming jobs report for September, which is to be released on Oct. 8—especially given the disappointing jobs report for August, which indicated that the U.S. added only 235,000 jobs, when the market was expecting something in the range of 750,000 jobs. Another disappointing jobs number would cause the Federal Reserve to be more cautious about making any changes to its current accommodating monetary policies, including reducing its assets purchases of $120 billion per month. We do not expect another major miss with the jobs support and that the number of jobs being added will align closer with the consensus expectations of 475,000 new jobs being added in September. A favorable jobs report will provide additional support for the US dollar, which will help constrain the increase in oil prices.

For fourth quarter of this year, we are still expecting oil demand to be more than 1.0 million bbl/d less than in fourth-quarter 2019. There have been some concerns voiced that there will be increased oil demand this winter stemming from power producers and industrial users shifting to oil and away from natural gas and coal because of high prices and shortages. There are signs that this shifting is already occurring in some parts of South Asia and the Middle East. While it is likely that some shifting will occur, we think the impact will be marginal. From a global standpoint, oil demand associated with power generation is around 1.2 million bbl/d and with respect to China, oil demand associated with power generation is about 20,000 bbl/d. Additionally, inventories of fuel oil are below typical levels, which means that as demand picks up, prices will also increase, thus making it less attractive to shift toward fuel oil. The more important outcome of high natural gas and coal prices will be the restrictions on power usage and power outages—and reduced economic activity.

About the Author:

John E. Paise, president of Stratas Advisors, is responsible for managing the research and consulting business worldwide. Prior to joining Stratas Advisors, Paisie was a partner with PFC Energy, a strategic consultancy based in Washington, D.C., where he led a global practice focused on helping clients (including IOCs, NOC, independent oil companies and governments) to understand the future market environment and competitive landscape, set an appropriate strategic direction and implement strategic initiatives. He worked more than eight years with IBM Consulting (formerly PriceWaterhouseCoopers, PwC Consulting) as an associate partner in the strategic change practice focused on the energy sector while residing in Houston, Singapore, Beijing and London.

Recommended Reading

Some Payne, But Mostly Gain for H&P in Q4 2023

2024-01-31 - Helmerich & Payne’s revenue grew internationally and in North America but declined in the Gulf of Mexico compared to the previous quarter.

Uinta Basin: 50% More Oil for Twice the Proppant

2024-03-06 - The higher-intensity completions are costing an average of 35% fewer dollars spent per barrel of oil equivalent of output, Crescent Energy told investors and analysts on March 5.

In Shooting for the Stars, Kosmos’ Production Soars

2024-02-28 - Kosmos Energy’s fourth quarter continued the operational success seen in its third quarter earnings 2023 report.

M4E Lithium Closes Funding for Brazilian Lithium Exploration

2024-03-15 - M4E’s financing package includes an equity investment, a royalty purchase and an option for a strategic offtake agreement.

California Resources Corp. Nominates Christian Kendall to Board of Directors

2024-03-21 - California Resources Corp. has nominated Christian Kendall, former president and CEO of Denbury, to serve on its board.