(Source: Shutterstock.com; Image of OPEC headquarters in Vienna courtesy of Sodel Vladyslav / Shutterstock.com)

[Editor’s note: This report is an excerpt from the Stratas Advisors weekly Short-Term Outlook service analysis, which covers a period of eight quarters and provides monthly forecasts for crude oil, natural gas, NGL, refined products, base petrochemicals and biofuels.]

OPEC shared last week its 2020 World Oil Outlook, which included the view that the same drivers that generated economic growth and oil demand growth over the last two decades in the emerging and expanding economies will continue underpinning development in Africa, the Middle East, as well as in Latin America and Asia. As these regions grow, oil demand will continue increasing as well. As such, OPEC is actually suggesting that oil will continue to play a prevalent role in the global energy mix, despite increasing use of alternative fuels.

In the view of Stratas Advisors, while OPEC’s outlook is directionally correct, OPEC is overestimating the impact of renewables and efficiency gains in the Americas. Furthermore, OPEC’s outlook describes negligible demand growth for Latin America, which is not a view we share when considering the potential for vehicle ownership, demographics and overall economic development that this region will likely see over the forecast period.

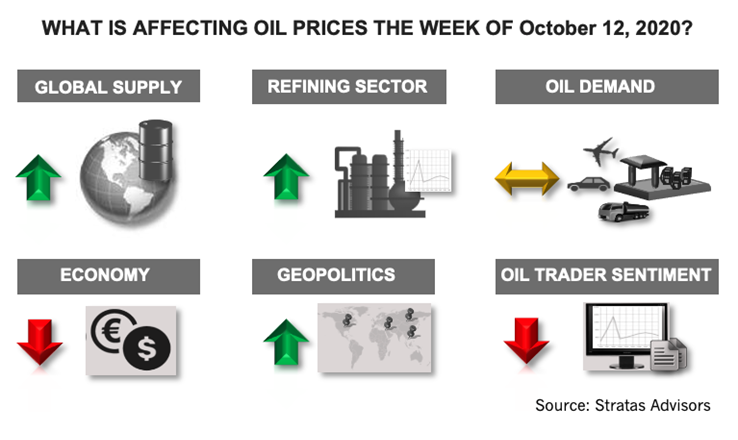

Global Supply—Positive

The supply side of the market is at center stage this week, as all major concerns last week were related to supply. Hurricane Delta disrupted oil production in the U.S. Gulf Coast, first due to workers evacuation plans and then continuing with the region experiencing power and infrastructure problems before activities returned to normal. Some 1.6 million bbl/d of halted crude production was seen Oct. 8-9.

For this week, we see this variable as positive since it will take time for U.S. Gulf Coast supply to come back to normal in the aftermath of Hurricane Delta.

Geopolitics—Positive

Geopolitics was disrupted last week with President Trump’s positive test and slippage in the polls—and the growing possibility of a Biden administration.

For the upcoming week, we see this variable as positive for crude prices.

Economy—Negative

The inability of the administration and Congress to reach an agreement on another round of financial support for businesses and individuals bode ill for oil markets because of the risk of an economic slowdown. Unless there are signs of an agreement being reached, we see this variable as negative for the upcoming week.

Oil Demand—Neutral

Gasoline and diesel demand in the U.S. reached levels in line with normal patterns, albeit still on the lower range, but within the five-year historical level despite the COVID uptick in several states. The picture for the rest of the world is mixed depending upon the region, but in general, oil consumption is increasing in line with higher economic activity when compared to March-May.

For the upcoming week, oil demand is expected to be relatively steady, and therefore we see this variable as neutral.

Refining sector—Positive

Refining margins across the globe have improved during the last two weeks thanks to an overall improvement of product prices, in conjunction with proportionately lower crude prices (prior to the supply disruptions described above).

Oil Trader Sentiment—Negative

Open interest for crude and ULSD contracts/options increased over the last week (2% and 1% respectively). Activity in the light-sweet contract underpinned an immediate crude price increase, whereas the distillates contract is following the seasonal pattern for early October.

About the Author:

Jaime Brito is vice president at Stratas Advisors with over 24 years of experience on refining economics and market strategies for the oil industry. He is responsible for managing the refining and crude-related services, as well as completing consulting.

Recommended Reading

TGS, SLB to Conduct Engagement Phase 5 in GoM

2024-02-05 - TGS and SLB’s seventh program within the joint venture involves the acquisition of 157 Outer Continental Shelf blocks.

2023-2025 Subsea Tieback Round-Up

2024-02-06 - Here's a look at subsea tieback projects across the globe. The first in a two-part series, this report highlights some of the subsea tiebacks scheduled to be online by 2025.

StimStixx, Hunting Titan Partner on Well Perforation, Acidizing

2024-02-07 - The strategic partnership between StimStixx Technologies and Hunting Titan will increase well treatments and reduce costs, the companies said.

Tech Trends: QYSEA’s Artificially Intelligent Underwater Additions

2024-02-13 - Using their AI underwater image filtering algorithm, the QYSEA AI Diver Tracking allows the FIFISH ROV to identify a diver's movements and conducts real-time automatic analysis.

Subsea Tieback Round-Up, 2026 and Beyond

2024-02-13 - The second in a two-part series, this report on subsea tiebacks looks at some of the projects around the world scheduled to come online in 2026 or later.