Comments made by Russian President Vladimir Putin on Oct. 22 are the clearest signal yet from Russia that it is ready to continue with unprecedented output cuts in the face of a sluggish oil market beset. (Source: Shutterstock.com; image of Russian President Vladimir Putin by Dimitrije Ostojic / Shutterstock.com)

[Editor’s note: This report is an excerpt from the Stratas Advisors weekly Short-Term Outlook service analysis, which covers a period of eight quarters and provides monthly forecasts for crude oil, natural gas, NGL, refined products, base petrochemicals and biofuels.]

Last week saw contradictory statements from OPEC’s technical committee with regards to how to address the upcoming market unbalance. But Russian President Vladimir Putin expressed that the current OPEC+ plan is currently an appropriate approach and if needed, producers should consider production adjustments.

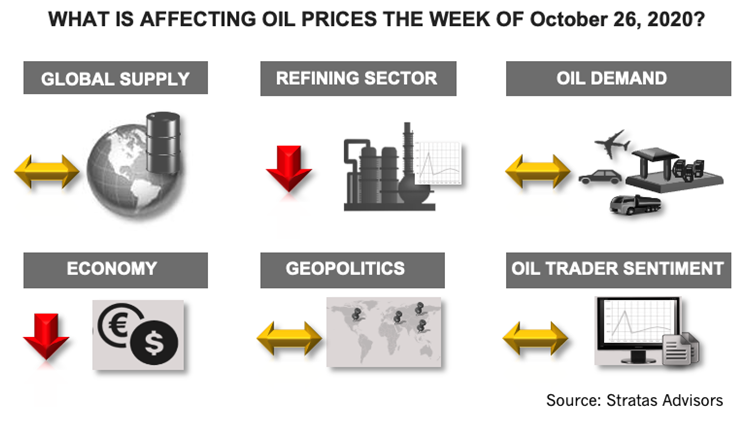

Global Supply—Neutral

While last week’s U.S. crude supply reduction is bullish for oil prices, the impact is offset by additional production from Libya coming online (as the result of the peace agreement signed last week). As such, we expect this variable to be a neutral factor for this week.

Geopolitics—Neutral

The most recent agreements reached by Israel with several countries could have important implications contingent upon the final position of Saudi Arabia. For this week we see this variable as neutral.

Economy—Negative

In the short-term, we expect this variable to be negative until there is the passing of a new stimulus package. While this development still remains, a possibility is not likely to occur before the upcoming presidential election.

Oil Demand—Neutral

The new lockdowns imposed in France and the continuous reports of additional infections throughout Italy, the U.K., and other countries bodes ill for crude prices this week.

Overall, oil consumption is remaining as resilient as possible in light of the COVID challenge, but it is difficult to see how this variable can play a positive role for prices this week. Therefore, we keep this variable as a neutral contribution to oil prices this week.

Refining Sector—Negative

Renewed lockdown orders in specific locations of Europe and Asia impacted refined product prices around the world, which translated into lower refining margins across all regions. The short-term picture bodes ill for refiners, given the demand concerns associated with the potential for a major rebound in COVID cases during the winter months, which will stifle product demand.

We expect this variable to be negative for this week.

Oil Trader Sentiment—Neutral

Open interest for the Light Sweet Nymex contract was 3% down, while the managed net statistics show an average increase of 15% with long positions increasing with respect to short positions. Meanwhile, open interest for the RBOB and USLD contracts were basically unchanged versus last week (a variation of less than 1%).

For the upcoming week, we expect this variable to be neutral for crude prices.

About the Author:

Jaime Brito is vice president at Stratas Advisors with over 24 years of experience on refining economics and market strategies for the oil industry. He is responsible for managing the refining and crude-related services, as well as completing consulting.

Recommended Reading

Williams Beats 2023 Expectations, Touts Natgas Infrastructure Additions

2024-02-14 - Williams to continue developing natural gas infrastructure in 2024 with growth capex expected to top $1.45 billion.

Balticconnector Gas Pipeline Will be in Commercial Use Again April 22, Gasgrid Says

2024-04-17 - The Balticconnector subsea gas link between Estonia and Finland was damaged in October along with three telecoms cables.

Wayangankar: Golden Era for US Natural Gas Storage – Version 2.0

2024-04-19 - While the current resurgence in gas storage is reminiscent of the 2000s —an era that saw ~400 Bcf of storage capacity additions — the market drivers providing the tailwinds today are drastically different from that cycle.

Pembina Pipeline Enters Ethane-Supply Agreement, Slow Walks LNG Project

2024-02-26 - Canadian midstream company Pembina Pipeline also said it would hold off on new LNG terminal decision in a fourth quarter earnings call.

Midstream Operators See Strong NGL Performance in Q4

2024-02-20 - Export demand drives a record fourth quarter as companies including Enterprise Products Partners, MPLX and Williams look to expand in the NGL market.