While OPEC+ announced a reduction of 2 million bbl/d on Oct. 5, the actual supply reduction will be around 1 million bbl/d because many members of OPEC+ have been struggling to meet production targets, Stratas Advisors wrote in its weekly oil price forecast. (Source: Shutterstock.com)

Editor’s note: This report is an excerpt from the Stratas Advisors weekly Short-Term Outlook service analysis, which covers a period of eight quarters and provides monthly forecasts for crude oil, natural gas, NGL, refined products, base petrochemicals and biofuels.]

The price of Brent crude ended the week at $97.92 after closing the previous week at $85.14. The price of WTI ended the week at $92.64 after closing the previous week $79.49.

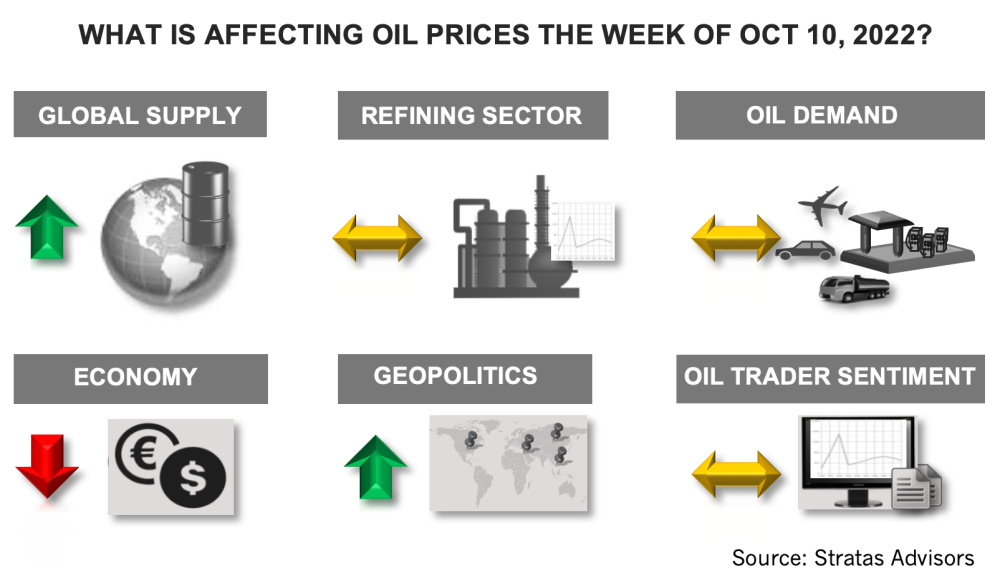

Obviously, the biggest factor underlying the spike in crude prices stems from the announcement by members of OPEC+ on Oct. 5 of an agreement to reduce their output target by 2 million bbl/d. The price increase was also supported by the U.S. Energy Information Administration (EIA) reporting drawdown in crude inventories and product inventories.

- The EIA report also indicated that US crude inventories decreased by 1.36 million bbl/d. Furthermore, the level of inventories in the Strategic Petroleum Reserve (SPR) declined by 6.19 million barrels. Since the beginning of the year, inventories in the SPR have been drawn down by 177 million barrels. In comparison, commercial inventories have increased by only 11.35 million barrels.

- Gasoline inventories in the U.S. decreased by 4.73 million barrels and are now 21.30 million barrels less than for the same period in 2019. Diesel inventories decreased by 3.44 million barrels and are now 16.41 million barrels less than for the same period in 2019. Jet fuel decreased by 0.537 million barrels and are now 7.95 million barrels less than for the same period in 2019.

Even though the above are positive factors for oil prices, we think that the market overreacted to the recent news. While OPEC+ announced a reduction of 2 million bbl/d, the actual supply reduction will be around 1 million bbl/d because many members of OPEC+ have been struggling to meet production targets. With respect to inventory levels in the U.S., in comparison to the same period during 2021, crude inventories are greater by 8.32 million barrels, and are 3.63 million barrels above the level of 2019 and 19.52 million barrels more than in 2018.

Product inventories in the U.S., especially with respect to diesel fuel are low; however, demand growth has been tepid—and the U.S. economy continues to show signs of weakness—as are the economies of Europe and China. Europe’s composite PMI (manufacturing and services) declined to 48.1 from 48.9 in August and is at the lowest level since April 2021. More troubling is that inflation continues to be extremely high after reaching 10% in September. Restrictions pertaining to COVID-19 and the slowing economies of major trading partners continue to have a negative effect on China’s economy and recent economic surveys indicate that China’s service and manufacturing sectors contracted in September.

For a complete forecast of energy prices, including crude oil and refined products, please refer to our Short-term Outlook.

About the Author: John E. Paise, president of Stratas Advisors, is responsible for managing the research and consulting business worldwide. Prior to joining Stratas Advisors, Paisie was a partner with PFC Energy, a strategic consultancy based in Washington, D.C., where he led a global practice focused on helping clients (including IOCs, NOC, independent oil companies and governments) to understand the future market environment and competitive landscape, set an appropriate strategic direction and implement strategic initiatives. He worked more than eight years with IBM Consulting (formerly PriceWaterhouseCoopers, PwC Consulting) as an associate partner in the strategic change practice focused on the energy sector while residing in Houston, Singapore, Beijing and London.

Recommended Reading

Amid ‘Battery Arms Race,’ Xerion CEO Talks Tech, Maturing Market, China

2024-04-10 - The late-stage battery startup is active in the military and electronics space, but is gaining attention for technology that extracts lithium from geothermal brine.

Element3 Extracts Lithium from Permian’s Double Eagle Wastewater

2024-01-30 - The field test was conducted with wastewater from a subsidiary of Double Eagle Energy Holdings’ produced water recycling facility.

Exclusive: Building Battery Value Chain is "Vital" to Energy Transition

2024-04-18 - Srini Godavarthy, the CEO of Li-Metal, breaks down the importance of scaling up battery production in North America and the traditional process of producing lithium anodes, in this Hart Energy Exclusive interview.

Could Concentrated Solar Power Be an Energy Storage Gamechanger?

2024-03-27 - Vast Energy CEO Craig Wood shares insight on concentrated solar power and its role in energy storage and green fuels.

Elephant in the North: E3 Lithium CEO on Finding Opportunity ‘Hunters’

2024-02-28 - E3 Lithium is working toward commercial lithium production for its Clearwater project in South-Central Alberta’s Bashaw District, while developing its own DLE technology.