Stratas Advisors are expecting that there will be more downward pressure on oil prices in the upcoming week, the firm said in its latest forecast. (Source: Shutterstock.com)

Editor’s note: This report is an excerpt from the Stratas Advisors weekly Short-Term Outlook service analysis, which covers a period of eight quarters and provides monthly forecasts for crude oil, natural gas, NGL, refined products, base petrochemicals and biofuels.]

The price of Brent crude ended the week at $91.63 after closing the previous week at $97.92. The price of WTI ended the week at $85.61 after closing the previous week $92.64.

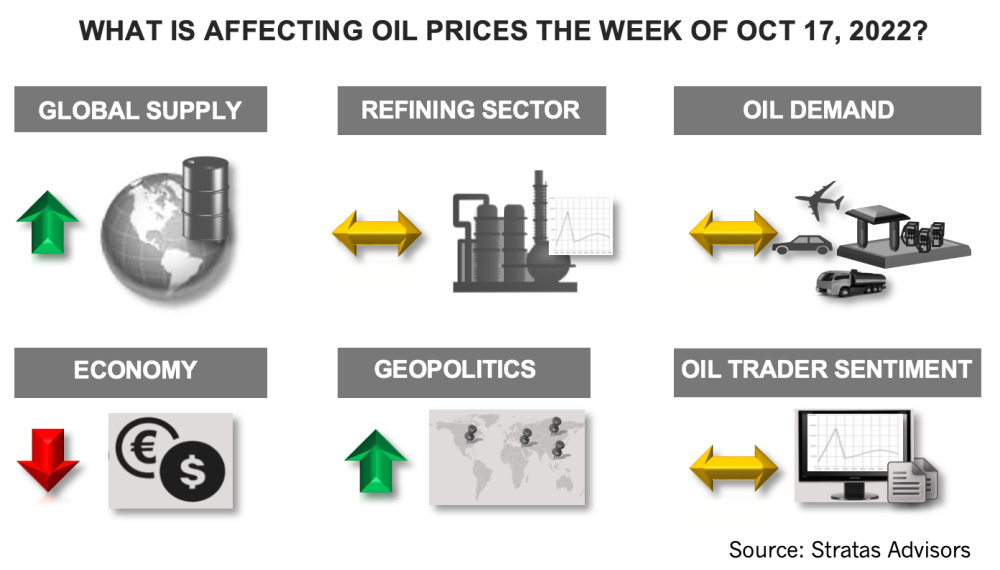

In our previous note published at the beginning of last week, we put forth the view that the market overreacted to the recently announced production cut from OPEC+ for several reasons:

- The actual supply reduction will be significantly less than the announced cut because many members of OPEC+ have been struggling to meet production targets

- Crude Inventory levels in the U.S. are greater than for the same period during 2021, as well as the levels of 2019 and 2018.

- The U.S. economy continues to show weakness—as are the economies of Europe and China—and the global economic growth is trending downward

- While product inventories are relatively low, demand growth has been tepid and slowing down

Developments that occurred last week highlighted each of the above points:

- The emerging consensus view is that the OPEC+ supply cut will be in the range of 1 million bbl/d—about half of the announced cut

- Furthermore, it is worth noting that Saudi Aramco seems to be planning to export full November contract volumes of crude oil to customers in North Asia

- According to the latest weekly Energy Information Administration (EIA) report, U.S. crude inventories increased by 9.88 million bbl/d—and in comparison, to the same period during 2021, crude inventories are greater by 12.11 million barrels, 13.51 million barrels above the level of 2019, and 29.13 million barrels more than in 2018

- Recent statements from the International Monetary Fund (IMF) further emphasized the growing risk stemming from inflation, concerns about the supply of energy and food, and higher interest rates, and that the global economy is being pushed towards a recession with the possibility that the worse is yet to come

- The research arm of OPEC reduced its forecast for oil demand growth in 2022 to 2.64 million bbl/d from its previous forecast of 3.1 million bbl/d (in comparison, Stratas Advisors has been forecasting since the second quarter that global demand will increase by 2.2 million bbl/d during 2022)

With respect to the upcoming week, we are expecting that there will be more downward pressure on oil prices. For a complete forecast of energy prices, including crude oil and refined products, please refer to our Short-term Outlook.

About the Author: John E. Paise, president of Stratas Advisors, is responsible for managing the research and consulting business worldwide. Prior to joining Stratas Advisors, Paisie was a partner with PFC Energy, a strategic consultancy based in Washington, D.C., where he led a global practice focused on helping clients (including IOCs, NOC, independent oil companies and governments) to understand the future market environment and competitive landscape, set an appropriate strategic direction and implement strategic initiatives. He worked more than eight years with IBM Consulting (formerly PriceWaterhouseCoopers, PwC Consulting) as an associate partner in the strategic change practice focused on the energy sector while residing in Houston, Singapore, Beijing and London.

Recommended Reading

The One Where EOG’s Stock Tanked

2024-02-23 - A rare earnings miss pushed the wildcatter’s stock down as much as 6%, while larger and smaller peers’ share prices were mostly unchanged. One analyst asked if EOG is like Narcissus.

Hess Corp. Boosts Bakken Output, Drilling Ahead of Chevron Merger

2024-01-31 - Hess Corp. increased its drilling activity and output from the Bakken play of North Dakota during the fourth quarter, the E&P reported in its latest earnings.

Canadian Natural Resources Boosting Production in Oil Sands

2024-03-04 - Canadian Natural Resources will increase its quarterly dividend following record production volumes in the quarter.

Marathon Chasing 20%+ IRRs with Los Angeles, Galveston Refinery Upgrades

2024-02-01 - Marathon Petroleum Corp. is pursuing improvements at its Los Angeles refinery and a hydrotreater project at its Galveston Bay refinery that are each boasting internal rate returns (IRRs) of 20% or more.

Enbridge Advances Expansion of Permian’s Gray Oak Pipeline

2024-02-13 - In its fourth-quarter earnings call, Enbridge also said the Mainline pipeline system tolling agreement is awaiting regulatory approval from a Canadian regulatory agency.