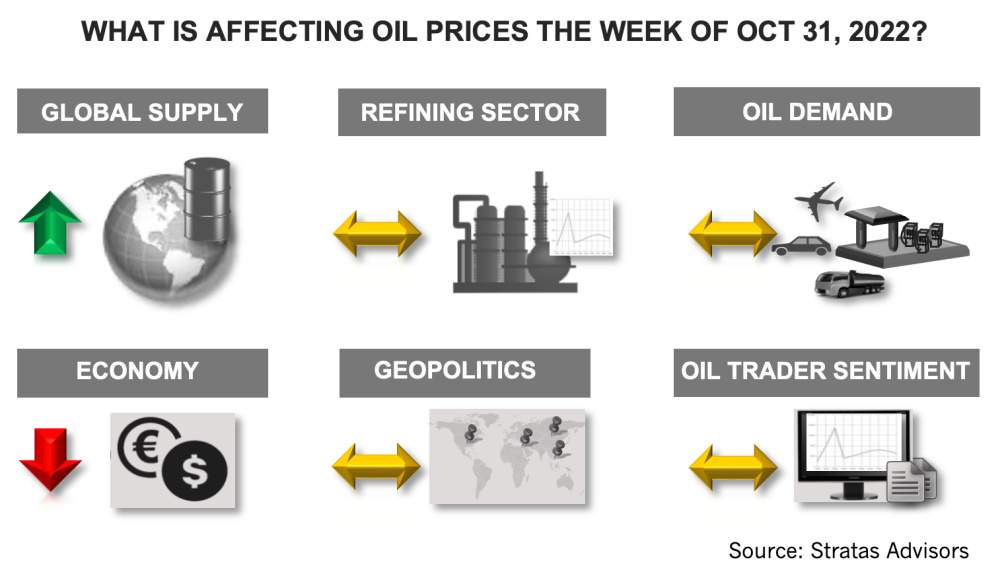

With oil demand being muted, Stratas Advisors expects oil supply will be only slightly outstripped during the fourth quarter, in part, because the firm is not expecting that the sanctions on Russia oil exports, including the proposed price cap, will have much impact, Stratas said in its weekly oil price forecast. (Source: Shutterstock.com)

Editor’s note: This report is an excerpt from the Stratas Advisors weekly Short-Term Outlook service analysis, which covers a period of eight quarters and provides monthly forecasts for crude oil, natural gas, NGL, refined products, base petrochemicals and biofuels.]

The price of Brent crude ended the week at $95.77 after closing the previous week at $91.34. The price of WTI ended the week at $87.90 after closing the previous week $85.05.

We are still holding to our forecast that the price of Brent crude will average around $90 throughout the fourth quarter with the price moving around this level in reaction to news flow. The $90 aligns with the price we expect OPEC+ to defend, as well as the supply/demand fundamentals.

While the latest quarterly report from Bureau of Economic Analysis indicated that the U.S. economy grew by 2.6%, the report also highlights some of the concerns pertaining to the U.S. economy.

- Much of the growth stemmed from increased exports and a narrowing trade deficit, which is unlikely to continue, given the strength of the U.S. dollar and the relative weakness of the major trading partners.

- Consumer spending increased by only 1.4%, while gross private domestic investment decreased by 8.5%.

- Residential investment decreased by 26.4%, which indicates the downturn in homebuilding and the real estate market.

Additionally, we remain worried that the Federal Reserve is being too aggressive in raising rates and will ultimately push the U.S. economy into recession. As we pointed out earlier this month, the current pace of rate increases is twice that of any of the previous cycle of rate increases since 1988. Additionally, a significant portion of the inflation is related to ongoing supply chain issues and increases in commodity prices because of supply/demand fundamentals—neither of which the Federal Reserve can directly affect.

Outside of the U.S., the outlook for Eurozone economies continues to trend downward with more than half of the countries facing recessions with weakness in both the manufacturing and service sectors. Of these countries, Germany is seeing the most substantial weakness. China is taking steps to shore up its economy, including China’s central bank reiterating its policies to ensure sufficient liquidity and to increase credit support for the real economy. Regardless, China’s economy continues to be hampered by COVID-19 restrictions. During the last two weeks China’s authorities have imposed tighter COVID-related control in response to several cities reporting COVID-19 cases. Furthermore, it is expected that COVID-related restrictions will remain in place through at least March of next year.

With oil demand being muted, we are expecting that oil supply will be only slightly outstripped during the fourth quarter, in part, because we are not expecting that the sanctions on Russia oil exports, including the proposed price cap, will have much impact.

Several months ago when the idea of a price cap was floated, we put forth the view that the price cap was not practical for several reasons:

- There is sufficient capacity in the tanker fleet to allow Russia to bypass the use of vessels that would be affected by the price cap. Additionally, it is being reported that some other ships are changing their countries of origin so as not be affected by the price cap.

- While 90% of protection and indemnity (P&I) insurance is provided by EU-based entities, the vessels that will be used to avoid the price cap can be self-insured or obtain insurance from Russian P&I providers—or P&I providers based in Asia.

- Additionally, oil trading involving Russian oil is increasingly shifting from Europe to the Middle East and Asia.

- Collectively, the above developments will undermine the western control of the oil markets, which represents a structural shift.

In addition to the above factors, the biggest factor that is undermining the price cap is that major importers of crude oil, such as India and China, cannot afford to put their economies in jeopardy by risking the potential of not being able to access their required imports of oil.

Consequently, we are still holding to our view that price cap and other sanctions will have limited impact on Russian oil exports and that Russia’s oil production will average only around 400,000 bbl/d less in 2023 than in 2022.

For a complete forecast of energy prices, including crude oil and refined products, please refer to our Short-term Outlook.

About the Author: John E. Paise, president of Stratas Advisors, is responsible for managing the research and consulting business worldwide. Prior to joining Stratas Advisors, Paisie was a partner with PFC Energy, a strategic consultancy based in Washington, D.C., where he led a global practice focused on helping clients (including IOCs, NOC, independent oil companies and governments) to understand the future market environment and competitive landscape, set an appropriate strategic direction and implement strategic initiatives. He worked more than eight years with IBM Consulting (formerly PriceWaterhouseCoopers, PwC Consulting) as an associate partner in the strategic change practice focused on the energy sector while residing in Houston, Singapore, Beijing and London.

Recommended Reading

Deepwater Roundup 2024: Offshore Australasia, Surrounding Areas

2024-04-09 - Projects in Australia and Asia are progressing in part two of Hart Energy's 2024 Deepwater Roundup. Deepwater projects in Vietnam and Australia look to yield high reserves, while a project offshore Malaysia looks to will be developed by an solar panel powered FPSO.

Deepwater Roundup 2024: Offshore Africa

2024-04-02 - Offshore Africa, new projects are progressing, with a number of high-reserve offshore developments being planned in countries not typically known for deepwater activity, such as Phase 2 of the Baleine project on the Ivory Coast.

Tech Trends: Halliburton’s Carbon Capturing Cement Solution

2024-02-20 - Halliburton’s new CorrosaLock cement solution provides chemical resistance to CO2 and minimizes the impact of cyclic loading on the cement barrier.

BP: Gimi FLNG Vessel Arrival Marks GTA Project Milestone

2024-02-15 - The BP-operated Greater Tortue Ahmeyim project on the Mauritania and Senegal maritime border is expected to produce 2.3 million tonnes per annum during it’s initial phase.

The OGInterview: How do Woodside's Growth Projects Fit into its Portfolio?

2024-04-01 - Woodside Energy CEO Meg O'Neill discusses the company's current growth projects across the globe and the impact they will have on the company's future with Hart Energy's Pietro Pitts.